Description P.R. Debit Credit

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

100%

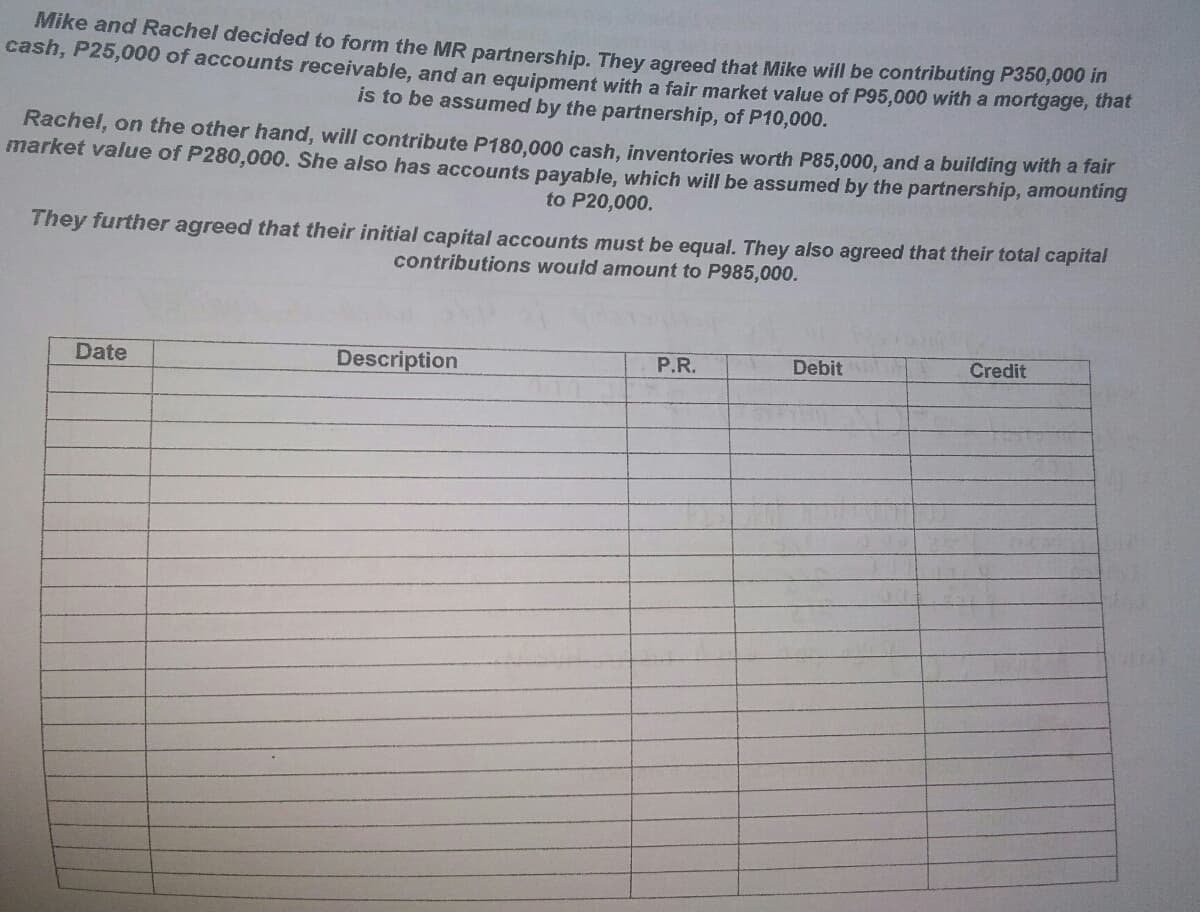

Transcribed Image Text:Mike and Rachel decided to form the MR partnership. They agreed that Mike will be contributing P350,000 m

cash, P25,000 of accounts receivable, and an equipment with a fair market value of P95,000 with a morigage, uhat

is to be assumed by the partnership, of P10,000.

Rachel, on the other hand, will contribute P180,000 cash, inventories worth P85,000, and a building with a fair

market value of P280,000. She also has accounts payable, which will be assumed by the partnership, amounting

to P20,000.

They further agreed that their initial capital accounts must be equal. They also agreed that their total capital

contributions would amount to P985,000.

Description

Debit

Credit

Date

P.R.

EGO

Transcribed Image Text:Solution for bonus computation (if there is any bonus):

CCOUNTING

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College