Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and c "Dividend per Preferred Share" answer to 3 decimal places.) Par Value per Preferred Share Dividend per Preferred Share Number of Preferred Shares Preferred Dividend Rate Dividend Annual Preferred Dividend: Dividends in Total Cash Dividend Paid Paid to Preferred Paid to Common Arrears at year-end Year 1 24 13,200 Year 2 22,000 Year 3 240,000 Year 4 390,000 Total: $4 665,200

Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and c "Dividend per Preferred Share" answer to 3 decimal places.) Par Value per Preferred Share Dividend per Preferred Share Number of Preferred Shares Preferred Dividend Rate Dividend Annual Preferred Dividend: Dividends in Total Cash Dividend Paid Paid to Preferred Paid to Common Arrears at year-end Year 1 24 13,200 Year 2 22,000 Year 3 240,000 Year 4 390,000 Total: $4 665,200

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 32BE

Related questions

Question

I need help with this

![Required information

Use the following information for the Exercises below.

(The following information applies to the questions displayed below.]

Year 1 total cash dividends S 13,200

Year 2 total cash dividends

Year 3 total cash dividends

Year 4 total cash dividends

22,000

240,000

390, 000](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F97b5df25-1667-438a-b46e-c2a0d1ae7c86%2F5bca1604-987d-4346-aa1e-d98200b087da%2Fa6rcis6_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

Use the following information for the Exercises below.

(The following information applies to the questions displayed below.]

Year 1 total cash dividends S 13,200

Year 2 total cash dividends

Year 3 total cash dividends

Year 4 total cash dividends

22,000

240,000

390, 000

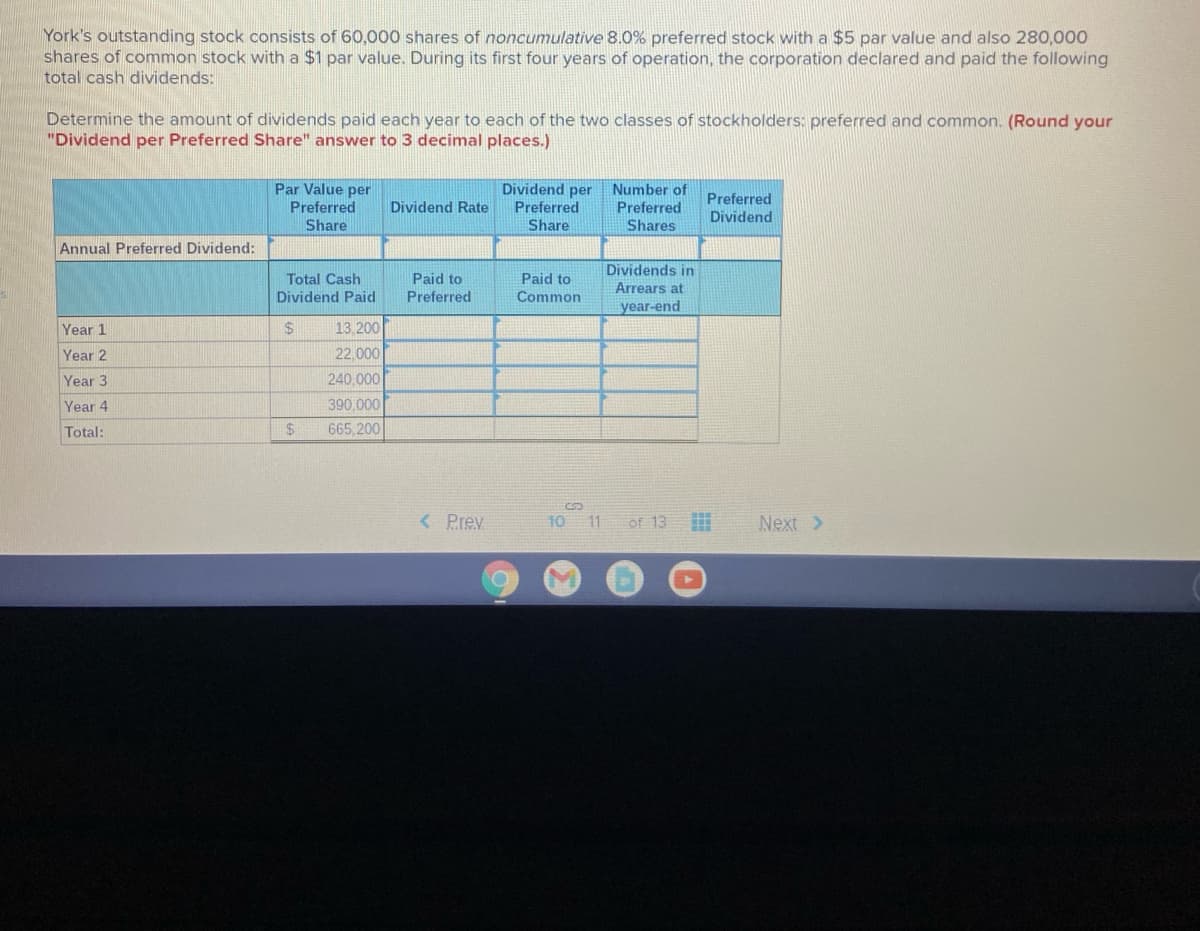

Transcribed Image Text:York's outstanding stock consists of 60,000 shares of noncumulative 8.0% preferred stock with a $5 par value and also 280,000

shares of common stock with a $1 par value. During its first four years of operation, the corporation declared and paid the following

total cash dividends:

Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. (Round your

"Dividend per Preferred Share" answer to 3 decimal places.)

Par Value per

Preferred

Share

Dividend per

Preferred

Share

Number of

Preferred

Dividend

Dividend Rate

Preferred

Shares

Annual Preferred Dividend:

Dividends in

Total Cash

Paid to

Paid to

Arrears at

Dividend Paid

Preferred

Common

year-end

Year 1

$4

13.200

Year 2

22,000

Year 3

240,000

Year 4

390,000

Total:

$4

665,200

< Prev

10

11

of 13

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning