Determine the best investment using the following decision criteria: a) Maximax b) Maximin O Minimas Regret

Determine the best investment using the following decision criteria: a) Maximax b) Maximin O Minimas Regret

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter2: Introduction To Spreadsheet Modeling

Section: Chapter Questions

Problem 20P: Julie James is opening a lemonade stand. She believes the fixed cost per week of running the stand...

Related questions

Question

Assignment No. 11

Answer 2 a, b, c

Transcribed Image Text:ASSIGNMENT NO. 11 (Decision Analysis)

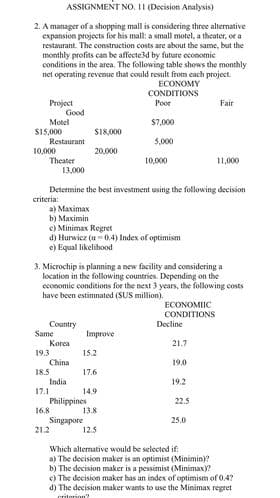

2. A manager of a shopping mall is considering three alternative

expansion projects for his mall: a small motel, a theater, or a

restaurant. The construction costs are about the same, but the

monthly profits can be affecte3d by future economie

conditions in the area. The following table shows the monthly

net operating revenue that could result from each project.

ECONOMY

CONDITIONS

Project

Good

Poor

Fair

Motel

$7,000

SI8,000

S15,000

Restaurant

5,000

10,000

Theater

13,000

20,000

10,000

11,000

Determine the best investment using the following decision

criteria:

a) Maximax

b) Maximin

e) Minimax Regret

d) Hurwicz (a- 0,4) Index of optimism

e) Equal likelihood

3. Microchip is planning a new facility and considering a

location in the following countries. Depending on the

economic conditions for the next 3 years, the following costs

have been estimnated (SUS million).

ЕCONOMIC

CONDITIONS

Country

Same

Decline

Improve

Korea

21.7

19.3

15.2

China

19.0

18.5

17.6

India

19.2

17.1

14.9

Philippines

16,8

22.5

13.8

Singapore

21.2

25.0

12.5

Which alternative would be selected if:

a) The decision maker is an optimist (Minimin)?

b) The decision maker is a pessimist (Minimaxy?

e) The decision maker has an index of optimism of 0.4?

d) The decision maker wants to use the Minimax regret

criterion?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 7 images

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Operations Management

Operations Management

ISBN:

9781259667473

Author:

William J Stevenson

Publisher:

McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi…

Operations Management

ISBN:

9781259666100

Author:

F. Robert Jacobs, Richard B Chase

Publisher:

McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:

9781285869681

Author:

Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:

Cengage Learning

Production and Operations Analysis, Seventh Editi…

Operations Management

ISBN:

9781478623069

Author:

Steven Nahmias, Tava Lennon Olsen

Publisher:

Waveland Press, Inc.