Determine the following amounts at the beginning of the lease: (Round your intermediate and final answer to the nearest whole dollar amount.)

Determine the following amounts at the beginning of the lease: (Round your intermediate and final answer to the nearest whole dollar amount.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter20: Accounting For Leases

Section: Chapter Questions

Problem 9E: Lessor Accounting with Guaranteed Residual Value Use the information for Edom Company in E20-8,...

Related questions

Question

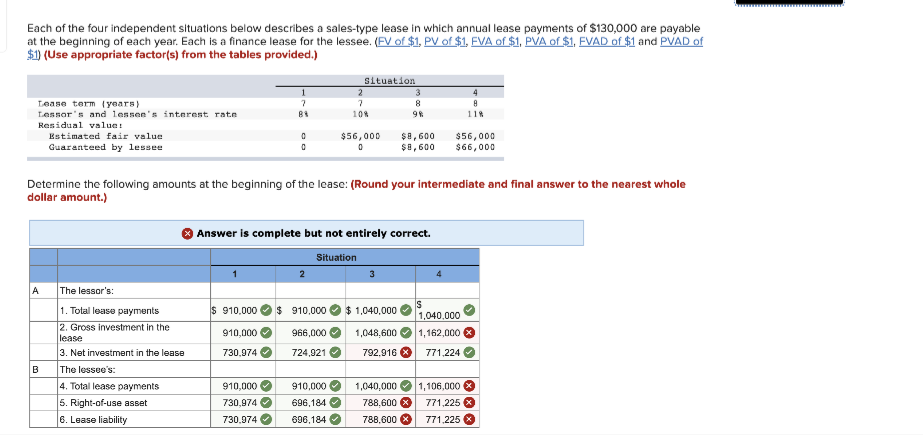

Transcribed Image Text:Each of the four independent situations below describes a sales-type lease in which annual lease payments of $130,000 are payable

at the beginning of each year. Each is a finance lease for the lessee. (FV of $1, PV of $1, FVA of $1, PVA of $1, EVAD of $1 and PVAD of

$1) (Use appropriate factor(s) from the tables provided.)

Situation

2

4

Lease term ( years)

Lessor's and lessen's interest rate

8

10%

11%

Residual value:

Estimated fair value

Guaranteed by lessee

$56,000

$8,600

$日,600

$56,000

$66,000

Determine the following amounts at the beginning of the lease: (Round your intermediate and final answer to the nearest whole

dollar amount.)

Answer is complete but not entirely correct.

Situation

A

The lessor's:

1. Total lease payments

$ 910,000

$ 910,000

$ 1,040,000

1,040.000

2. Gross investment in the

lease

3. Net investment in the lease

The lessee's:

910,000

966,000

1,048,600

1,162,000

730,974

724,921 O

792,916

771.224

B

4. Total lease payments

910,000

910,000

1,040,000

1,106,000

5. Right-of-use asset

6. Lease liability

730,974

696,184

788,600

771,225

730,974

696,184

788,600

771.225

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning