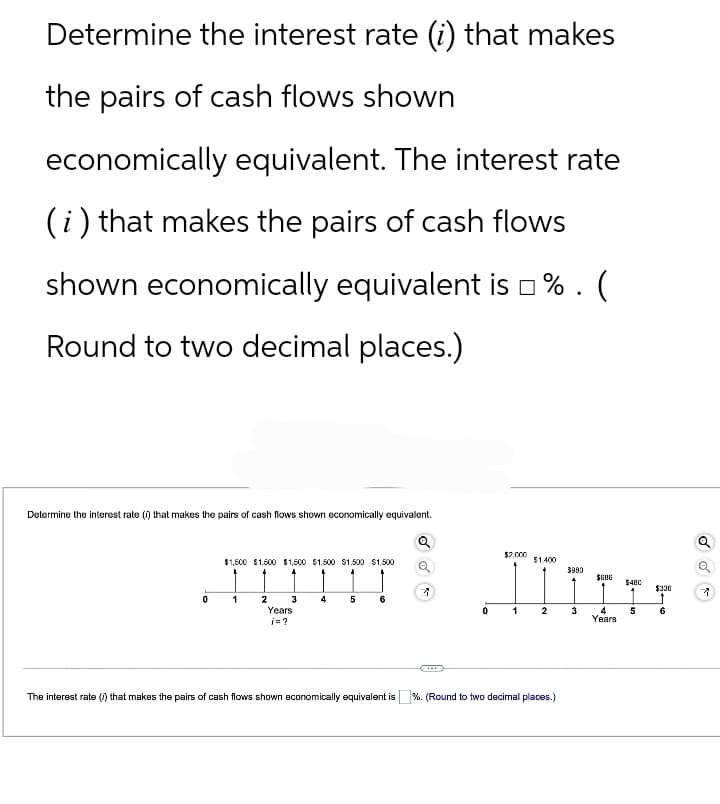

Determine the interest rate (i) that makes the pairs of cash flows shown economically equivalent. The interest rate (i) that makes the pairs of cash flows shown economically equivalent is ☐ %. ( Round to two decimal places.)

Determine the interest rate (i) that makes the pairs of cash flows shown economically equivalent. The interest rate (i) that makes the pairs of cash flows shown economically equivalent is ☐ %. ( Round to two decimal places.)

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Long-term Assets: Fixed And Intangible

Section: Chapter Questions

Problem 28E

Related questions

Question

The answer should be typed.

Transcribed Image Text:Determine the interest rate (i) that makes

the pairs of cash flows shown

economically equivalent. The interest rate

(i) that makes the pairs of cash flows

shown economically equivalent is □ % . (

Round to two decimal places.)

Determine the interest rate (1) that makes the pairs of cash flows shown economically equivalent.

0

$1,500 $1,500 $1,500 $1,500 $1,500 $1.500

1

2 3

Years

i=?

4

5

6

The interest rate (1) that makes the pairs of cash flows shown economically equivalent is

C

0

$2,000

$1.400

3980

IIIIF

$686

$480

1

2

3

4

5

Years

%. (Round to two decimal places.)

$336

6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning