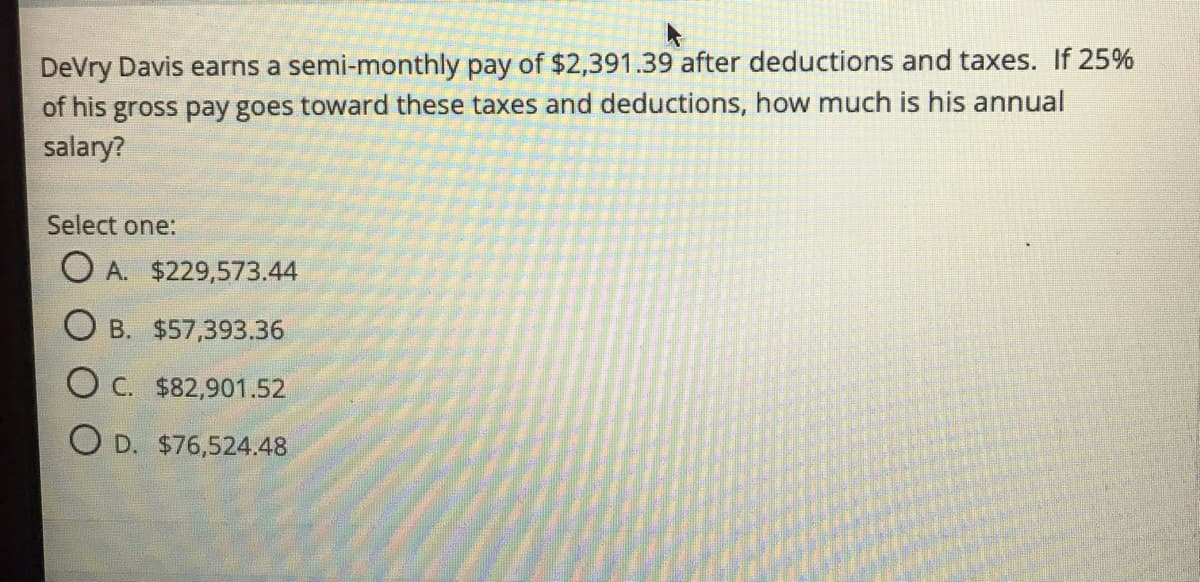

DeVry Davis earns a semi-monthly pay of $2,391.39 after deductions and taxes. If 25% of his gross pay goes toward these taxes and deductions, how much is his annual salary? Select one: O A. $229,573.44 O B. $57,393.36 O C. $82,901.52 O D. $76,524.48

DeVry Davis earns a semi-monthly pay of $2,391.39 after deductions and taxes. If 25% of his gross pay goes toward these taxes and deductions, how much is his annual salary? Select one: O A. $229,573.44 O B. $57,393.36 O C. $82,901.52 O D. $76,524.48

Chapter12: Sequences, Series And Binomial Theorem

Section12.3: Geometric Sequences And Series

Problem 12.57TI: What is the total effect on the economy of a government tax rebate of $1,000 to each household in...

Related questions

Question

Transcribed Image Text:DeVry Davis earns a semi-monthly pay of $2,391.39 after deductions and taxes. If 25%

of his gross pay goes toward these taxes and deductions, how much is his annual

salary?

Select one:

O A. $229,573.44

O B. $57,393.36

O C. $82,901.52

O D. $76,524.48

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you