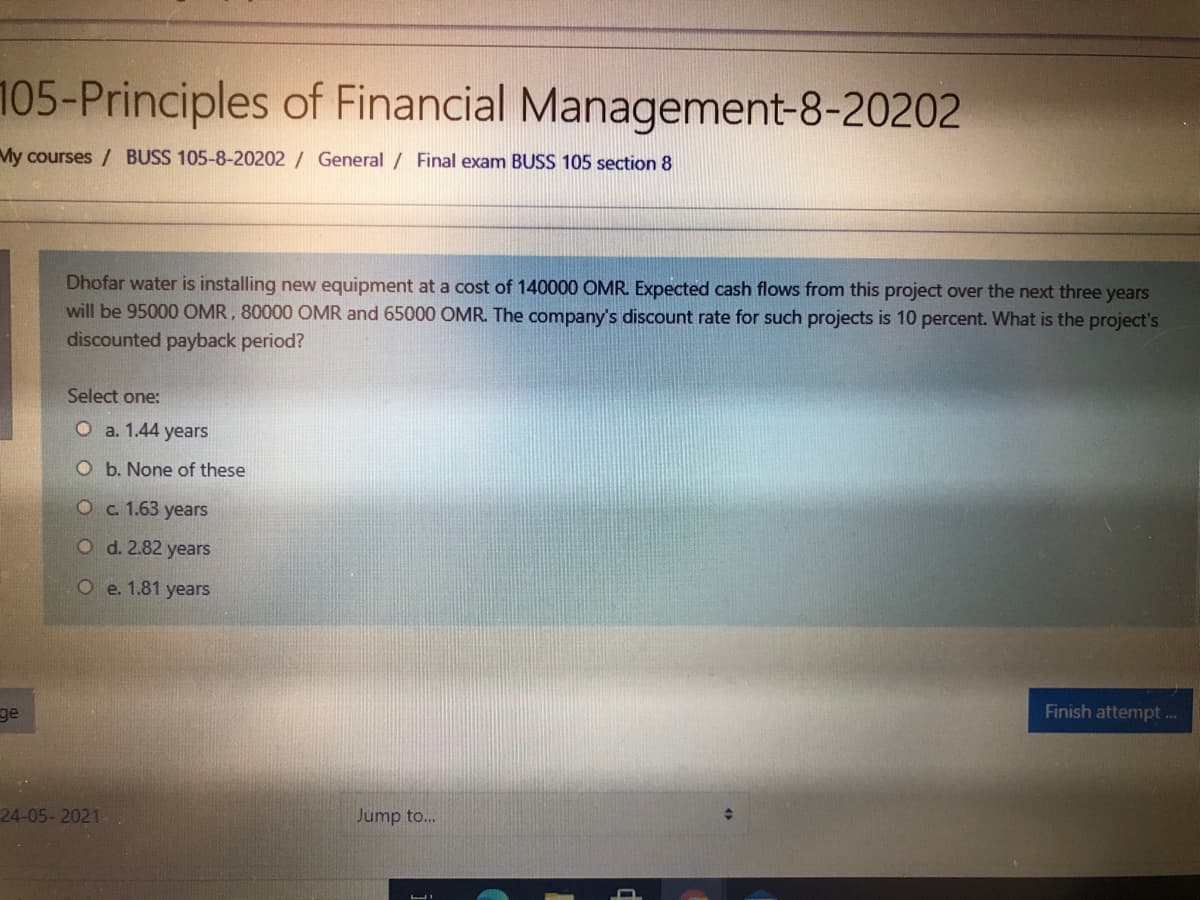

Dhofar water is installing new equipment at a cost of 140000 OMR. Expected cash flows from this project over the next three years will be 95000 OMR, 80000 OMR and 65000 OMR. The company's discount rate for such projects is 10 percent. What is the project's discounted payback period? Select one: O a. 1.44 years O b. None of these Oc. 1.63 years O d. 2.82 years O e. 1.81 years

Dhofar water is installing new equipment at a cost of 140000 OMR. Expected cash flows from this project over the next three years will be 95000 OMR, 80000 OMR and 65000 OMR. The company's discount rate for such projects is 10 percent. What is the project's discounted payback period? Select one: O a. 1.44 years O b. None of these Oc. 1.63 years O d. 2.82 years O e. 1.81 years

Chapter9: Capital Budgeting Techniques

Section: Chapter Questions

Problem 7PROB

Related questions

Question

Transcribed Image Text:105-Principles of Financial Management-8-20202

My courses / BUSS 105-8-20202 / General / Final exam BUSS 105 section 8

Dhofar water is installing new equipment at a cost of 140000 OMR. Expected cash flows from this project over the next three years

will be 95000 OMR, 80000 OMR and 65000 OMR. The company's discount rate for such projects is 10 percent. What is the project's

discounted payback period?

Select one:

O a. 1.44 years

O b. None of these

O c. 1.63 years

O d. 2.82 years

O e. 1.81 years

Finish attempt .

ge

24-05- 2021

Jump to...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning