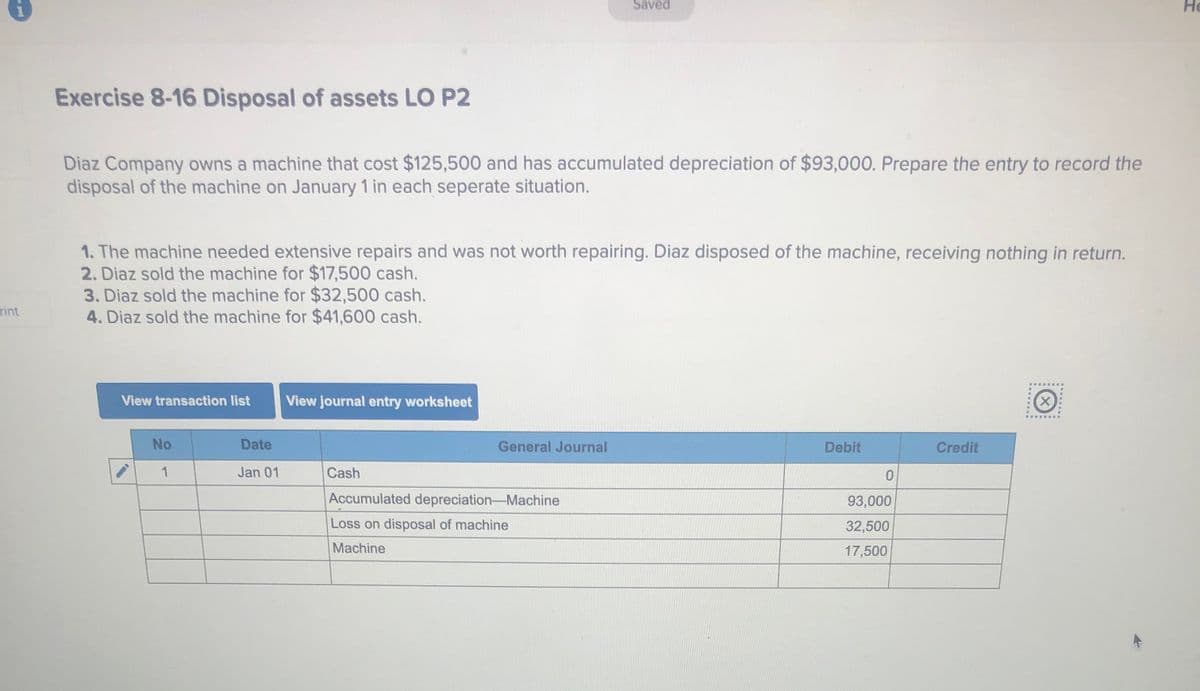

Diaz Company owns a machine that cost $125,500 and has accumulated depreciation of $93,000. Prepare the entry to record the disposal of the machine on January 1 in each seperate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $17,500 cash. 3. Diaz sold the machine for $32,500 cash. 4. Diaz sold the machine for $41,600 cash. View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Jan 01 Cash Accumulated depreciation-Machine 93,000 Loss on disposal of machine 32,500 Machine 17,500

Diaz Company owns a machine that cost $125,500 and has accumulated depreciation of $93,000. Prepare the entry to record the disposal of the machine on January 1 in each seperate situation. 1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return. 2. Diaz sold the machine for $17,500 cash. 3. Diaz sold the machine for $32,500 cash. 4. Diaz sold the machine for $41,600 cash. View transaction list View journal entry worksheet No Date General Journal Debit Credit 1 Jan 01 Cash Accumulated depreciation-Machine 93,000 Loss on disposal of machine 32,500 Machine 17,500

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter9: Long-term Assets: Fixed And Intangible

Section: Chapter Questions

Problem 9.5APR

Related questions

Question

Can you please check my work

Transcribed Image Text:Saved

Не

Exercise 8-16 Disposal of assets LO P2

Diaz Company owns a machine that cost $125,500 and has accumulated depreciation of $93,000. Prepare the entry to record the

disposal of the machine on January 1 in each seperate situation.

1. The machine needed extensive repairs and was not worth repairing. Diaz disposed of the machine, receiving nothing in return.

2. Diaz sold the machine for $17,500 cash.

3. Diaz sold the machine for $32,500 cash.

4. Diaz sold the machine for $41,600 cash.

rint

View transaction list

View journal entry worksheet

(X)

No

Date

General Journal

Debit

Credit

1

Jan 01

Cash

Accumulated depreciation-Machine

93,000

Loss on disposal of machine

32,500

Machine

17,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning