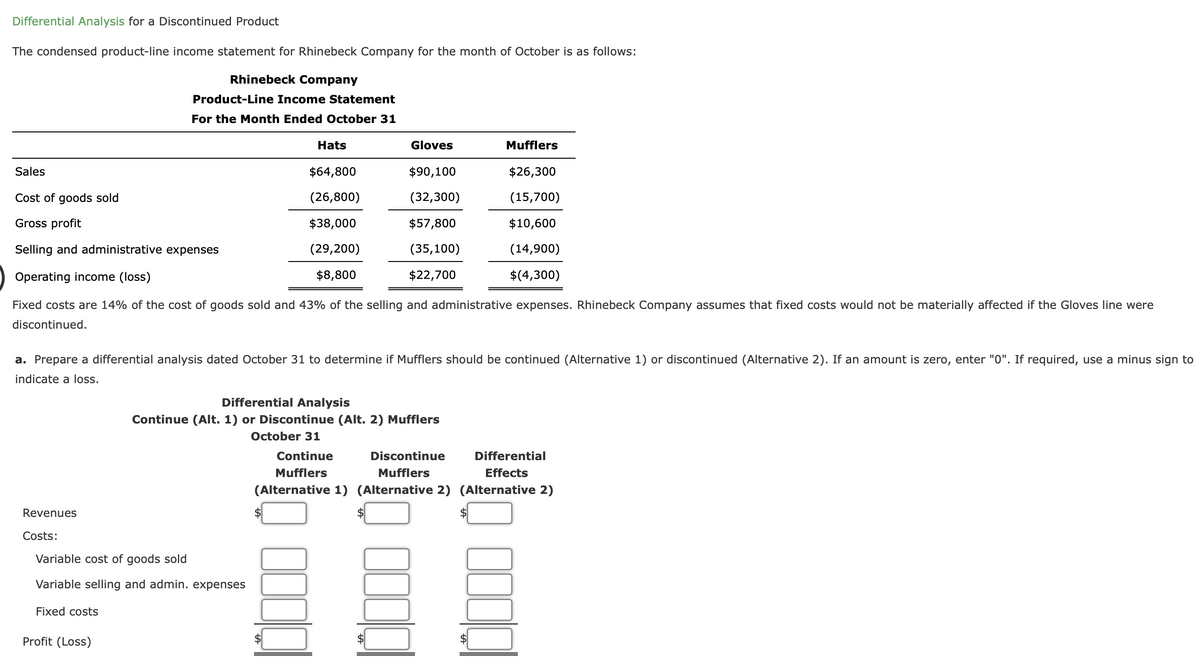

Differential Analysis for a Discontinued Product The condensed product-line income statement for Rhinebeck Company for the month of October is as follows: Rhinebeck Company Product-Line Income Statement For the Month Ended October 31 Hats Gloves Mufflers Sales $64,800 $90,100 $26,300 Cost of goods sold (26,800) (32,300) (15,700) Gross profit $38,000 $57,800 $10,600 Selling and administrative expenses (29,200) (35,100) (14,900) Operating income (loss) $8,800 $2,700 $(4,300) Fixed costs are 14% of the cost of goods sold and 43% of the selling and administrative expenses. Rhinebeck Company assumes that fixed discontinued. a. Prepare a differential analysis dated October 31 to determine if Mufflers should be continued (Alternative 1) or discontinued (Alternative indicate a loss. Differential Analysis Continue (Alt. 1) or Discontinue (Alt. 2) Mufflers October 31 Continue Discontinue Differential Mufflers Mufflers Effects (Alternative 1) (Alternative 2) (Alternative 2) Revenues Costs: Variable cost of goods sold Variable selling and admin. expenses Fixed costs

Differential Analysis for a Discontinued Product The condensed product-line income statement for Rhinebeck Company for the month of October is as follows: Rhinebeck Company Product-Line Income Statement For the Month Ended October 31 Hats Gloves Mufflers Sales $64,800 $90,100 $26,300 Cost of goods sold (26,800) (32,300) (15,700) Gross profit $38,000 $57,800 $10,600 Selling and administrative expenses (29,200) (35,100) (14,900) Operating income (loss) $8,800 $2,700 $(4,300) Fixed costs are 14% of the cost of goods sold and 43% of the selling and administrative expenses. Rhinebeck Company assumes that fixed discontinued. a. Prepare a differential analysis dated October 31 to determine if Mufflers should be continued (Alternative 1) or discontinued (Alternative indicate a loss. Differential Analysis Continue (Alt. 1) or Discontinue (Alt. 2) Mufflers October 31 Continue Discontinue Differential Mufflers Mufflers Effects (Alternative 1) (Alternative 2) (Alternative 2) Revenues Costs: Variable cost of goods sold Variable selling and admin. expenses Fixed costs

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 4E: Differential analysis for a discontinued product The condensed product-line income statement for...

Related questions

Question

100%

Diff Analysis & Product Pricing:

Transcribed Image Text:Differential Analysis for a Discontinued Product

The condensed product-line income statement for Rhinebeck Company for the month of October is as follows:

Rhinebeck Company

Product-Line Income Statement

For the Month Ended October 31

Hats

Gloves

Mufflers

Sales

$64,800

$90,100

$26,300

Cost of goods sold

(26,800)

(32,300)

(15,700)

Gross profit

$38,000

$57,800

$10,600

Selling and administrative expenses

(29,200)

(35,100)

(14,900)

Operating income (loss)

$8,800

$22,700

$(4,300)

Fixed costs are 14% of the cost of goods sold and 43% of the selling and administrative expenses. Rhinebeck Company assumes that fixed costs would not be materially affected if the Gloves line were

discontinued.

a. Prepare a differential analysis dated October 31 to determine if Mufflers should be continued (Alternative 1) or discontinued (Alternative 2). If an amount is zero, enter "0". If required, use a minus sign to

indicate a loss.

Differential Analysis

Continue (Alt. 1) or Discontinue (Alt. 2) Mufflers

October 31

Continue

Discontinue

Differential

Mufflers

Mufflers

Effects

(Alternative 1) (Alternative 2) (Alternative 2)

Revenues

Costs:

Variable cost of goods sold

Variable selling and admin. expenses

Fixed costs

Profit (Loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning