Dimsdale Sports, a merchandising company, reports the following balance sheet at December 31. DIMSDALE SPORTS COMPANY Balance Sheet December 31 Assets Cash Accounts receivable Inventory Equipment Less: Accumulated depreciation Equipment, net Total assets Liabilities Liabilities and Equity Accounts payable Loan payable Taxes payable (due March 15) Equity $ 528,000 66,000 $ 375,000 13,000 88,000 $ 470,500 215,000 $ 22,000 520,000 157,500 462,000 $ 1,161,500 $ 476,000 Common stock Retained earnings Total stockholders' equity Total liabilities and equity To prepare a master budget for January, February, and March, use the following Information. 685,500 $ 1,161,500 a. The company's single product is purchased for $30 per unit and resold for $57 per unit. The Inventory level of 5,250 units on December 31 is more than management's desired level, which is 20% of the next month's budgeted sales units. Budgeted sales are January, 7,250 units; February, 9,000 units; March, 10,500 units; and April, 10,500 units. All sales are on credit. b. Cash receipts from sales are budgeted as follows: January, $269,638; February, $738,403; March, $517,639. c. Cash payments for merchandise purchases are budgeted as follows: January, $60,000; February, $337,800; March, $147,000. d. Sales commissions equal to 20% of sales dollars are paid each month. Sales salaries (excluding commissions) are $6,000 per month. e. General and administrative salaries are $12,000 per month. Maintenance expense equals $2,000 per month and is paid in cash. 1. New equipment purchases are budgeted as follows: January, $36,000; February, $93,600; and March, $19,200. Budgeted depreciation expense Is January, $ 5,875; February, $6,850; and March, $7,050. g. The company budgets a land purchase at the end of March at a cost of $150,000, which will be paid with cash on the last day of the month. h. The company has an agreement with its bank to obtain additional loans as needed. The Interest rate is 1% per month and Interest is paid at each month-end based on the beginning-month balance. Partial or full payments on these loans are made on the last day of the month. The company maintains a minimum ending cash balance of $22,000 at the end of each month. 1. The Income tax rate for the company is 39%. Income taxes on the first quarter's Income will not be paid until April 15.

Dimsdale Sports, a merchandising company, reports the following balance sheet at December 31. DIMSDALE SPORTS COMPANY Balance Sheet December 31 Assets Cash Accounts receivable Inventory Equipment Less: Accumulated depreciation Equipment, net Total assets Liabilities Liabilities and Equity Accounts payable Loan payable Taxes payable (due March 15) Equity $ 528,000 66,000 $ 375,000 13,000 88,000 $ 470,500 215,000 $ 22,000 520,000 157,500 462,000 $ 1,161,500 $ 476,000 Common stock Retained earnings Total stockholders' equity Total liabilities and equity To prepare a master budget for January, February, and March, use the following Information. 685,500 $ 1,161,500 a. The company's single product is purchased for $30 per unit and resold for $57 per unit. The Inventory level of 5,250 units on December 31 is more than management's desired level, which is 20% of the next month's budgeted sales units. Budgeted sales are January, 7,250 units; February, 9,000 units; March, 10,500 units; and April, 10,500 units. All sales are on credit. b. Cash receipts from sales are budgeted as follows: January, $269,638; February, $738,403; March, $517,639. c. Cash payments for merchandise purchases are budgeted as follows: January, $60,000; February, $337,800; March, $147,000. d. Sales commissions equal to 20% of sales dollars are paid each month. Sales salaries (excluding commissions) are $6,000 per month. e. General and administrative salaries are $12,000 per month. Maintenance expense equals $2,000 per month and is paid in cash. 1. New equipment purchases are budgeted as follows: January, $36,000; February, $93,600; and March, $19,200. Budgeted depreciation expense Is January, $ 5,875; February, $6,850; and March, $7,050. g. The company budgets a land purchase at the end of March at a cost of $150,000, which will be paid with cash on the last day of the month. h. The company has an agreement with its bank to obtain additional loans as needed. The Interest rate is 1% per month and Interest is paid at each month-end based on the beginning-month balance. Partial or full payments on these loans are made on the last day of the month. The company maintains a minimum ending cash balance of $22,000 at the end of each month. 1. The Income tax rate for the company is 39%. Income taxes on the first quarter's Income will not be paid until April 15.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter9: Profit Planning And Flexible Budgets

Section: Chapter Questions

Problem 14MCQ: The percentage of accounts receivable that is uncollectible can be ignored for cash budgeting...

Related questions

Question

need assistance with this

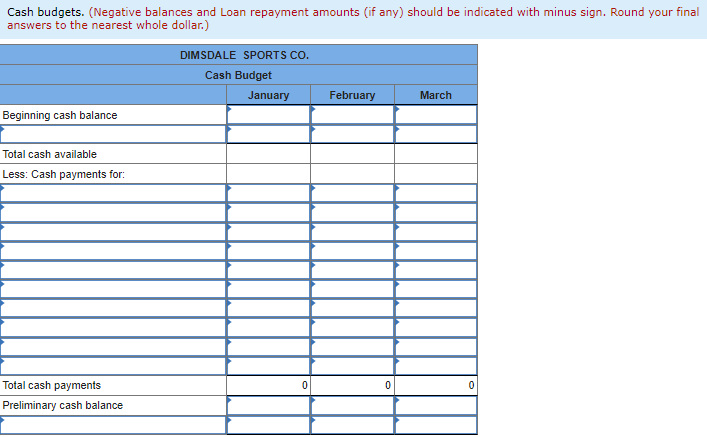

Transcribed Image Text:Cash budgets. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final

answers to the nearest whole dollar.)

Beginning cash balance

Total cash available

Less: Cash payments for:

Total cash payments

Preliminary cash balance

DIMSDALE SPORTS CO.

Cash Budget

January

0

February

0

March

0

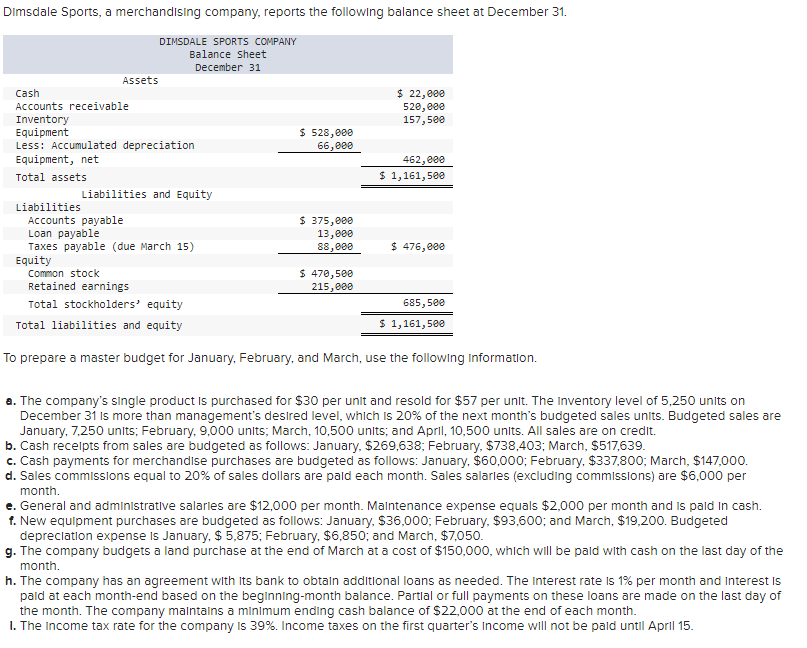

Transcribed Image Text:Dimsdale Sports, a merchandising company, reports the following balance sheet at December 31.

DIMSDALE SPORTS COMPANY

Balance Sheet

December 31

Assets

Cash

Accounts receivable

Inventory

Equipment

Less: Accumulated depreciation

Equipment, net

Total assets

Liabilities

Liabilities and Equity

Accounts payable

Loan payable

Taxes payable (due March 15)

Equity

$ 528,000

66,000

$ 375,000

13,000

88,000

$ 22,000

520,000

157,500

$ 470,500

215,000

462,000

$ 1,161,500

$ 476,000

Common stock

Retained earnings

Total stockholders' equity

Total liabilities and equity

To prepare a master budget for January, February, and March, use the following information.

685,500

$ 1,161,500

a. The company's single product is purchased for $30 per unit and resold for $57 per unit. The Inventory level of 5,250 units on

December 31 is more than management's desired level, which is 20% of the next month's budgeted sales units. Budgeted sales are

January, 7,250 units; February, 9,000 units; March, 10,500 units; and April, 10,500 units. All sales are on credit.

b. Cash receipts from sales are budgeted as follows: January, $269,638; February, $738,403; March, $517,639.

c. Cash payments for merchandise purchases are budgeted as follows: January, $60,000; February, $337,800; March, $147,000.

d. Sales commissions equal to 20% of sales dollars are paid each month. Sales salaries (excluding commissions) are $6,000 per

month.

e. General and administrative salaries are $12,000 per month. Maintenance expense equals $2,000 per month and is paid in cash.

f. New equipment purchases are budgeted as follows: January, $36,000; February, $93,600; and March, $19,200. Budgeted

depreciation expense is January, $ 5,875; February, $6,850; and March, $7,050.

g. The company budgets a land purchase at the end of March at a cost of $150,000, which will be paid with cash on the last day of the

month.

h. The company has an agreement with its bank to obtain additional loans as needed. The Interest rate is 1% per month and Interest is

paid at each month-end based on the beginning-month balance. Partial or full payments on these loans are made on the last day of

the month. The company maintains a minimum ending cash balance of $22,000 at the end of each month.

1. The Income tax rate for the company is 39%. Income taxes on the first quarter's Income will not be paid until April 15.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning