ding operating and free cash flows Consider the balance sheets and se Calculate the firm's net operating profit after taxes (NOPAT) for this year. Calculate the firm's operating cash flow (OCF) for the year. Calculate the firm's free cash flow (FCF) for the year. nterpret, compare and contrast your cash flow estimate in parts (b) and (c) The net operating profit after taxes is $. (Round to the nearest dollar.)

ding operating and free cash flows Consider the balance sheets and se Calculate the firm's net operating profit after taxes (NOPAT) for this year. Calculate the firm's operating cash flow (OCF) for the year. Calculate the firm's free cash flow (FCF) for the year. nterpret, compare and contrast your cash flow estimate in parts (b) and (c) The net operating profit after taxes is $. (Round to the nearest dollar.)

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter15: Statement Of Cash Flows

Section: Chapter Questions

Problem 19E

Related questions

Question

Fast pls solve this question correctly in 5 min pls I will give u like for sure

Svtrik

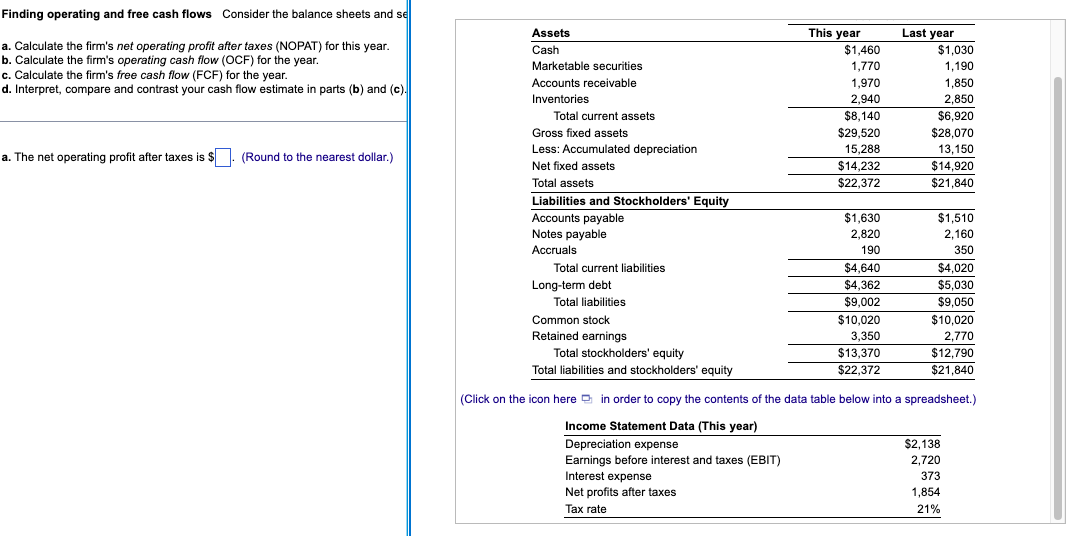

Transcribed Image Text:Finding operating and free cash flows Consider the balance sheets and se

a. Calculate the firm's net operating profit after taxes (NOPAT) for this year.

b. Calculate the firm's operating cash flow (OCF) for the year.

c. Calculate the firm's free cash flow (FCF) for the year.

d. Interpret, compare and contrast your cash flow estimate in parts (b) and (c).

a. The net operating profit after taxes is $. (Round to the nearest dollar.)

Assets

Cash

Marketable securities

Accounts receivable

Inventories

Total current assets

Gross fixed assets

Less: Accumulated depreciation.

Net fixed assets

Total assets

Liabilities and Stockholders' Equity

Accounts payable

Notes payable

Accruals

Total current liabilities

Long-term debt

Total liabilities

Common stock

Retained earnings

This year

$1,460

1,770

1.970

2,940

$8,140

$29,520

15.288

$14,232

$22,372

$1,630

2,820

190

$4,640

$4,362

$9,002

$10,020

3,350

$13,370

$22,372

Last year

$1,030

1,190

1,850

2,850

$6,920

$28,070

13,150

$14,920

$21,840

$1,510

2,160

350

$4,020

$5,030

$9,050

$10,020

2,770

$12,790

$21,840

Total stockholders' equity

Total liabilities and stockholders' equity

(Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)

Income Statement Data (This year)

Depreciation expense

Earnings before interest and taxes (EBIT)

Interest expense

Net profits after taxes

Tax rate

$2,138

2,720

373

1,854

21%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,