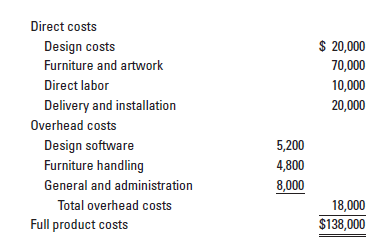

Direct costs $ 20,000 Design costs Furniture and artwork 70,000 Direct labor 10,000 Delivery and installation 20,000 Overhead costs Design software Furniture handling 5,200 4,800 8,000 General and administration Total overhead costs 18,000 $138,000 Full product costs

Ethics and pricing. Instyle Interior Designs has been requested to prepare a bid to decorate four model homes for a new development. Winning the bid would be a big boost for sales representative Jim Doogan, who works entirely on commission. Sara Groom, the cost accountant for Instyle, prepares the bid based on the following cost information:

Based on the company policy of pricing at 120% of full cost, Groom gives Doogan a figure of $165,600 to submit for the job. Doogan is very concerned. He tells Groom that at that price, Instyle has no chance of winning the job. He confides in her that he spent $600 of company funds to take the developer to a basketball playoff game where the developer disclosed that a bid of $156,000 would win the job. He hadn’t planned to tell Groom because he was confident that the bid she developed would be below that amount. Doogan reasons that the $600 he spent will be wasted if Instyle doesn’t capitalize on this valuable information. In any case, the company will still make money if it wins the bid at $156,000 because it is higher than the full cost of $138,000.

- Is the $600 spent on the basketball tickets relevant to the bid decision? Why or why not?

- Groom suggests that if Doogan is willing to use cheaper furniture and artwork, he can achieve a bid of $156,000. The designs have already been reviewed and accepted and cannot be changed without additional cost, so the entire amount of reduction in cost will need to come from furniture and artwork. What is the target cost of furniture and artwork that will allow Doogan to submit a bid of $156,000 assuming a target markup of 20% of full cost?

- Evaluate whether Groom’s suggestion to Doogan to use the developer’s tip is unethical. Would it be unethical for Doogan to redo the project’s design to arrive at a lower bid? What steps should Doogan and Groom take to resolve this situation?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images