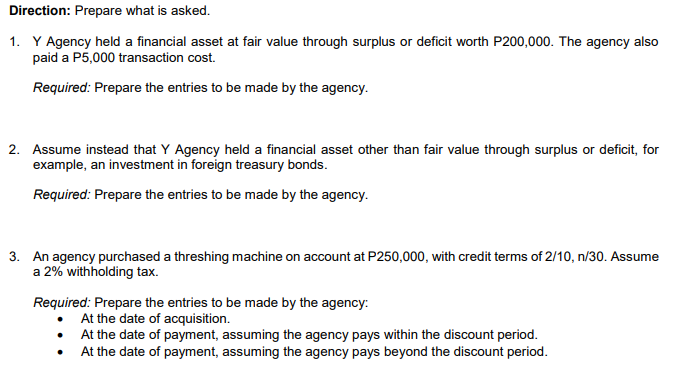

Direction: Prepare what is asked. 1. Y Agency held a financial asset at fair value through surplus or deficit worth P200,000. The agency also paid a P5,000 transaction cost. Required: Prepare the entries to be made by the agency. 2. Assume instead that Y Agency held a financial asset other than fair value through surplus or deficit, for example, an investment in foreign treasury bonds. Required: Prepare the entries to be made by the agency. 3. An agency purchased a threshing machine on account at P250,000, with credit terms of 2/10, n/30. Assume a 2% withholding tax. Required: Prepare the entries to be made by the agency: • At the date of acquisition. • At the date of payment, assuming the agency pays within the discount period. • At the date of payment, assuming the agency pays beyond the discount period.

Direction: Prepare what is asked. 1. Y Agency held a financial asset at fair value through surplus or deficit worth P200,000. The agency also paid a P5,000 transaction cost. Required: Prepare the entries to be made by the agency. 2. Assume instead that Y Agency held a financial asset other than fair value through surplus or deficit, for example, an investment in foreign treasury bonds. Required: Prepare the entries to be made by the agency. 3. An agency purchased a threshing machine on account at P250,000, with credit terms of 2/10, n/30. Assume a 2% withholding tax. Required: Prepare the entries to be made by the agency: • At the date of acquisition. • At the date of payment, assuming the agency pays within the discount period. • At the date of payment, assuming the agency pays beyond the discount period.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

Transcribed Image Text:Direction: Prepare what is asked.

1. Y Agency held a financial asset at fair value through surplus or deficit worth P200,000. The agency also

paid a P5,000 transaction cost.

Required: Prepare the entries to be made by the agency.

2. Assume instead that Y Agency held a financial asset other than fair value through surplus or deficit, for

example, an investment in foreign treasury bonds.

Required: Prepare the entries to be made by the agency.

3. An agency purchased a threshing machine on account at P250,000, with credit terms of 2/10, n/30. Assume

a 2% withholding tax.

Required: Prepare the entries to be made by the agency:

At the date of acquisition.

At the date of payment, assuming the agency pays within the discount period.

At the date of payment, assuming the agency pays beyond the discount period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,