Discount-Mart Issues $20 million In bonds on January 1, 2021. The bonds have a seven-year term and pay Interest semlannually on June 30 and December 31 each year. Below Is a partlal bond amortization schedule for the bonds Interest Increase in Carrying Date Cash Paid Expense Carrying Value Value 01/01/2021 06/30/2021 12/31/2021 $18,820,272 $800,000 800, 000 800, 000 800,000 $901,014 906,064 911,368 916,936 $101,014 18,121, 286 106,864 18,227,350 06/30/2022 111,368 116,936 18,338,718 18,455,654 12/31/2022 What is the stated annual rate of Interest on the bonds? (Hint: Be sure to provide the annual rate rather than the stx-month rate) (Do not round your Intermedlate calculations.) Multiple Cholce 8%

Discount-Mart Issues $20 million In bonds on January 1, 2021. The bonds have a seven-year term and pay Interest semlannually on June 30 and December 31 each year. Below Is a partlal bond amortization schedule for the bonds Interest Increase in Carrying Date Cash Paid Expense Carrying Value Value 01/01/2021 06/30/2021 12/31/2021 $18,820,272 $800,000 800, 000 800, 000 800,000 $901,014 906,064 911,368 916,936 $101,014 18,121, 286 106,864 18,227,350 06/30/2022 111,368 116,936 18,338,718 18,455,654 12/31/2022 What is the stated annual rate of Interest on the bonds? (Hint: Be sure to provide the annual rate rather than the stx-month rate) (Do not round your Intermedlate calculations.) Multiple Cholce 8%

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 8RE

Related questions

Question

Please answer both. This is part A and B

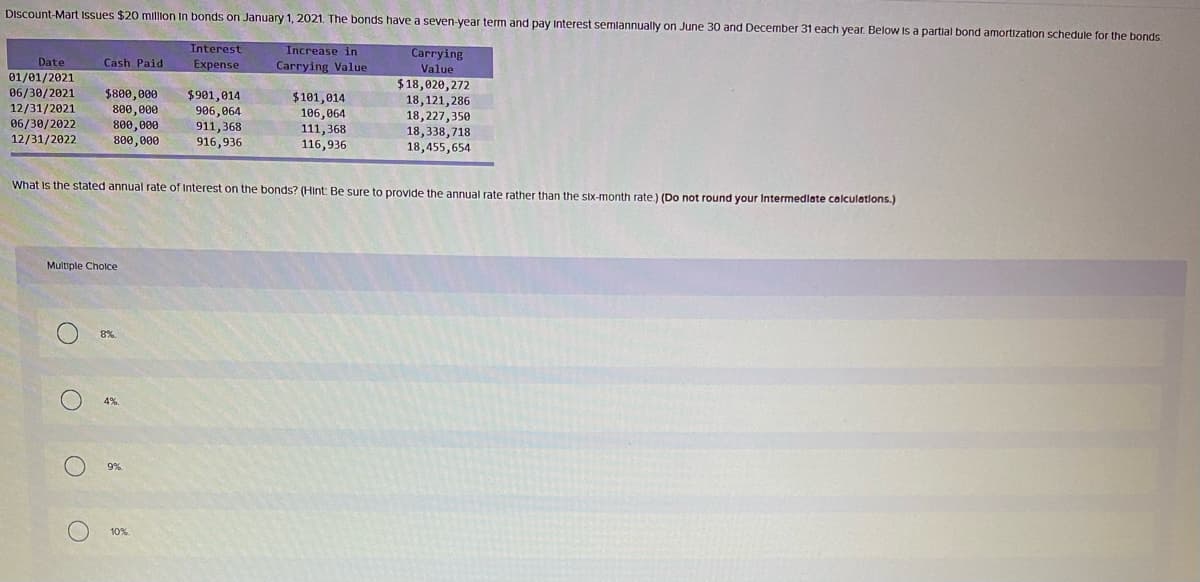

Transcribed Image Text:DIscount-Mart Issues $20 million In bonds on January 1, 2021. The bonds have a seven-year term and pay Interest semlannually on June 30 and December 31 each year. Below Is a partlal bond amortization schedule for the bonds

Interest

Increase in

Carrying

Date

Cash Paid

Expense

Carrying Value

Value

01/01/2021

$18,020,272

18,121,286

18,227,350

18,338,718

18,455,654

06/30/2021

$800, 000

800,000

800, 000

800,000

$901,014

906,064

12/31/2021

06/30/2022

12/31/2022

$101,014

106,864

111, 368

116,936

911,368

916,936

What is the stated annual rate of Interest on the bonds? (Hint: Be sure to provide the annual rate rather than the six-month rate) (Do not round your Intermedlate calculations.)

Multiple Cholce

8%

4%.

9%.

10%.

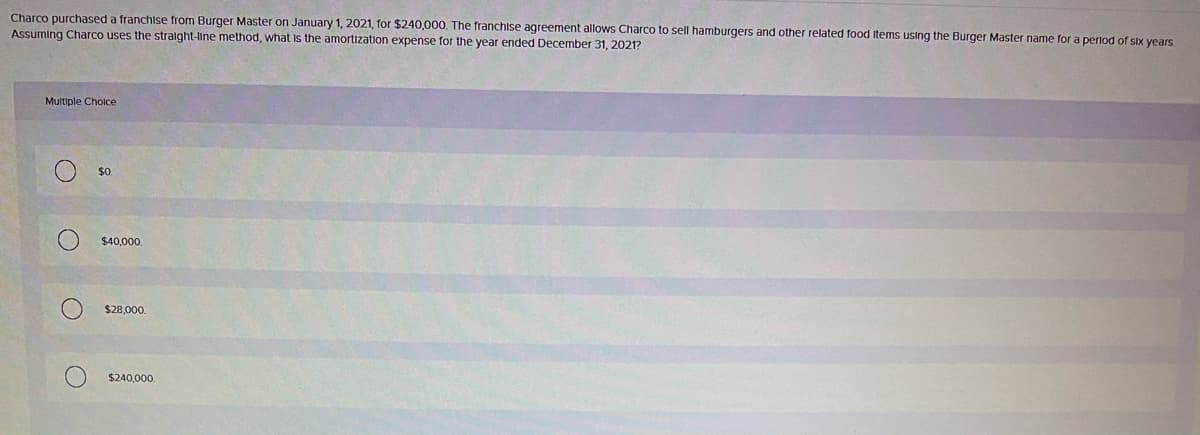

Transcribed Image Text:Charco purchased a franchise from Burger Master on January 1, 2021, for $240,000. The franchise agreement allows Charco to sell hamburgers and other related food Items using the Burger Master name for a perlod of six years

Assuming Charco uses the straight-line method, what is the amortization expense for the year ended December 31, 2021?

Multiple Cholce

$0

$40,000,

$28,000.

$240.000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT