Discuss special depreciation methods and other depreciation issues.

Discuss special

Depreciation is decrease in the value of assets due to normal wear, tear, and obsolesce

Depreciation only levied on fixed assets such as plant and machinery, building etc.

Depreciation arises due to change in technology, usage, passage of time

Various methods of depreciation are as follows:

- Straight line method

- Diminishing balance methods

- Sum of years digit methods

- Machine hours rate methods

- Depletion methods

- Revaluation methods

Straight line methods: Under this method same amount of depreciation is charged in every year during the life of the assets

Diminishing balance methods : Under this method depreciation is charged on written down balance of an assets

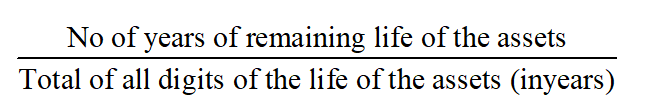

Sum of years digit method: Under this method depreciation is calculated using this formula

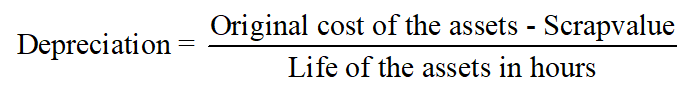

Machine hours rate methods: Under this method depreciation is charged on the basis of no. of hours the machine is used

Formula:

Depletion methods: this method of depreciation is used when the assets is of natural resources.

Examples of natural resources: forest, mines, oils

Revaluation method : Amount of depreciation under this method is equal to difference between revalued figure and the book value of assets

Step by step

Solved in 3 steps with 2 images