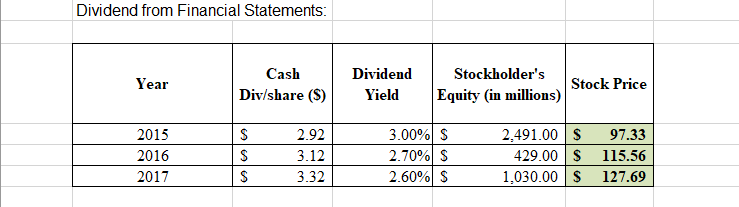

Dividend from Financial Statements Stockholder's Cash Dividend Year Stock Price Equity (in millions) Div/share (S) Yield 3.00% S 2.70% S 2.60% S 97.33 2015 2.92 2,491.00 2016 3.12 429.00 115.56 2017 3.32 1,030.00 127.69 2. The dividend yield if the firm doubled it's outstanding shares Stockholder's Cash Dividend Equity (in millions) Stock Price Year Div/Share (S) Yield doubled 1.50% S 1.35% S 1.30% S 4,982.00 S 858.00 115.56 2,060.00 97.33 1.46 2015 2016 1.56 127.69 2017 1.66

Dividend from Financial Statements Stockholder's Cash Dividend Year Stock Price Equity (in millions) Div/share (S) Yield 3.00% S 2.70% S 2.60% S 97.33 2015 2.92 2,491.00 2016 3.12 429.00 115.56 2017 3.32 1,030.00 127.69 2. The dividend yield if the firm doubled it's outstanding shares Stockholder's Cash Dividend Equity (in millions) Stock Price Year Div/Share (S) Yield doubled 1.50% S 1.35% S 1.30% S 4,982.00 S 858.00 115.56 2,060.00 97.33 1.46 2015 2016 1.56 127.69 2017 1.66

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 8BE: Earnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow:...

Related questions

Question

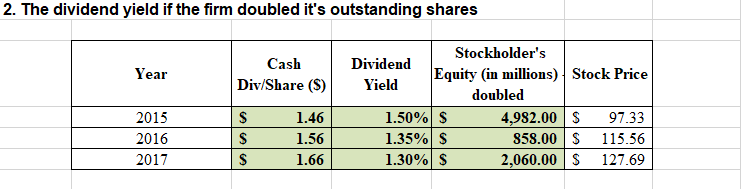

What effect would the calculation performed have in terms of shareholder value? In other words, suppose the company’s goal is to maximize shareholder value. How will doubling outstanding shares support or inhibit that goal? Be sure to justify reasoning.

Transcribed Image Text:Dividend from Financial Statements

Stockholder's

Cash

Dividend

Year

Stock Price

Equity (in millions)

Div/share (S)

Yield

3.00% S

2.70% S

2.60% S

97.33

2015

2.92

2,491.00

2016

3.12

429.00

115.56

2017

3.32

1,030.00

127.69

Transcribed Image Text:2. The dividend yield if the firm doubled it's outstanding shares

Stockholder's

Cash

Dividend

Equity (in millions) Stock Price

Year

Div/Share (S)

Yield

doubled

1.50% S

1.35% S

1.30% S

4,982.00 S

858.00 115.56

2,060.00

97.33

1.46

2015

2016

1.56

127.69

2017

1.66

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning