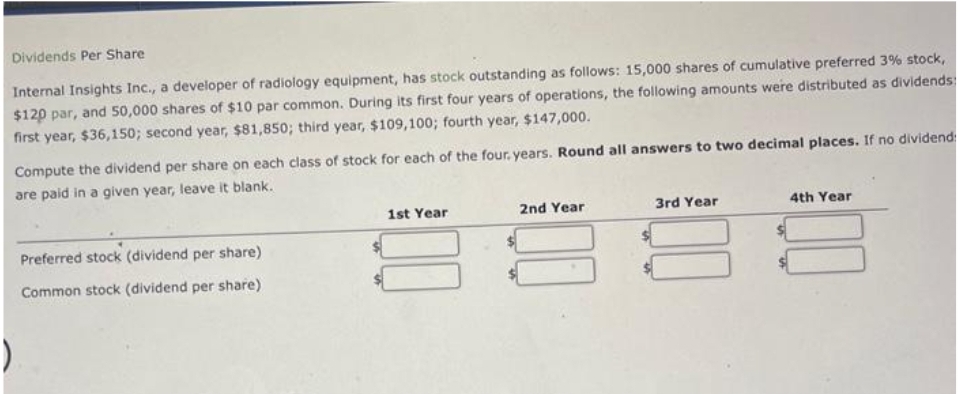

Dividends Per Share Internal Insights Inc., a developer of radiology equipment, has stock outstanding as follows: 15,000 shares of cumulative preferred 3% stock, $120 par, and 50,000 shares of $10 par common. During its first four years of operations, the following amounts were distributed as dividends first year, $36,150; second year, $81,850; third year, $109,100; fourth year, $147,000. Compute the dividend per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividend are paid in a given year, leave it blank. Preferred stock (dividend per share) Common stock (dividend per share) 1st Year 2nd Year 3rd Year 4th Year

Dividends Per Share Internal Insights Inc., a developer of radiology equipment, has stock outstanding as follows: 15,000 shares of cumulative preferred 3% stock, $120 par, and 50,000 shares of $10 par common. During its first four years of operations, the following amounts were distributed as dividends first year, $36,150; second year, $81,850; third year, $109,100; fourth year, $147,000. Compute the dividend per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividend are paid in a given year, leave it blank. Preferred stock (dividend per share) Common stock (dividend per share) 1st Year 2nd Year 3rd Year 4th Year

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 12RE: Given the following year-end information, compute Greenwood Corporations basic and diluted earnings...

Related questions

Question

A19.

Transcribed Image Text:Dividends Per Share

Internal Insights Inc., a developer of radiology equipment, has stock outstanding as follows: 15,000 shares of cumulative preferred 3% stock,

$120 par, and 50,000 shares of $10 par common. During its first four years of operations, the following amounts were distributed as dividends:

first year, $36,150; second year, $81,850; third year, $109,100; fourth year, $147,000.

Compute the dividend per share on each class of stock for each of the four years. Round all answers to two decimal places. If no dividend:

are paid in a given year, leave it blank.

Preferred stock (dividend per share)

Common stock (dividend per share)

1st Year

2nd Year

3rd Year

4th Year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning