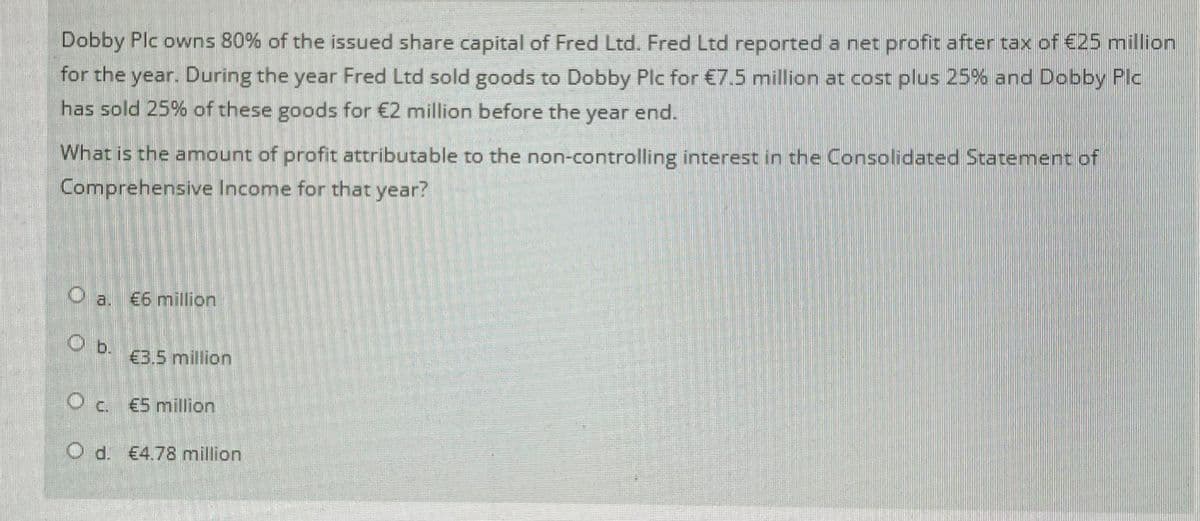

Dobby Plc owns 80% of the issued share capital of Fred Ltd. Fred Ltd reported a net profit after tax of €25 million for the year. During the year Fred Ltd sold goods to Dobby Plc for €7.5 million at cost plus 25% and Dobby Plc has sold 25% of these goods for €2 million before the year end. What is the amount of profit attributable to the non-controlling interest in the Consolidated Statement of Comprehensive Income for that year? €6 million Ob. €3.5 million O c. €5 million O d. €4.78 million

Q: On January 2, 2020, Tuao Company purchased 10% of Abulug Company's outstanding ordinary shares for…

A: The investment in shares of another company gets increased by net profit and gets decreased by…

Q: H plc owns 80% of the the voting shares of S plc. S plc is a subsidiary of H plc. The most recent…

A: Consolidated Accounting Statements: The accounting statement which are formed by holding and…

Q: On January 2, 2017, Normal Inc. acquired 15% interest in Laco Co. by paying P1,500,000 for 7,500…

A: Investment Income For Recognize of investment income which has to be the fair value at the end of…

Q: Penny Ltd, a reporting entity, acquired 100% of the issued shares of Lane Ltd on 1 July 2016. The…

A: Intragroup transactions are transactions that occur between entities in the group which are to be…

Q: Paloma, Inc., owns 90 percent of Blanca Corporation. Both companies have been profitable for many…

A: Deferred tax assets seem to be items that can be utilized for future tax reduction. Typically, this…

Q: From the data given, compute the goodwill or gain from bargain purchase for the different items.…

A: Goodwill is an intangible asset that is related to the takeover of one company by another. In fact,…

Q: On 1 July 2020 Harry Ltd purchased 70 per cent of the issued share capital of Wills Ltd and has…

A: So on 1st July 2020, Harry Ltd Purchases 70% of Issued share capital of Wills Ltd Net Assets on that…

Q: Shaun Company reports a net income of P280,000 each year and pays an annual cash dividend of…

A: given that, Shaun company reports net income = P280000 Shaun company pays annual cash dividend =…

Q: Delta Plc has an 80% subsidiary Golf Ltd, which has been a subsidiary of Delta for the whole of the…

A: When there is unrealized profit on account of sale by subsidiary to parent, then the profit which is…

Q: H plc owns 80% of the the voting shares of S plc. S plc is a subsidiary of H plc. The most recent…

A: Introduction An affiliate may make loans to another affiliate of may transfer the debt of affiliate…

Q: On 1 July 2014. Ark Ltd acquired a 30% interest in Sign Ltd for $54,929,000. During the year ended…

A: The share of the parent company in the profits of its subsidiary is equal to the amount of adjusted…

Q: Hot Plc owns 80% of the issued share capital of Warm Plc and 40% of the issued share capital of Cold…

A: Tax expenses are as follows: Hot Plc = GH¢20,000Warm Plc = GH¢18,000Cold Plc = GH¢10,000

Q: A Corporation purchased a 70% interest in B Company on January 1, 2013 for P140,000, when B’s…

A: B total income = P55000 A’ s share = 70% x P55000 = P38500

Q: On January 2, 2016, Barney Co. acquired all of Dora's ordinary shares for $180,000. On that date,…

A: Accumulated profits are the retained profits which are set aside from the surplus profits to use…

Q: On January 1, 2018, Potter Corporation purchased 80% of Draco Company’s outstanding shares for…

A: The question is multiple choice question Required Choose the Correct Option.

Q: Unicorn Ltd acquired 80% of the issued shares of Pegasus Ltd for $685,700 on 1 July 2020. The…

A: The consolidated financial statements are the financial statements that are created by merging the…

Q: H plc owns 70% of the the voting shares of S plc. S plc is a subsidiary of H plc. The most recent…

A: At the time of preparing a consolidated financial statement (CFS), adjustments related to…

Q: Alpha Ltd acquired 30% of the voting shares of Beta Ltd on 1 July 2021 for $150 000. This…

A: Equity method of accounting for the investment in a company records each and every change made by…

Q: Liala Ltd acquired all the issued shares of Jordan Ltd on 1 January 2015. The following transactions…

A: Consolidated worksheet is a tool used by the companies to prepare the consolidated financial…

Q: On July 1, 2016 TICKLE Company purchased 80% of the outstanding shares of DOODLE Company at a cost…

A: The consolidated net income is calculated below,

Q: On June 30, 2016, Gab Company purchased 25% of the outstanding ordinary shares of IB Co. at a total…

A: Under the fair value method, the investment is reported at the fair value of the market share of the…

Q: Senpai Company acquires 15% of Kohai Company’s common stock for P600,000 cash and carries the…

A: Total fair value on acquisition date = Purchase of 15% share + Purchase of 60% share + fair value of…

Q: Gera Corporation owns two financial investments in the shares of listed companies. Details of which…

A: The details of two investments made by the company are as follows: Investment 1 – Acquired on…

Q: On June 30, 2016, Gab Company purchased 25% of the outstanding ordinary shares of IB Co. at a total…

A: As the question has more than 3 sub-parts, the first 3 subparts are answered. If you want the answer…

Q: Delta Plc has an 80% subsidiary Golf Ltd, which has been a subsidiary of Delta for the whole of the…

A: Given that, Delta Plc = Parent Gold Ltd = subsidiary Golf's profit after tax = £600,000…

Q: In the December 31, 2011, consolidated balance sheet, non-controlling interest on a full-fair value…

A: Consolidated Balance Sheet: The consolidated balance sheet is the merger of the parent company…

Q: On January 1, 2016, Ritter Company bought 10% of the outstanding ordinary shares of Bear…

A:

Q: Wrenten plc owns 65% of the voting shares of Arcanan plc and Arcanan plc is a subsidiary of Wrenten…

A: Intra group transaction: Two companies of the same group having financial or commercial transactions…

Q: Santo, Inc. acquired 30% of Nino Corp.'s voting stock on January 1, 2008 for P360,000. During 2008,…

A: Formula: Gain = Sale price - Purchase price

Q: At the beginning of current year, Cynosure Company purchased 30% of the ordinary shares of another…

A: Solution: Net fair value of assets = P7,000,000 + P1,500,000 + P500,000…

Q: Ryan Limited acquired 80% of the shares in Tully Limited for $165 000. At acquisition date, share…

A: Goodwill under the full goodwill method is the difference between the amount paid as consideration…

Q: APA Corporation is a parent, having purchased 60% of ABC Company’s common stock at par value for…

A: Subsidiary company refers to the company which is owned through another company that is regarded as…

Q: House Plc owns 80% of the issued share capital of Window Plc and 25% of the issued share capital of…

A: Revenues are as follows: House Plc = GH¢1,500,000Window Plc = GH¢1,000,000Door Plc = GH¢160,000

Q: BP (SME A) and BTS (SME B) each acquired 30% of the outstanding shares of Big Hit Corporation for…

A: Equity Method of Accounting: If an investor owns 20–50% of the voting stock of the associate…

Q: Shaun Company reports a net income of P280,000 each year and pays an annual cash dividend of…

A: The difference between Purchase Price and Book Value is either Goodwill or Capital Reserve. When…

Q: Hodge Co. owns 90 percent of the voting common shares of Bison Co. During 2022, Hodge had sales of…

A: Introduction Intercompany upstream sale of inventory occurs, the effect of this transaction is…

Q: On 1s January 2020, Khairul Bhd acquired 20,000 shares in Amin Bhd for RM 80,000. This gave Khairul…

A: 20000 shares for RM80000 on 01.01.2020

Q: Mokwena Limited acquired 48% investment in Masibi Limited at R100 000. At the date of acquisition,…

A: Value of net assets of masibi limited : Net assets = (Fixed assets+ Non current assets + current…

Q: 1 February 2011 PETA acquired 35% of the equity shares of AVO, its only associate, for $20,000,000…

A: Solution. Investment is an asset or item acquired with the goel of generating income or…

Q: On January 1, Balanger Company buys 10 percent of the outstanding shares of its parent, Altgeld,…

A: Consolidated financial statements: When an investor company holds above 50% in the outstanding stock…

Q: On January 1, 2016, Uncle Company purchased 80 percent of Nephew Company's capital stock for…

A: Dividend refers to the percentage of earning shared by a company or organization to its…

Q: Addo Plc owns many subsidiaries and 25% of Vivian Plc. In the year ended 31 December 2018, Addo Plc…

A: Consolidation Statement- Consolidated Statement refers to the statement that final account of parent…

Q: Marc, Inc., owns 75 percent of SRS Company. During the current year, SRS reported net income of…

A: Given information is: Marc, Inc., owns 75 percent of SRS Company. During the current year, SRS…

Q: At the beginning of current year, Cynosure Company purchased 40% of the ordinary shares of another…

A: The following computations are done for Cynosure Company.

Q: At the beginning of current year, Cinnamon Company purchased 40% of the ordinary shares of another…

A: Acquisition by a company shares of another entity is known as the acquisition of business or…

Q: Highpoint owns a 95 percent majority voting interest in Middlebury. In turn, Middlebury owns an 80…

A: Hey, since there are multiple sub-parts posted, we will answer the three sub-parts. If you want any…

Q: MD Corp. completed the following transactions relating to investment in AO Company ordinary sha…

A: When shares for investment are purchased, they are recorded at the cost. At the end of every…

Q: On 1 July 2021, King Ltd acquired all the share capital of Queen Ltd for $1,800,000, and on that…

A: The following table shows the calculation of goodwill on acquisition: Particulars Amount Amount…

Which one is correct

Step by step

Solved in 2 steps with 1 images

- House Plc owns 80% of the issued share capital of Window Plc and 25% of the issued share capital of Door Plc. The revenues for the year are as follows:House Plc GH¢1,500,000Window Plc GH¢1,000,000Door Plc GH¢160,000What amount for revenue should appear in the consolidated statement of profit or loss for the year?Hot Plc owns 80% of the issued share capital of Warm Plc and 40% of the issued share capital of Cold Plc. In the individual accounts, the income tax expenses for the year are as follows:3Hot Plc GH¢20,000Warm Plc GH¢18,000Cold Plc GH¢10,000At what amount should the income tax expense appear in the consolidated statement of profit or loss? [Note: The share of profit of Associate is shown in the statement of profit or loss at a figure net of tax]On January 1, 2008, Pedestal Company purchased 80% of the outstanding shares of StarletCompany at a cost of P800,000. On that date, Starlet Company had P300,000 of Ordinary ShareCapital and P600,000 of Retained Earnings.For 2008, Pedestal Company had income of P300,000 from its own operations and paiddividends of P150,000. On the other hand, Starlet Company reported a net income of P100,000and paid dividends of P40,000. All assets and liabilities of Starlet Company have book valuesapproximately equal to their respective market values.Pedestal Company uses the equity method to account for its investment in StarletCompany. Impairment loss on goodwill for 2008 is P4,000.1. The amount Pedestal Company should record as Equity in Starlet Company Income for2008 isa. P78,000 c. P82,000b. P80,000 d. P76,000

- The Passers Co. acquired 70% of the net assets of Failures Co. for P1,100,000. The assets of Failures Co. have a book value of P1,200,000 and a fair market value of P1,300,000; its liabilities are P200,000. What is the amount of minority interest in the stockholders’ equity section of the consolidated balance sheet?Shaun Company reports a net income of P280,000 each year and pays an annual cash dividend of P100,000. The company holds net assets of P2,400,000 on January 1, 20x1. Ón that date, Jared Company purchases 40% of the outstanding stock for P1,200,000, which gives it the ability to have joint control with Glassman Company over Shaun. At the purchase date, the excess of Jared's cost over its proportionate share of Shaun's book value was assigned to goodwill. REQUIRED: 5. How much is the net investment income each year? 6. On December 31, 20x2, what is the investment in Shaun Company balance (equity method) in Jared's financial records? Shaun Company reports a net income of P280,000 each year and pays an annual cash dividend of P100,000. The company holds net assets of P2,400,000 on January 1, 20x1. Ón that date, Jared Company purchases 40% of the outstanding stock for P1,200,000, which gives it the ability to have joint control with Glassman Company over Shaun. At the purchase date, the…Senpai Company acquires 15% of Kohai Company’s common stock for P600,000 cash and carries the investment using the cost model. A few months later, Senpai purchases another 60% of Kohai Company’s stock for P2,592,000. At that date, Kohai Company reports identifiable assets with a book value of P4,680,000 and a fair value of P6,120,000, and it has liabilities with a book value and fair value of P2,280,000. The fair value of the 25% non-controlling interest in Kohai Company is P1,080,000. Compute the amount of goodwill, using full-goodwill or fair value basis approach.

- Senpai Company acquires 15% of Kohai Company’s common stock for P600,000 cash and carries the investment using the cost model. A few months later, Senpai purchases another 60% of Kohai Company’s stock for P2,592,000. At that date, Kohai Company reports identifiable assets with a book value of P4,680,000 and a fair value of P6,120,000, and it has liabilities with a book value and fair value of P2,280,000. The fair value of the 25% non-controlling interest in Kohai Company is P1,080,000. Compute the amount of goodwill, using full-goodwill or fair value basis approach: Group of answer choices None of the given P360,000 None P480,000Senpai Company acquires 15% of Kohai Company’s common stock for P600,000 cash and carries the investment using the cost model. A few months later, Senpai purchases another 60% of Kohai Company’s stock for P2,592,000. At that date, Kohai Company reports identifiable assets with a book value of P4,680,000 and a fair value of P6,120,000, and it has liabilities with a book value and fair value of P2,280,000. The fair value of the 25% non-controlling interest in Kohai Company is P1,080,000. Compute the amount of goodwill, using full-goodwill or fair value basis approach: a. 480,000 b. 360,000 c. None of the given d. NoneSenpai Company acquires 15% of Kohai Company’s common stock for P600,000 cash and carries the investment using the cost model. A few months later, Senpai purchases another 60% of Kohai Company’s stock for P2,592,000. At that date, Kohai Company reports identifiable assets with a book value of P4,680,000 and a fair value of P6,120,000, and it has liabilities with a book value and fair value of P2,280,000. The fair value of the 25% non-controlling interest in Kohai Company is P1,080,000. Compute for the amount of goodwill, using partial goodwill or proportionate basis approach: a. None b. 480,000 c. None of the given d. 360,000

- (TCO A) Bend Inc. holds 25% of the outstanding voting shares of Calico Co. and appropriately applies the equity method of accounting. Amortization associated with this investment equals $9,000 per year. For 20X3, Calico reported earnings of $80,000 and paid cash dividends of $30,000. During 20X3, Calico acquired inventory for $57,600, which was then sold to Bend for $90,000. At the end of 20X3, Bend still held some of this inventory at its transfer price of $40,000.Required:(1) Determine the amount of intra-entity profit at the end of 20X3.(2) Determine the amount of Equity in Investee Income that Bend should have reported for 20X3.On January 1, 2016, Ritter Company bought 10% of the outstanding ordinary shares of Bear Construction Company for P3 million. Their book value was P8 million and the difference was attributable to the fair value of Bear's buildings exceeding book value. Bear's net income for the year ended December 31, 2016, was P10 million. During 2016, Bear declared and paid cash dividends of P2 million. The buildings have a remaining life of 10 years. The investment in Bear is to be held as Investment in equity securities designated as at fair Value through other comprehensive income. Also, Bear's net income for the year ended December 31, 2017 was P12 million and Bear declared and paid cash dividends of P2.5 million. The fair value of Ritter's investment in Bear securities is as follows: December 31, 2016, P3,200,000; December 31, 2017, P3,100,000; and December 31, 2018, P13 million. On January 2, 2018, Ritter purchased an additional 20% of Bear's stock for P5,600,000 cash when the carrying amount…A Corporation purchased a 70% interest in B Company on January 1, 2013 for P140,000, when B’s stockholders’ equity consisted of P30,000 common stock, P100,000 additional paid-in-capital, and P200,000 retained earnings. Income and dividends data for B are as follows: Net income (or loss) P50,000 Dividends 5,000 NCI is measured at fair value If A reported separate income from own operations of P120,000 for 2013, what is the consolidated total comprehensive income for 2013?