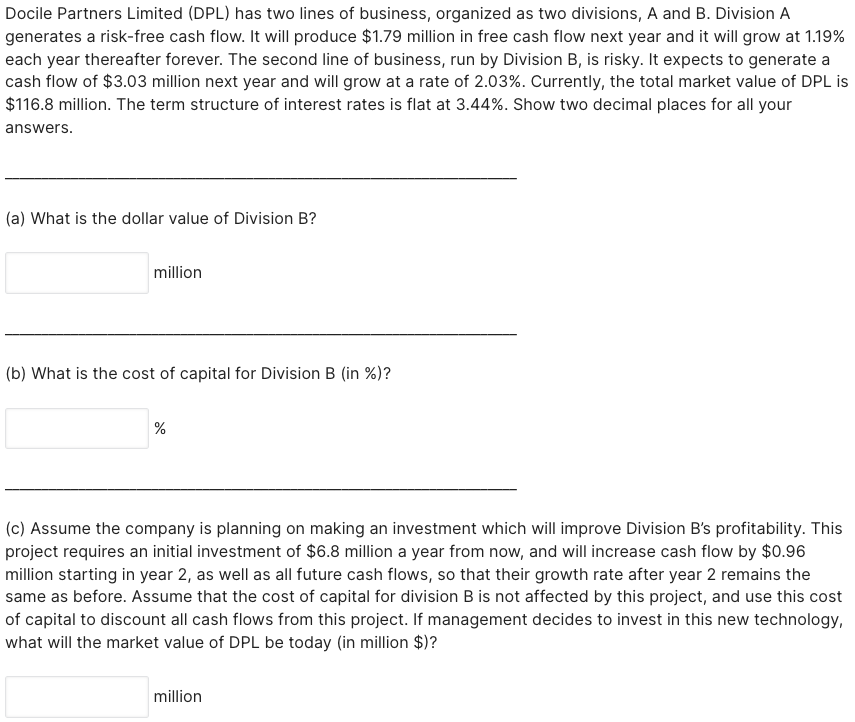

Docile Partners Limited (DPL) has two lines of business, organized as two divisions, A and B. Division A generates a risk-free cash flow. It will produce $1.79 million in free cash flow next year and it will grow at 1.19% each year thereafter forever. The second line of business, run by Division B, is risky. It expects to generate a cash flow of $3.03 million next year and will grow at a rate of 2.03%. Currently, the total market value of DPL is $116.8 million. The term structure of interest rates is flat at 3.44%. Show two decimal places for all your answers. (a) What is the dollar value of Division B? million (b) What is the cost of capital for Division B (in %)? % (c) Assume the company is planning on making an investment which will improve Division B's profitability. This project requires an initial investment of $6.8 million a year from now, and will increase cash flow by $0.96 million starting in year 2, as well as all future cash flows, so that their growth rate after year 2 remains the same as before. Assume that the cost of capital for division B is not affected by this project, and use this cost of capital to discount all cash flows from this project. If management decides to invest in this new technology, what will the market value of DPL be today (in million $)? million

Docile Partners Limited (DPL) has two lines of business, organized as two divisions, A and B. Division A generates a risk-free cash flow. It will produce $1.79 million in free cash flow next year and it will grow at 1.19% each year thereafter forever. The second line of business, run by Division B, is risky. It expects to generate a cash flow of $3.03 million next year and will grow at a rate of 2.03%. Currently, the total market value of DPL is $116.8 million. The term structure of interest rates is flat at 3.44%. Show two decimal places for all your answers. (a) What is the dollar value of Division B? million (b) What is the cost of capital for Division B (in %)? % (c) Assume the company is planning on making an investment which will improve Division B's profitability. This project requires an initial investment of $6.8 million a year from now, and will increase cash flow by $0.96 million starting in year 2, as well as all future cash flows, so that their growth rate after year 2 remains the same as before. Assume that the cost of capital for division B is not affected by this project, and use this cost of capital to discount all cash flows from this project. If management decides to invest in this new technology, what will the market value of DPL be today (in million $)? million

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 7P

Related questions

Question

Transcribed Image Text:Docile Partners Limited (DPL) has two lines of business, organized as two divisions, A and B. Division A

generates a risk-free cash flow. It will produce $1.79 million in free cash flow next year and it will grow at 1.19%

each year thereafter forever. The second line of business, run by Division B, is risky. It expects to generate a

cash flow of $3.03 million next year and will grow at a rate of 2.03%. Currently, the total market value of DPL is

$116.8 million. The term structure of interest rates is flat at 3.44%. Show two decimal places for all your

answers.

(a) What is the dollar value of Division B?

million

(b) What is the cost of capital for Division B (in %)?

%

(c) Assume the company is planning on making an investment which will improve Division B's profitability. This

project requires an initial investment of $6.8 million a year from now, and will increase cash flow by $0.96

million starting in year 2, as well as all future cash flows, so that their growth rate after year 2 remains the

same as before. Assume that the cost of capital for division B is not affected by this project, and use this cost

of capital to discount all cash flows from this project. If management decides to invest in this new technology,

what will the market value of DPL be today (in million $)?

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning