$ 3 Direct materials Variable direct manufacturing labor Variable manufacturing overhead 40 10 Fixed manufacturing overhead allocated Total manufacturing cost per unit 21 $74 %24

Multiple choice. (CPA) Choose the best answer.

- The Cozy Company manufactures slippers and sells them at $10 a pair. Variable

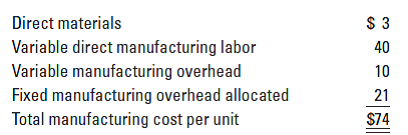

manufacturing cost is $5.75 a pair, and allocated fixed manufacturing cost is $1.75 a pair. It has enough idle capacity available to accept a one-time-only special order of 25,000 pairs of slippers at $7.50 a pair. Cozy will not incur any marketing costs as a result of the special order. What would the effect on operating income be if the special order could be accepted without affecting normal sales: (a) $0, (b) $43,750 increase, (c) $143,750 increase, or (d) $187,500 increase? Show your calculations. - The Manchester Company manufactures Part No. 498 for use in its production line. The manufacturing cost per unit for 10,000 units of Part No. 498 is as follows:

The Remnant Company has offered to sell 10,000 units of Part No. 498 to Manchester for $71 per unit. Manchester will make the decision to buy the part from Remnant if there is an overall savings of at least $45,000 for Manchester. If Manchester accepts Remnant’s offer, $11 per unit of the fixed

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 4 images