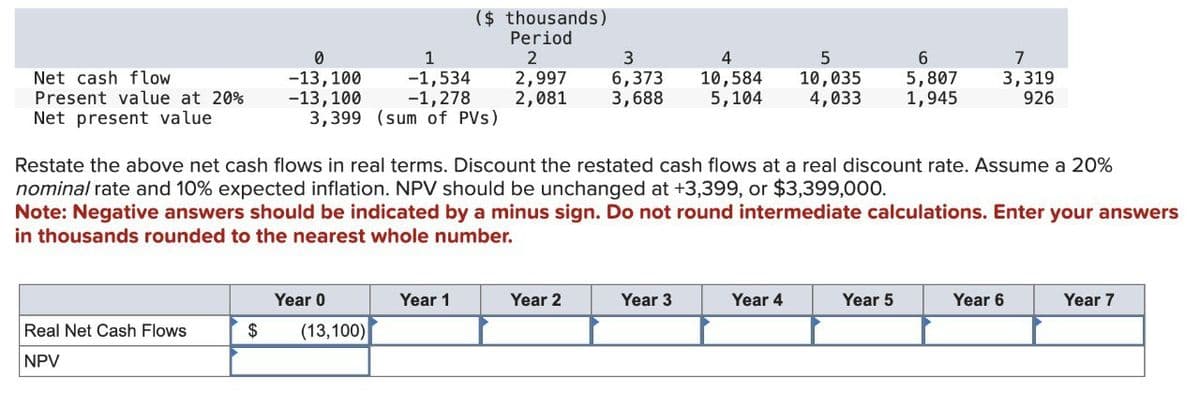

($ thousands) Period Net cash flow Present value at 20% Net present value 0 -13,100 1 2 3 4 5 6 7 -1,534 -13,100 -1,278 2,997 2,081 6,373 3,688 10,584 10,035 5,104 5,807 4,033 1,945 3,319 926 3,399 (sum of PVs) Restate the above net cash flows in real terms. Discount the restated cash flows at a real discount rate. Assume a 20% nominal rate and 10% expected inflation. NPV should be unchanged at +3,399, or $3,399,000. Note: Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in thousands rounded to the nearest whole number. Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Real Net Cash Flows $ (13,100) NPV

($ thousands) Period Net cash flow Present value at 20% Net present value 0 -13,100 1 2 3 4 5 6 7 -1,534 -13,100 -1,278 2,997 2,081 6,373 3,688 10,584 10,035 5,104 5,807 4,033 1,945 3,319 926 3,399 (sum of PVs) Restate the above net cash flows in real terms. Discount the restated cash flows at a real discount rate. Assume a 20% nominal rate and 10% expected inflation. NPV should be unchanged at +3,399, or $3,399,000. Note: Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers in thousands rounded to the nearest whole number. Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Real Net Cash Flows $ (13,100) NPV

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 8EP

Related questions

Question

Transcribed Image Text:($ thousands)

Net cash flow

Present value at 20%

Net present value

Period

0

-13,100

1

2

3

4

5

6

-13,100

-1,534

-1,278

2,997

6,373

2,081

3,688

10,584

5,104

10,035

5,807

7

3,319

4,033

1,945

926

3,399 (sum of PVs)

Restate the above net cash flows in real terms. Discount the restated cash flows at a real discount rate. Assume a 20%

nominal rate and 10% expected inflation. NPV should be unchanged at +3,399, or $3,399,000.

Note: Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers

in thousands rounded to the nearest whole number.

Year 0

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Real Net Cash Flows

NPV

$

(13,100)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you