(dollars in thousands) Assets: Liabilities: Cash $69 Accounts payable $ 246 Accounts receivable (net) 178 Other liabilities 90 Investments 58 Total current liabilities 336 Inventory 200 Long-term liabilities 119 Prepaid rent 31 Total liabilities 455 Total current assets 536 Stockholders' equity: Property & Equipment, (net) 266 Common stock 154 Retained earnings 193 Total stockholders' equity 347 Total assets $802 Total liabilities and equity $802 ne current ratio is: (Round your answer to 2 decimal places.)

(dollars in thousands) Assets: Liabilities: Cash $69 Accounts payable $ 246 Accounts receivable (net) 178 Other liabilities 90 Investments 58 Total current liabilities 336 Inventory 200 Long-term liabilities 119 Prepaid rent 31 Total liabilities 455 Total current assets 536 Stockholders' equity: Property & Equipment, (net) 266 Common stock 154 Retained earnings 193 Total stockholders' equity 347 Total assets $802 Total liabilities and equity $802 ne current ratio is: (Round your answer to 2 decimal places.)

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter1: Starting A Proprietorship: Changes That Affect The Accounting Equation

Section: Chapter Questions

Problem 1ANFS

Related questions

Question

Practice Pack

Please answer both. This is part A and B

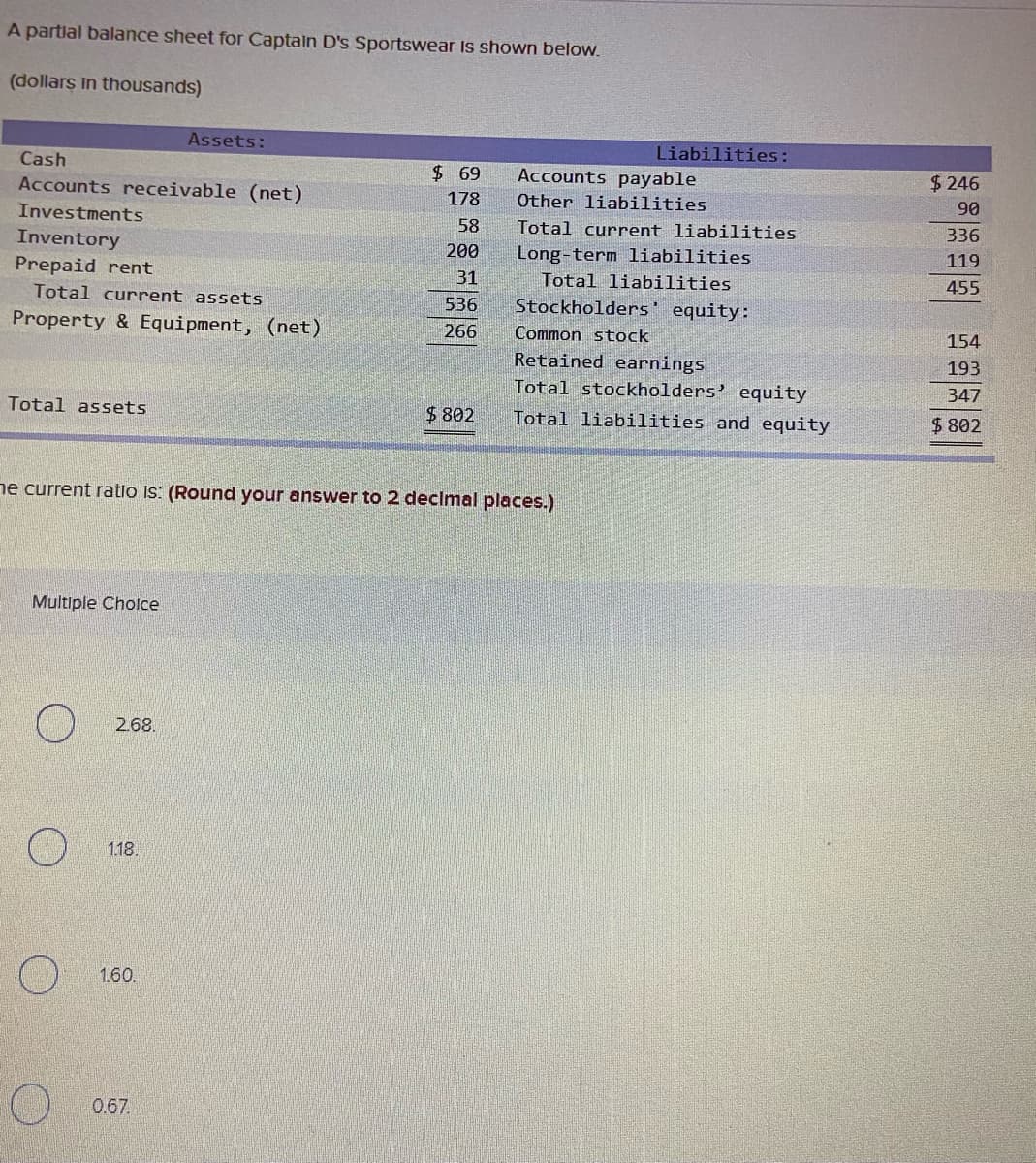

Transcribed Image Text:A partlal balance sheet for Captain D's Sportswear Is shown below.

(dollars in thousands)

Assets:

Liabilities:

Cash

$69

Accounts payable

$246

Accounts receivable (net)

178

Other liabilities

90

Investments

58

Total current liabilities

336

Inventory

200

Long-term liabilities

119

Prepaid rent

31

Total liabilities

455

Total current assets

536

Stockholders' equity:

Property & Equipment, (net)

266

Common stock

154

Retained earnings

193

Total stockholders’ equity

347

Total assets

$ 802

Total liabilities and equity

$ 802

ne current ratio is: (Round your answer to 2 decimal places.)

Multiple Cholce

2.68.

118.

1.60.

0.67

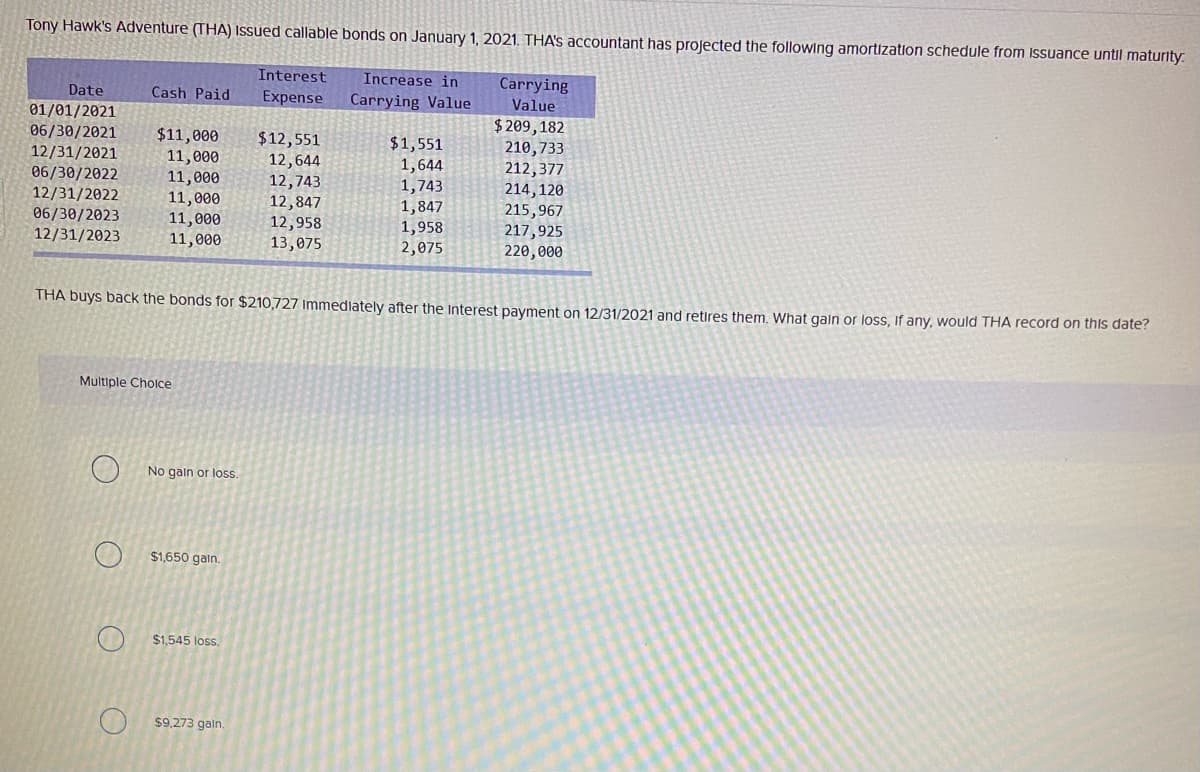

Transcribed Image Text:Tony Hawk's Adventure (THA) Issued callable bonds on January 1, 2021. THA's accountant has projected the followIng amortization schedule from Issuance until maturity:

Interest

Increase in

Carrying

Date

Cash Paid

Expense

Carrying Value

Value

01/01/2021

$ 209,182

06/30/2021

12/31/2021

06/30/2022

12/31/2022

06/30/2023

12/31/2023

$11,000

11,000

11,000

11,000

11,000

11,000

$12,551

12,644

12,743

12,847

12,958

13,075

$1,551

1,644

1,743

1,847

1,958

2,075

210,733

212,377

214,120

215,967

217,925

220,000

THA buys back the bonds for $210,727 immediately after the Interest payment on 12/31/2021 and retires them. What gain or loss, If any, would THA record on this date?

Multiple Cholce

No gain or loss.

$1,650 galn.

$1,545 loss.

$9.273 galn.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your way

Includes step-by-step video

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you