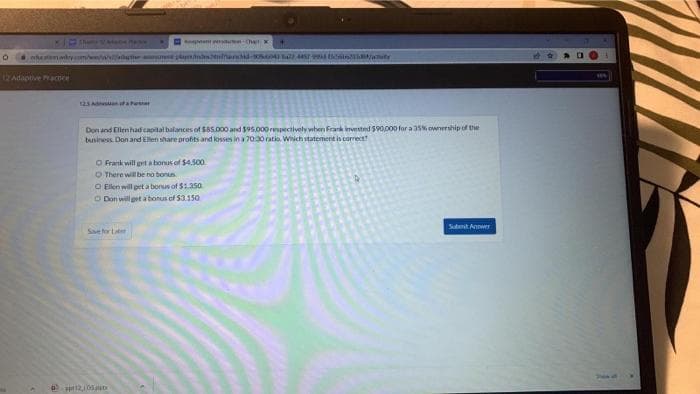

Don and Ellen had capital balances of $85.000 and $95.000 respectively when Frank invested $90,000 for a 35% ownership of the business Don and Ellen share profits and losses in a 70:30 ratio. Which statement is correct O Frank will get a bonus of $4.500 O There will be no bonus O Ellen will get a bonus of $1.350 O Don will get a bonus of $3.150

12 Adaptive Practice #tx w Chapter 12 Adaptive Practice ^ education.wiley.com/was/ui/v2/adaptive-assessment-player/index.html?launchid-909eb940-8a22-4497-999d-f3c56b6203d8#/activity 12.5 Admission of a Partner m: X we Assignment introduction - Chapt X + Don and Ellen had capital balances of $85,000 and $95,000 respectively when Frank invested $90,000 for a 35% ownership of the business. Don and Ellen share

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images