Donald Foster owes $68,400 on an 8%, 140-day note. On day 15, he pays $17,100 on the note. On day 70, he pays an additional $23,940. Based on the U.S. Rule, calculate the following. (Use a 360-day year, and round all answers to the nearest cent.) 1. Adjusted balance after the first payment: 2. Adjusted balance after the second payment: 3. Balance at maturity: $0

Donald Foster owes $68,400 on an 8%, 140-day note. On day 15, he pays $17,100 on the note. On day 70, he pays an additional $23,940. Based on the U.S. Rule, calculate the following. (Use a 360-day year, and round all answers to the nearest cent.) 1. Adjusted balance after the first payment: 2. Adjusted balance after the second payment: 3. Balance at maturity: $0

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 61P

Related questions

Question

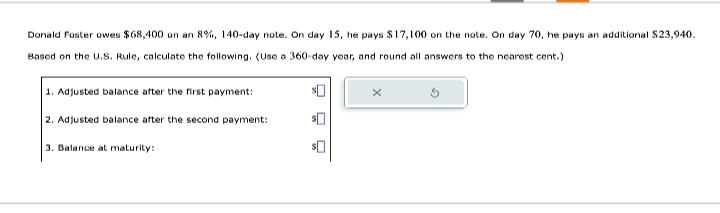

Transcribed Image Text:Donald Foster owes $68,400 on an 8%, 140-day note. On day 15, he pays $17,100 on the note. On day 70, he pays an additional $23,940.

Based on the U.S. Rule, calculate the following. (Use a 360-day year, and round all answers to the nearest cent.)

1. Adjusted balance after the first payment:

2. Adjusted balance after the second payment:

3. Balance at maturity:

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT