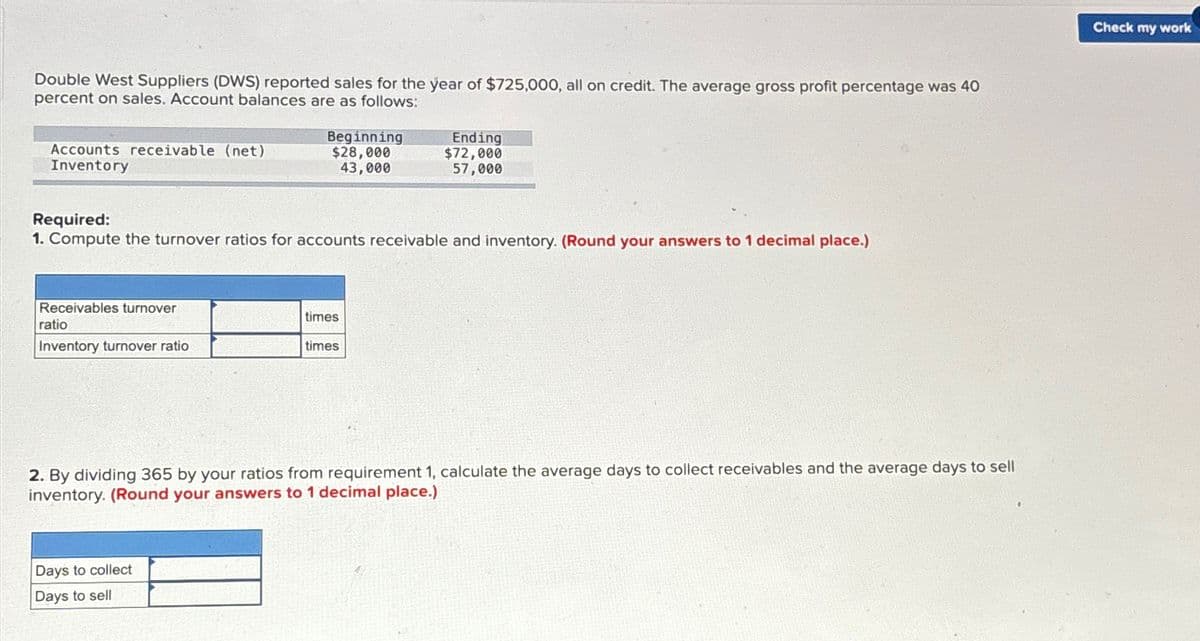

Double West Suppliers (DWS) reported sales for the year of $725,000, all on credit. The average gross profit percentage was 40 percent on sales. Account balances are as follows: Accounts receivable (net) Inventory Beginning $28,000 43,000 Ending $72,000 57,000 Required: 1. Compute the turnover ratios for accounts receivable and inventory. (Round your answers to 1 decimal place.) Receivables turnover ratio Inventory turnover ratio times times 2. By dividing 365 by your ratios from requirement 1, calculate the average days to collect receivables and the average days to sell inventory. (Round your answers to 1 decimal place.) Days to collect Days to sell Check my work

Double West Suppliers (DWS) reported sales for the year of $725,000, all on credit. The average gross profit percentage was 40 percent on sales. Account balances are as follows: Accounts receivable (net) Inventory Beginning $28,000 43,000 Ending $72,000 57,000 Required: 1. Compute the turnover ratios for accounts receivable and inventory. (Round your answers to 1 decimal place.) Receivables turnover ratio Inventory turnover ratio times times 2. By dividing 365 by your ratios from requirement 1, calculate the average days to collect receivables and the average days to sell inventory. (Round your answers to 1 decimal place.) Days to collect Days to sell Check my work

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 27BEB: Last year, Tobys Hats had net sales of 45,000,000 and cost of goods sold of 29,000,000. Tobys had...

Related questions

Question

Transcribed Image Text:Double West Suppliers (DWS) reported sales for the year of $725,000, all on credit. The average gross profit percentage was 40

percent on sales. Account balances are as follows:

Accounts receivable (net)

Inventory

Beginning

$28,000

43,000

Ending

$72,000

57,000

Required:

1. Compute the turnover ratios for accounts receivable and inventory. (Round your answers to 1 decimal place.)

Receivables turnover

ratio

Inventory turnover ratio

times

times

2. By dividing 365 by your ratios from requirement 1, calculate the average days to collect receivables and the average days to sell

inventory. (Round your answers to 1 decimal place.)

Days to collect

Days to sell

Check my work

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College