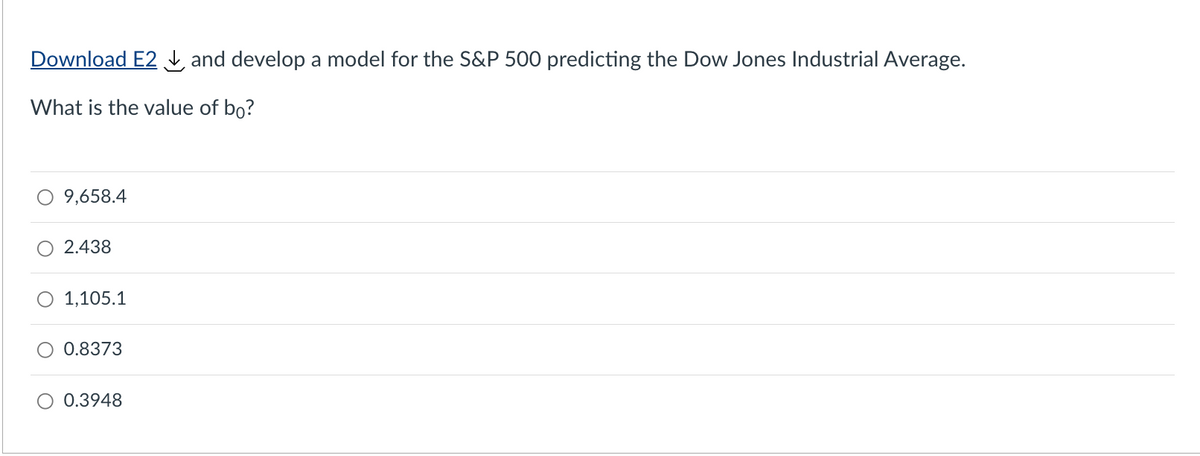

Download E2 and develop a model for the S&P 500 predicting the Dow Jones Industrial Average. What is the value of bo? O 9,658.4 O 2.438 O 1,105.1 O 0.8373 O 0.3948

Q: Calculate the monthly payment for a 30 year mortgage of $100,000 at 6% interest. Solve for PMT

A: Mortgages A mortgage is a property that a borrower grants a lender to take in the event of a failure…

Q: Find the commission # Sales Amount 11 12 13 14 $4,000 $8,000 $18,000 $27,500 5% of first $5,000 8%…

A:

Q: From California to New York, legislative bodies across the United States are considering eliminating…

A: Non customers earn wage - $ 26/ hr ATM fees - $ 3.50 / transaction Based on the given information,…

Q: consider a 30 - year U.S. corporate bond with a 10% coupon rate. The current interest rate is 7…

A: Data given: Face value= $ 1000 N=30 year Coupon rate= 10% Interest rate=7% Working Note #1…

Q: Suppose you bought a 10 year coupon bond with par value $500 and coupon rate 4%. What is the market…

A: Solution:- Bond price means the price at which a bond is trading in the market. It is the summation…

Q: Information Risk Analyst (IT Controls Audit) will help the organization assess risk controls and…

A: Risk The possibility of occurring a loss in a business is known as a risk. It is very important to…

Q: Mrs. Lim's purchase contract for a house and lot specifies that she will pay $500,000 cash and…

A: Loans are paid by the equal monthly installments and these carry the payment for interest and also…

Q: Parts A and B Piscataway valves decided to pursue development of a new product line for natural gas…

A:

Q: Empirical evidence suggests that upon announcement of a new equity issue.current stock prices…

A: New equity is issued for investing in new capital projects. It will be issued through Initial public…

Q: Lee wants to receive $18,000 each year for the next 20 years. Assume a 4% rate compounded annually.…

A: Annual receipt (C) = $18,000 Interest rate (r) = 0.04 Period (n) = 20 Years Amount need to invest…

Q: 2. Conspicuous Consumption Ine, a prominent consumer products firm is debating Whether or not to…

A: Given: Particulars All equity Equity and debt Shares outstanding 8000 Share price $70…

Q: An investor pays $275,000 for a mine that will produce level annual revenue for 18 years. What…

A: Sinking funds are funds created with the sole purpose of repaying debt at a future date. The…

Q: q1- Bunning Warehouse wants to balance the prices for selling 500 trees. Data is in the screenshot.…

A: Total profits refer to the amount remaining with a company after it has paid all its liabilities. It…

Q: Which of the following statements is correct about corporate bond/ A.The corporate bond with AAA…

A: Default risk means risk that issuer of the bond may fail to pay coupon or face value at the…

Q: You found your dream house. It will cost you $300000 and you will put down $30000 as a down payr For…

A: Mortgage loans are secured loans and they are necessary while buying home because these make buying…

Q: You decide to work part-time at a local supermarket. The job pays $10.50 per hour and you work 20…

A: The FICA taxes are deducted from the gross pay of the employees. These taxes are deducted to fund…

Q: A company needs to raise $9 million and issues bonds for that amount rather than additional capital…

A: Equity shares are having residual claim on the company at the time of liquidation because equity…

Q: You borrow $1,000 from the bank and agree to repay the loan over the next year in 12 equal…

A: The Present Value of Ordinary Annuity refers to the concept which gives out the discounted or…

Q: Melissa is starting a savings for the initial capital to start a jewelry company right after…

A: With number of compounding in a year (n) and nominal interest rate (i), the effective annual…

Q: An investor considers the purchase of a 2-year bond with a 5% coupon rate, with interest paid…

A: Price of bond is present value of the coupon payments and the present value of par value of bond…

Q: Stoneheart Group is expected to pay a dividend of $3.09 next year. The company's dividend growth…

A: Dividend next year D1 = $3.09 Growth rate of dividends is 4.3% Required return is 11.3% To Find:…

Q: (C) Assuming that bank charges simple interest, P 50,000 will accumulate to P 57 annum after a…

A: The simple interest is very simple that means there is no interest on interest and there is no…

Q: Assuming that the bond with the coupon you computed in b.4 were issued today, show to what the…

A: The bond price is inversely proportional to the market rate. It means if market rate reduces, the…

Q: John wants to buy a property for $121,250 and wants an 80 percent loan for $97,000. A lender…

A: Here, To Find: Part a. Disbursed amount =? Part b. APR for the borrower after 30 years =? Part c.…

Q: Consider a $1,100 deposit earning 9 percent interest per year for four years. What is the future…

A: Given, The amount deposited is $1100 rate of interest is 9%

Q: QUESTION 1 Which of the following is not a behaviour bias? a. Prospect theory b. Conservatism C.…

A: Analysis of the given options: a) Prospect theory ANALYSIS- Prospect theory finds application in…

Q: When visualising the distribution of a variable using a histogram, if only the right tail has…

A: A distribution's skewness is a measurement of its asymmetry. When a distribution's left and right…

Q: A new product requires an initial investment of $140,000, and an annual operating expense of…

A: External rate of return (ERR) With present value of all costs and expenses (PVC), future value of…

Q: ding to the time value of money concept, also referred to as the present discounted value, is based…

A: Time value of concepts as the time period goes on due to the inflation goes on increasing and hence…

Q: he average overall cost of a Bachelor’s degree per year is $30,500. Assuming my children are 8 and…

A: The future value of the amount includes the amount being deposited and also amount of interest being…

Q: If a firm's marginal revenue is smaller than its marginal cost, then the firm should collect…

A: Answer (d) Decrease output to increase profit Marginal Revenue means Additional Revenue generating…

Q: Ogren Corporation is considering purchasing a new spectrometer for the firm’s R&D department. The…

A: Cashflow The cash which flows inward and outward from the business or the project is known as cash…

Q: Which of the following is the advantage of swaps? Answer choices: a. Early termination of swaps…

A: Swap means a contract of exchanging one financial instrument with another between the parties…

Q: The balance on a credit card, that charges a 10.5% APR interest rate, over a 1 month period is given…

A: Here, Interest rate (APR) = 10.5% No. of months in a year = 12 months To Find: Finance charge on…

Q: could you please provide the solution for b and c without using excel?

A: concept. 1. changes in future price = future price of current month - future price of previous…

Q: aintenance cost for small bridge with an expected 50 year life are estimated to be $15,000 each year…

A: Equivalent present value is the present values of all future cost that are going to occur in the…

Q: a) What is the payback period for this project? b) If a hurdle rate of 20% is considered; what is…

A: Payback Period: It is one of the methods used in capital budgeting to determine the period in which…

Q: How much will a firm receive in net funding from a firm commitment underwriting of 250 shares priced…

A: Given: Particulars Amount Shares 250 Price $33.60 Spread 12% Legal fees $1,000

Q: Date DJIA S&P 500 January 6 11,998 1,278 January 13 12,022 1,289…

A: Date DJIA S&P 500 Jan-06 11,998.00 1,278.00 Jan-13 12,022.00…

Q: Esfandairi Enterprises is considering a new three-year expansion project that requires an initial…

A: Net present value is the difference between Present Value of cash Inflows and Initial Investment. A…

Q: onsider an EOY geometric gradient, which lasts for eight years, whose initial value at EOY one is…

A: formula. P = A(1-(1+i)-n(1+g)n)i-g where , A= cash flow in period 1. i = interest rate g= rate of…

Q: Bombay Inc has 8.5 million shares of common stock outstanding, 250,000 shares of 5% preferred stock…

A: Capital structure of a company is its component of financing. The proportion of each financing in…

Q: Who is richer because of the inheritance?

A: Information Provided: Amount received today =10,0000 Amount received by friend 3 years from now =…

Q: You are going to buy a home, and will be taking out a home loan for $275,000. The loan will be a…

A: Amount of home loan is $275,000 Time period is 30 years Interest rate is 7.9% compounded monthly To…

Q: An unlevered firm has a value of $625 million. An otherwise identical but levered firm has $75…

A: MM Model with zero tax assumption that in completely efficient markets, businesses pay no taxes. As…

Q: 7. A car dealership offers financing toward the purchase of a Toyota Prius. The dealership's offer…

A: When an amount of money is borrowed by a person it becomes the principal amount of the loan on which…

Q: 7. A car dealership offers financing toward the purchase of a Toyota Prius. The dealership' offer…

A: Monthly payment includes the amount of principle and Interest. Total amount of installment paid =…

Q: In a geometric sequence of annual cash flows starting at the EOY zero, the value of A0 is $65,217.50…

A: A0 is $65,217.50 A10 is $263,841 Discount rate is 20% To Find: Equivalent value of A for years 1…

Q: How might capital rationing conflict with the goal of maximizing shareholders' wealth?

A: Capital rationing means the company has limited capital that must be invested in the most profitable…

Q: Assuming the bank charges simple interest, 50,000 pesos will accumulate to 57,500 at rate i per…

A: Simple interest is straight interest on the principal amount and there is no interest on interest…

| Date | DJIA | S&P 500 |

| January 6 | 12,360 | 1,278 |

| January 13 | 12,422 | 1,289 |

| January 20 | 12,720 | 1,287 |

| January 27 | 12,660 | 1,234 |

| February 3 | 12,862 | 1,267 |

| February 10 | 12,801 | 1,243 |

| February 17 | 12,950 | 1,262 |

| February 24 | 12,983 | 1,313 |

| March 2 | 12,978 | 1,255 |

| March 9 | 12,922 | 1,371 |

| March 16 | 13,233 | 1,404 |

| March 23 | 13,081 | 1,397 |

| March 30 | 13,212 | 1,408 |

| April 5 | 13,060 | 1,398 |

| April 13 | 12,850 | 1,370 |

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

- Given the following information, calculate the expected value for Firm C's EPS. Data for Firms A and B are as follows: E(EPSA) = $5.10, and σA = $3.63; E(EPSB) = $4.20, and σB = $2.94. Do not round intermediate calculations. Round your answer to the nearest cent. Probability 0.1 0.2 0.4 0.2 0.1 Firm A: EPSA ($1.61) $1.80 $5.10 $8.40 $11.81 Firm B: EPSB (1.20) 1.30 4.20 7.10 9.60 Firm C: EPSC (2.59) 1.35 5.10 8.85 12.79 E(EPSC): $ You are given that σc = $4.12. Discuss the relative riskiness of the three firms' earnings using their respective coefficients of variation. Do not round intermediate calculations. Round your answers to two decimal places. CV A B C The most risky firm is .The table shows the average returns and betas for the five ETFs, S&P 500, and Treasury. VONF IJT PDP FTA FNY S&P 500 TreasuryAnnualize mean 0.07148 0.11941 0.09613 0.07483 0.10233 0.09637 0.02541Beta 1.01106 1.11377 1.01507 1.02652 1.09928 1.00000 0.00000 Create a SML with the S&P 500 index's and the Treasury's average returns and betas. Determine whether the ETFs have return and beta combinations above or below the line you generated. Explain the arbitrage strategy you would form with one of the ETFs, index, or Treasury.The SSO ETF is a X2 power share on the S&P500. What would you expect the correlation to be between the returns of SSO and the returns of the S&P500

- Estimate the beta value of your company using CAPM model and check the adequacy of the model (Current US 3 month Treasury bill is 0.03%) Clarity as you have asked: THE RETURNS ARE NOT IN PERCENTAGE. They are just as they are S&P index Iron Inc -2.47567 1.5888 3.433569 1.747917 0.701043 1.115125 0.96953 2.20568 0.409803 0.37909 0.451845 0.842537 -0.01463 0.345743 -0.52576 -0.17227 1.072171 0.201313 0.222197 0.574076 0.759145 1.11301 1.318305 0.592719 -1.41573 -0.19641 0.220289 0.365459 0.137568 0.588253 0.848872 0.389854 -0.78469 0.527053 -0.14562 0.469088 1.554924 1.180992 0.859738 0.977212 0.089864 -1.58603 0.67762 0.901378 0.470848 -0.1895 -0.22245 -0.35259 -0.93571 -0.54436 0.067626 -0.0821 0.070904 -0.35606 1.289025 -1.62177 0.302398 0.139707 -0.26516 -1.5904 1.087871 -0.42531 0.149878…Here are data on two companies. The T-bill rate is 4% and the market risk premium is 6%. Company $1 Discount Store Everything $5 Forecast return 12% 11% Standard deviation of returns 8% 10% Beta 1.5 1.0 What would be the fair return for $1 Discount Store according to the capital asset pricing model (CAPM)? Enter your answer as a decimal.Show the monthly return of the company and S&P 500 in the same graph. What is your interruption interpretation of the change of return of the company comparing with the market index? Calculate the monthly standard deviation and return for both the company and S&P 500. What is your interruption of the risk and return of the company comparing with the market index? S&P 500 last 6 months : Date Open High Low Close* Adj. close** Volume 01 Apr 2022 4,540.32 4,593.45 4,381.34 4,392.59 4,392.59 37,024,560,000 01 Mar 2022 4,363.14 4,637.30 4,157.87 4,530.41 4,530.41 100,978,320,000 01 Feb 2022 4,519.57 4,595.31 4,114.65 4,373.94 4,373.94 73,167,790,000 01 Jan 2022 4,778.14 4,818.62 4,222.62 4,515.55 4,515.55 73,279,440,000 01 Dec 2021 4,602.82 4,808.93 4,495.12 4,766.18 4,766.18 68,699,830,000…

- Suppose S(NZD/USD) = 1.5000 and S(MYR/USD) = 4.4000. What is the cross rate S(MYR/NZD)? Choose the closest answer to your own calculations. a. 2.9333 b. 0.3409 c. 6.6000 d. 0.1515Dhofar Energy Services has a Beta = 1.68 The risk-free rate on a treasury bill is currently 4.4% and the cost of equity has 20.70%. What is the market return? Select one: a. 0.1410 b. 1.0970 c. All the given choices are not correct d. 0.1654 e. 0.2369Here are data on two companies. The T-bill rate is 4% and the market risk premium is 6%. Company $1 Discount Store Everything $5 Actual return 12% 11% Standard deviation of returns 8% 10% Beta 1.5 1.0 What would be the required return for $1 Discount Store according to the capital asset pricing model (CAPM)? Enter your answer as a decimal.

- A4 5c Consider the following information on three stocks in four possible future states of the economy: State of economy Probability of state of economy Stock A Stock B Stock C Boom 0.3 0.35 0.45 0.38 Good 0.3 0.15 0.20 0.12 Poor 0.3 0.05 –0.10 –0.05 Bust 0.1 0.00 –0.30 –0.10 stock A: State of economy Probability Rate of return Average (a) (b) (c) (d = b × c)(d = b × c) Boom 0.3 0.35 0.105 Good 0.3 0.15 0.045 Poor 0.3 0.05 0.015 Bust 0.1 0 0 Expected rate of return 0.165 stock B: State of economy Probability Rate of return Average (a) (b) (c) (d = b × c)(d = b × c) Boom 0.3 0.45 0.135 Good 0.3 0.2 0.06 Poor 0.3 -0.1 -0.03 Bust 0.1 -0.3 -0.03 Expected rate of return 0.135 Stock C: State of economy Probability Rate of return Average (a) (b) (c) (d = b × c)(d = b…a. Given the following information, calculate the expected value for Firm C’s EPS. Datafor Firms A and B are as follows: E(EPSA) =$5.10, σA =$3.61, E(EPSB) =$4.20, and σB = $2.96. b. You are given that σC = $4.11. Discuss the relative riskiness of the three firms’ earnings.Mf2. 1. Consider the data in the following table for a hypothetical two-stock version of the Dow Jones Industrial Average. a) Calculate the percentage change in the index value. b) Suppose firm XYZ from part (a) were to split two for one during the period (price drops to $35 immediately after the split and the new final price is $30). Calculate the percentage change in the index value. c) If this was for S&P500-type index, what is the percentage change in the index value? Is it affected by the stock split of firm XYZ?