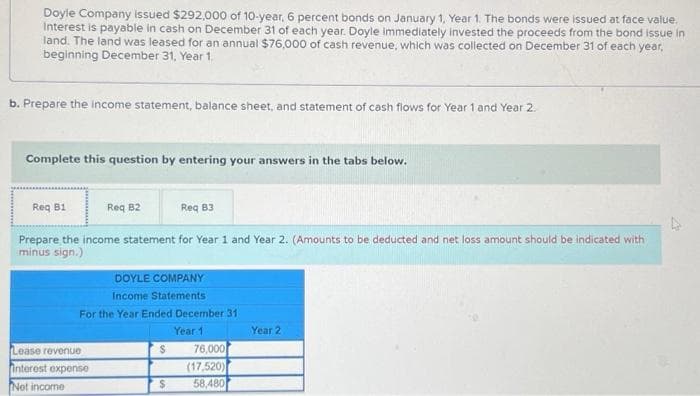

Doyle Company issued $292,000 of 10-year, 6 percent bonds on January 1, Year 1. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land was leased for an annual $76,000 of cash revenue, which was collected on December 31 of each year, beginning December 31, Year 1. b. Prepare the income statement, balance sheet, and statement of cash flows for Year 1 and Year 2. Complete this question by entering your answers in the tabs below. Req B1 Req B2 Prepare the income statement for Year 1 and Year 2. (Amounts to be deducted and net loss amount should be indicated with minus sign.) Lease revenue Interest expense Not income DOYLE COMPANY Income Statements For the Year Ended December 31 Year 1 Req 83 S $ 76,000 (17,520) 58,480 Year 2

Doyle Company issued $292,000 of 10-year, 6 percent bonds on January 1, Year 1. The bonds were issued at face value. Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in land. The land was leased for an annual $76,000 of cash revenue, which was collected on December 31 of each year, beginning December 31, Year 1. b. Prepare the income statement, balance sheet, and statement of cash flows for Year 1 and Year 2. Complete this question by entering your answers in the tabs below. Req B1 Req B2 Prepare the income statement for Year 1 and Year 2. (Amounts to be deducted and net loss amount should be indicated with minus sign.) Lease revenue Interest expense Not income DOYLE COMPANY Income Statements For the Year Ended December 31 Year 1 Req 83 S $ 76,000 (17,520) 58,480 Year 2

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 7MCQ

Related questions

Question

Transcribed Image Text:Doyle Company issued $292,000 of 10-year, 6 percent bonds on January 1, Year 1. The bonds were issued at face value.

Interest is payable in cash on December 31 of each year. Doyle immediately invested the proceeds from the bond issue in

land. The land was leased for an annual $76,000 of cash revenue, which was collected on December 31 of each year,

beginning December 31, Year 1.

b. Prepare the income statement, balance sheet, and statement of cash flows for Year 1 and Year 2.

Complete this question by entering your answers in the tabs below.

Req B1

Req B3

Prepare the income statement for Year 1 and Year 2. (Amounts to be deducted and net loss amount should be indicated with

minus sign.)

Req B2

DOYLE COMPANY

Income Statements

For the Year Ended December 31

Year 1

Lease revenue

Interest expense

Net income

$

$

76,000

(17,520)

58,480

Year 2

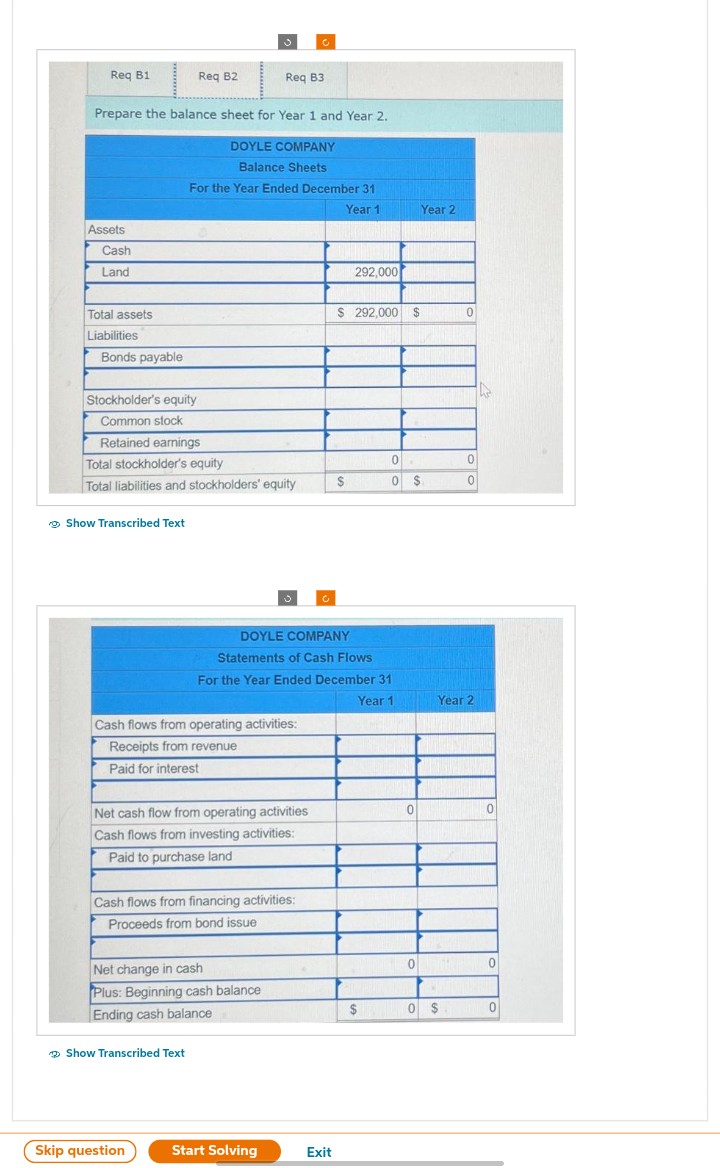

Transcribed Image Text:Req B1

Assets

Cash

Land

Total assets

Liabilities

Prepare the balance sheet for Year 1 and Year 2.

DOYLE COMPANY

Balance Sheets

Bonds payable

Req B2

Stockholder's equity

Common stock

Retained earnings

Show Transcribed Text

Total stockholder's equity

Total liabilities and stockholders' equity

3

For the Year Ended December 31

Year 1

Show Transcribed Text

Reg B3

Cash flows from operating activities:

Receipts from revenue

Paid for interest

Skip question

Net cash flow from operating activities

Cash flows from investing activities:

Paid to purchase land

Net change in cash

Plus: Beginning cash balance

Ending cash balance

Cash flows from financing activities:

Proceeds from bond issue

C

Start Solving

Ć

DOYLE COMPANY

Statements of Cash Flows

For the Year Ended December 31

Year 1

Exit

292,000

$ 292,000 $

$

0 R

0 $

$

0

0

Year 2

0

0 $

0

0

Year 2

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College