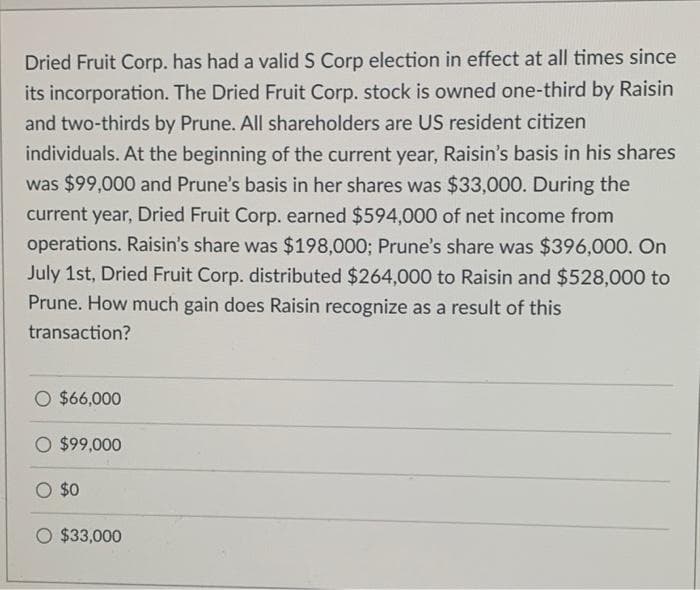

Dried Fruit Corp. has had a valid S Corp election in effect at all times since its incorporation. The Dried Fruit Corp. stock is owned one-third by Raisin and two-thirds by Prune. All shareholders are US resident citizen individuals. At the beginning of the current year, Raisin's basis in his shares was $99,000 and Prune's basis in her shares was $33,000. During the current year, Dried Fruit Corp. earned $594,000 of net income from operations. Raisin's share was $198,000; Prune's share was $396,000. On July 1st, Dried Fruit Corp. distributed $264,000 to Raisin and $528,000 to Prune. How much gain does Raisin recognize as a result of this transaction? $66,000 $99,000 O $0 $33,000

Dried Fruit Corp. has had a valid S Corp election in effect at all times since its incorporation. The Dried Fruit Corp. stock is owned one-third by Raisin and two-thirds by Prune. All shareholders are US resident citizen individuals. At the beginning of the current year, Raisin's basis in his shares was $99,000 and Prune's basis in her shares was $33,000. During the current year, Dried Fruit Corp. earned $594,000 of net income from operations. Raisin's share was $198,000; Prune's share was $396,000. On July 1st, Dried Fruit Corp. distributed $264,000 to Raisin and $528,000 to Prune. How much gain does Raisin recognize as a result of this transaction? $66,000 $99,000 O $0 $33,000

Chapter22: S Corporations

Section: Chapter Questions

Problem 36P

Related questions

Question

Transcribed Image Text:Dried Fruit Corp. has had a valid S Corp election in effect at all times since

its incorporation. The Dried Fruit Corp. stock is owned one-third by Raisin

and two-thirds by Prune. All shareholders are US resident citizen

individuals. At the beginning of the current year, Raisin's basis in his shares

was $99,000 and Prune's basis in her shares was $33,000. During the

current year, Dried Fruit Corp. earned $594,000 of net income from

operations. Raisin's share was $198,000; Prune's share was $396,000. On

July 1st, Dried Fruit Corp. distributed $264,000 to Raisin and $528,000 to

Prune. How much gain does Raisin recognize as a result of this

transaction?

O $66,000

$99,000

O $0

$33,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you