Dunbar (issuer): Effective Nominal Discount Date Interest (9%) Interest (8%) Amortization Balance $48,055 48,380 48,734 49,120 49,541 1/1/14 1/1/15 1/1/16 1/1/17 1/1/18 1/1/19 $4,000 4,000 4,000 $4,325 $325 4,354 354 4,386 4,421 4,459 386 4,000 4,000 421 459 50,000 Garfield (purchaser): Effective Nominal Discount Date Interest (10%) Interest (8%) Amortization Balance 1/2/16 1/1/17 1/1/18 1/1/19 $47,513 48,264 $4,751 $4,000 $751 4,826 4,000 4,000 826 49,090 4,909 909 50,000* *Adjusted for rounding.

Dunbar (issuer): Effective Nominal Discount Date Interest (9%) Interest (8%) Amortization Balance $48,055 48,380 48,734 49,120 49,541 1/1/14 1/1/15 1/1/16 1/1/17 1/1/18 1/1/19 $4,000 4,000 4,000 $4,325 $325 4,354 354 4,386 4,421 4,459 386 4,000 4,000 421 459 50,000 Garfield (purchaser): Effective Nominal Discount Date Interest (10%) Interest (8%) Amortization Balance 1/2/16 1/1/17 1/1/18 1/1/19 $47,513 48,264 $4,751 $4,000 $751 4,826 4,000 4,000 826 49,090 4,909 909 50,000* *Adjusted for rounding.

Chapter20: Income Taxation Of Trusts And Estates

Section: Chapter Questions

Problem 15CE

Related questions

Question

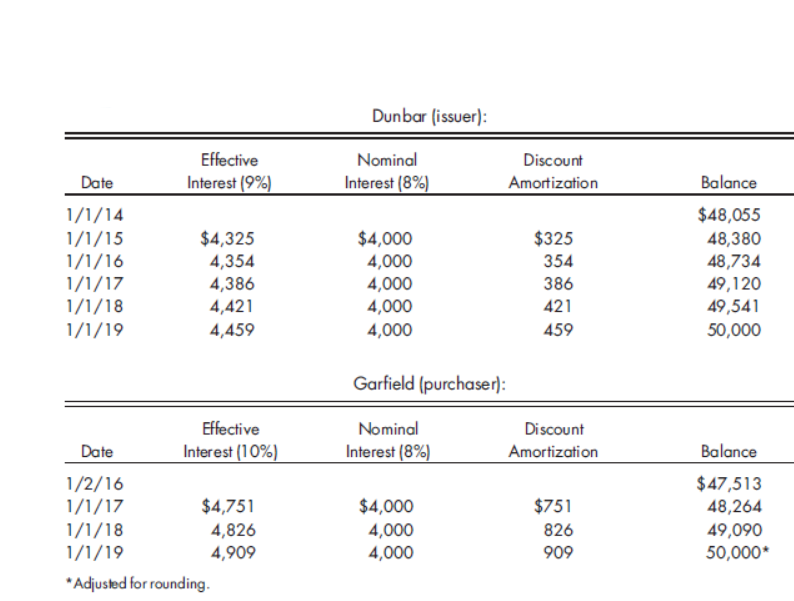

On January 1, 2014, Dunbar Corporation, an 85%-owned subsidiary of Garfield Industries, received $48,055 for $50,000 of 8%, 5-year bonds it issued when the market rate was 9%. When Garfield Industries purchased these bonds for $47,513 on January 2, 2016, the market rate was 10%. Given the following effective interest amortization schedules for both companies, calculate the gain or loss on retirement and the interest adjustments to the issuer’s income distribution schedules over the remaining term of the bonds.

Transcribed Image Text:Dunbar (issuer):

Effective

Nominal

Discount

Date

Interest (9%)

Interest (8%)

Amortization

Balance

$48,055

48,380

48,734

49,120

49,541

1/1/14

1/1/15

1/1/16

1/1/17

1/1/18

1/1/19

$4,000

4,000

4,000

$4,325

$325

4,354

354

4,386

4,421

4,459

386

4,000

4,000

421

459

50,000

Garfield (purchaser):

Effective

Nominal

Discount

Date

Interest (10%)

Interest (8%)

Amortization

Balance

1/2/16

1/1/17

1/1/18

1/1/19

$47,513

48,264

$4,751

$4,000

$751

4,826

4,000

4,000

826

49,090

4,909

909

50,000*

*Adjusted for rounding.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning