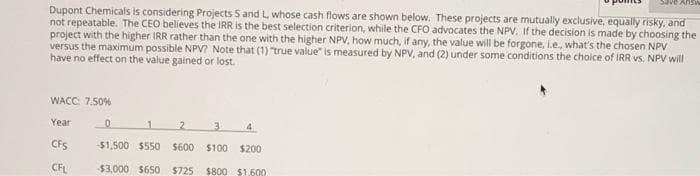

Dupont Chemicals is considering Projects S and L whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV. if the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much, if any, the value will be forgone, ie, what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. NPV will have no effect on the value gained or lost. WACC 7.50%

Dupont Chemicals is considering Projects S and L whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV. if the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV, how much, if any, the value will be forgone, ie, what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. NPV will have no effect on the value gained or lost. WACC 7.50%

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 11P

Related questions

Question

Transcribed Image Text:Dupont Chemicals is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and

not repeatable. The CEO believes the IRR is the best selection criterion, while the CFO advocates the NPV. If the decision is made by choosing the

project with the higher IRR rather than the one with the higher NPV, how much, if any, the value will be forgone, L.e, what's the chosen NPV

versus the maximum possible NPVn Note that (1) "true value" is measured by NPV, and (2) under some conditions the choice of IRR vs. NPV will

have no effect on the value gained or lost.

WACC: 7,50%

Year

4

CFS

-$1,500 $550 $600 $100

$200

CFL

$3,000 $650 $725

$800 $1.600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning