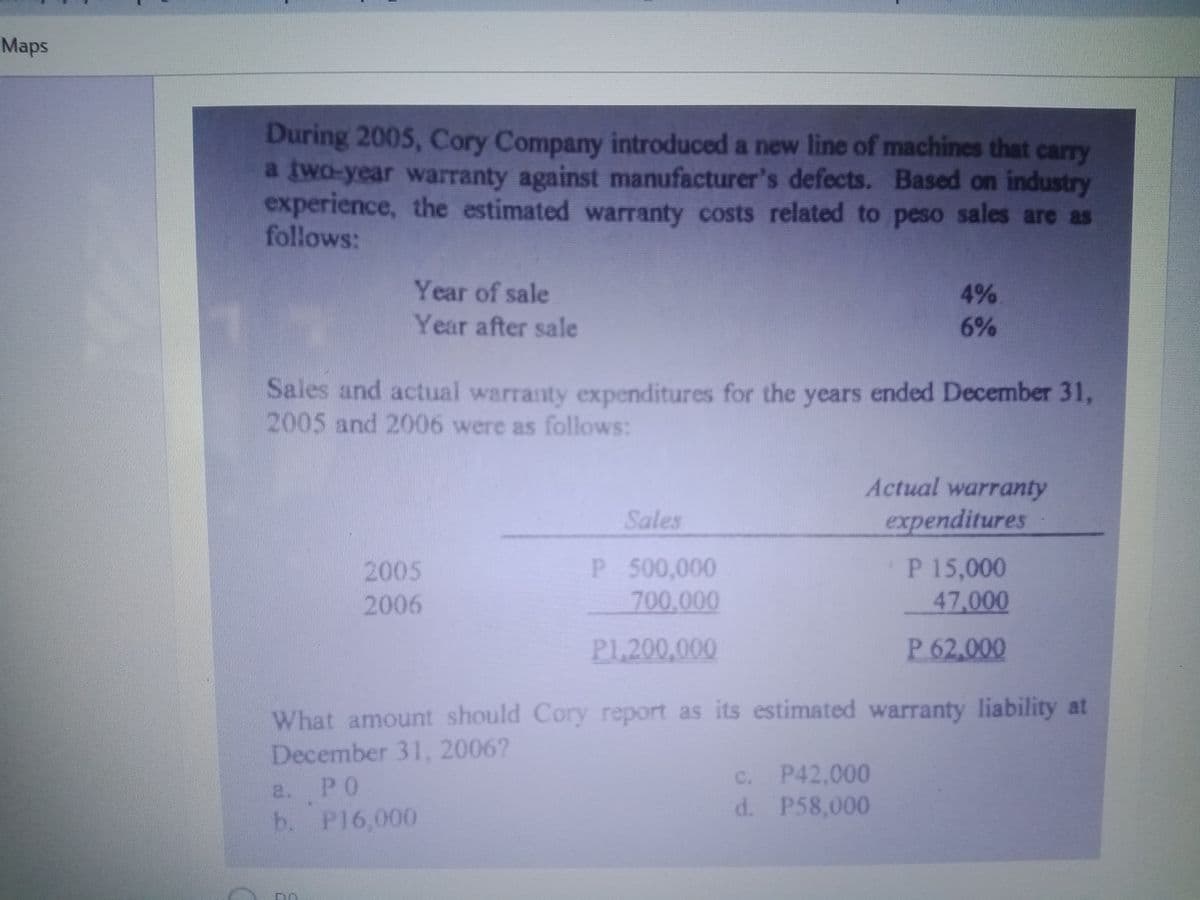

During 2005, Cory Company introduced a new line of machines that carry a two-year warranty against manufacturer's defects. Based on industry experience, the estimated warranty costs related to peso sales are as follows: Year of sale 4% Year after sale 6% Sales and actual warranty expenditures for the years ended December 31, 2005 and 2006 were as follows: Actual warranty Sales expenditures P 500,000 700,000 P 15,000 47,000 2005 2006 P1,200,000 P 62,000 What amount should Cory report as its estimated warranty liability at December 31, 2006? PO c. P42,000 d. P58,000 a. b. P16,000

During 2005, Cory Company introduced a new line of machines that carry a two-year warranty against manufacturer's defects. Based on industry experience, the estimated warranty costs related to peso sales are as follows: Year of sale 4% Year after sale 6% Sales and actual warranty expenditures for the years ended December 31, 2005 and 2006 were as follows: Actual warranty Sales expenditures P 500,000 700,000 P 15,000 47,000 2005 2006 P1,200,000 P 62,000 What amount should Cory report as its estimated warranty liability at December 31, 2006? PO c. P42,000 d. P58,000 a. b. P16,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10E

Related questions

Question

Transcribed Image Text:Maps

During 2005, Cory Company introduced a new line of machines that carry

a two-year warranty against manufacturer's defects. Based on industry

experience, the estimated warranty costs related to peso sales are as

follows:

Year of sale

4%

Year after sale

6%

Sales and actual warranty expenditures for the years ended December 31,

2005 and 2006 were as follows:

Actual warranty

Sales

expenditures

2005

2006

500,000

700,000

P 15,000

47,000

Pl,200,000

P 62,000

What amount should Cory report as its estimated warranty liability at

December 31, 2006?

PO

b. P16,000

c. P42,000

d. P58,000

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning