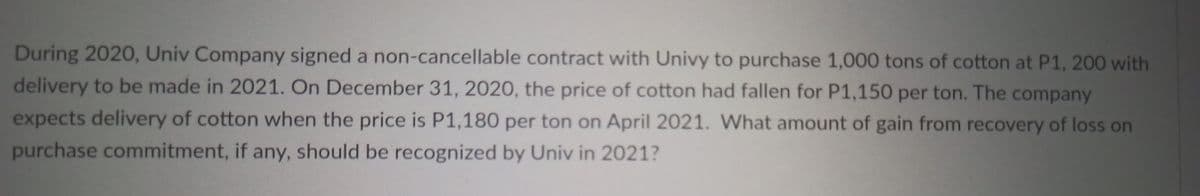

During 2020, Univ Company signed a non-cancellable contract with Univy to purchase 1,000 tons of cotton at P1, 200 with delivery to be made in 2021. On December 31, 2020, the price of cotton had fallen for P1,150 per ton. The company expects delivery of cotton when the price is P1,180 per ton on April 2021. What amount of gain from recovery of loss on purchase commitment, if any, should be recognized by Univ in 2021?

During 2020, Univ Company signed a non-cancellable contract with Univy to purchase 1,000 tons of cotton at P1, 200 with delivery to be made in 2021. On December 31, 2020, the price of cotton had fallen for P1,150 per ton. The company expects delivery of cotton when the price is P1,180 per ton on April 2021. What amount of gain from recovery of loss on purchase commitment, if any, should be recognized by Univ in 2021?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 8E

Related questions

Question

Transcribed Image Text:During 2020, Univ Company signed a non-cancellable contract with Univy to purchase 1,000 tons of cotton at P1, 200 with

delivery to be made in 2021. On December 31, 2020, the price of cotton had fallen for P1,150 per ton. The company

expects delivery of cotton when the price is P1,180 per ton on April 2021. What amount of gain from recovery of loss on

purchase commitment, if any, should be recognized by Univ in 2021?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT