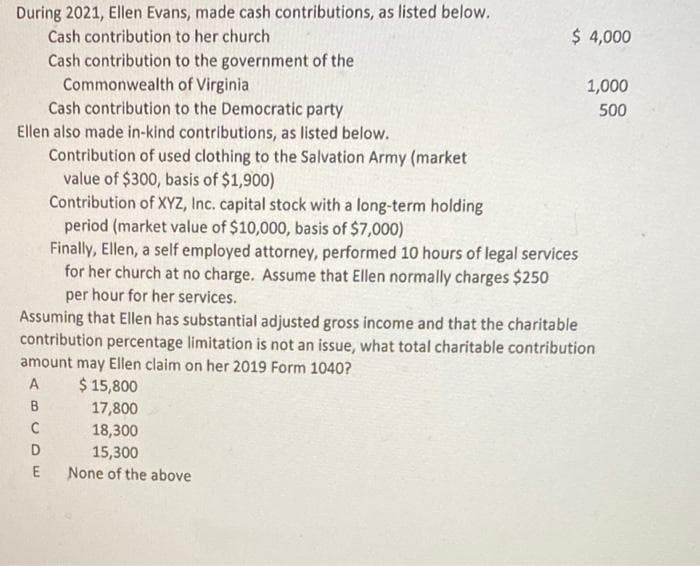

During 2021, Ellen Evans, made cash contributions, as listed below. Cash contribution to her church Cash contribution to the government of the of Virginia Commonwealth Cash contribution to the Democratic party Ellen also made in-kind contributions, as listed below. Contribution of used clothing to the Salvation Army (market value of $300, basis of $1,900) Contribution of XYZ, Inc. capital stock with a long-term holding period (market value of $10,000, basis of $7,000) Finally, Ellen, a self employed attorney, performed 10 hours of legal services for her church at no charge. Assume that Ellen normally charges $250 per hour for her services. $ 4,000 1,000 500 Assuming that Ellen has substantial adjusted gross income and that the charitable contribution percentage limitation is not an issue, what total charitable contribution amount may Ellen claim on her 2019 Form 1040? A $ 15,800 B 17,800 C 18,300 D 15,300 E None of the above

During 2021, Ellen Evans, made cash contributions, as listed below. Cash contribution to her church Cash contribution to the government of the of Virginia Commonwealth Cash contribution to the Democratic party Ellen also made in-kind contributions, as listed below. Contribution of used clothing to the Salvation Army (market value of $300, basis of $1,900) Contribution of XYZ, Inc. capital stock with a long-term holding period (market value of $10,000, basis of $7,000) Finally, Ellen, a self employed attorney, performed 10 hours of legal services for her church at no charge. Assume that Ellen normally charges $250 per hour for her services. $ 4,000 1,000 500 Assuming that Ellen has substantial adjusted gross income and that the charitable contribution percentage limitation is not an issue, what total charitable contribution amount may Ellen claim on her 2019 Form 1040? A $ 15,800 B 17,800 C 18,300 D 15,300 E None of the above

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 39P

Related questions

Question

Transcribed Image Text:During 2021, Ellen Evans, made cash contributions, as listed below.

Cash contribution to her church

Cash contribution to the government of the

of Virginia

Commonwealth

Cash contribution to the Democratic party

Ellen also made in-kind contributions, as listed below.

$ 4,000

Contribution of used clothing to the Salvation Army (market

value of $300, basis of $1,900)

Contribution of XYZ, Inc. capital stock with a long-term holding

period (market value of $10,000, basis of $7,000)

Finally, Ellen, a self employed attorney, performed 10 hours of legal services

for her church at no charge. Assume that Ellen normally charges $250

per hour for her services.

18,300

15,300

None of the above

1,000

500

Assuming that Ellen has substantial adjusted gross income and that the charitable

contribution percentage limitation is not an issue, what total charitable contribution

amount may Ellen claim on her 2019 Form 1040?

A

$ 15,800

B

17,800

C

D

E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you