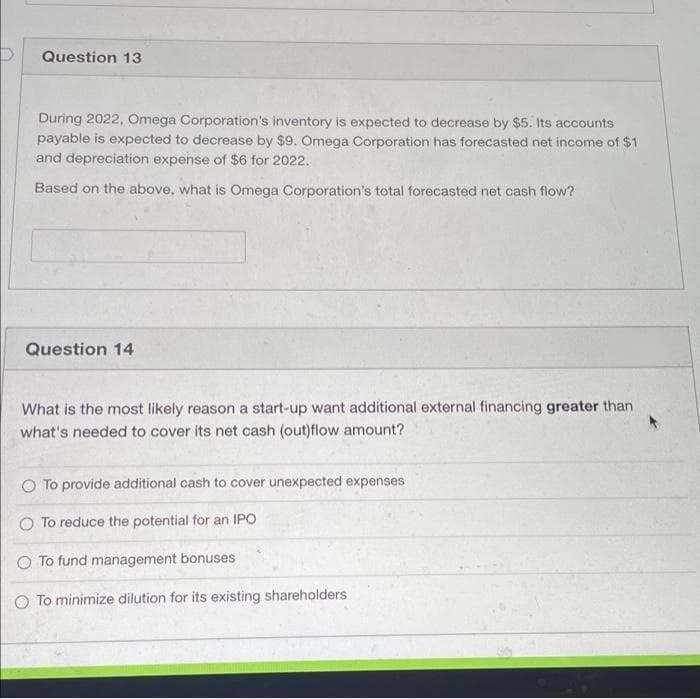

During 2022, Omega Corporation's inventory is expected to decrease by $5. Its accounts payable is expected to decrease by $9. Omega Corporation has forecasted net income of $1 and depreciation expense of $6 for 2022. Based on the above, what is Omega Corporation's total forecasted net cash flow?

During 2022, Omega Corporation's inventory is expected to decrease by $5. Its accounts payable is expected to decrease by $9. Omega Corporation has forecasted net income of $1 and depreciation expense of $6 for 2022. Based on the above, what is Omega Corporation's total forecasted net cash flow?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter9: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 3P: AFN Equation Refer to Problem 9-1. Return to the assumption that the company had 5 million in assets...

Related questions

Question

Transcribed Image Text:Question 13

During 2022, Omega Corporation's inventory is expected to decrease by $5. Its accounts

payable is expected to decrease by $9. Omega Corporation has forecasted net income of $1

and depreciation expense of $6 for 2022.

Based on the above, what is Omega Corporation's total forecasted net cash flow?

Question 14

What is the most likely reason a start-up want additional external financing greater than

what's needed to cover its net cash (out)flow amount?

O To provide additional cash to cover unexpected expenses

O To reduce the potential for an IPO

To fund management bonuses

O To minimize dilution for its existing shareholders

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning