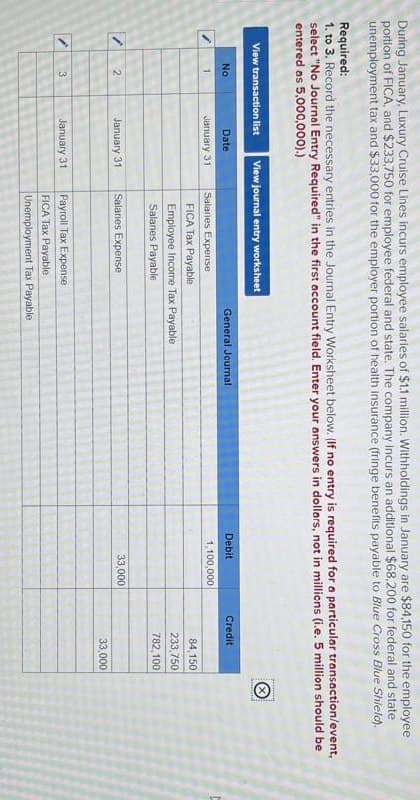

During January, Luxury Cruise Lines incurs employee salaries of $1.1 million. Withholdings in January are $84,150 for the employee portion of FICA, and $233,750 for employee federal and state. The company incurs an additional $68,200 for federal and state unemployment tax and $33,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shield). Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).) View transaction list View journal entry worksheet Ⓡ 2 No Date 1 January 31 Salaries Expense FICA Tax Payable General Journal Employee Income Tax Payable Salaries Payable January 31 Salaries Expense 3 January 31 Payroll Tax Expense FICA Tax Payable. Unemployment Tax Payable Debit Credit 1,100,000 84,150 233,750 782,100 33,000 33,000

During January, Luxury Cruise Lines incurs employee salaries of $1.1 million. Withholdings in January are $84,150 for the employee portion of FICA, and $233,750 for employee federal and state. The company incurs an additional $68,200 for federal and state unemployment tax and $33,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shield). Required: 1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).) View transaction list View journal entry worksheet Ⓡ 2 No Date 1 January 31 Salaries Expense FICA Tax Payable General Journal Employee Income Tax Payable Salaries Payable January 31 Salaries Expense 3 January 31 Payroll Tax Expense FICA Tax Payable. Unemployment Tax Payable Debit Credit 1,100,000 84,150 233,750 782,100 33,000 33,000

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter9: Payroll Accounting: Employer Taxes And Reports

Section: Chapter Questions

Problem 1CP

Related questions

Question

Transcribed Image Text:During January, Luxury Cruise Lines incurs employee salaries of $1.1 million. Withholdings in January are $84,150 for the employee

portion of FICA, and $233,750 for employee federal and state. The company incurs an additional $68,200 for federal and state

unemployment tax and $33,000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Blue Shield).

Required:

1. to 3. Record the necessary entries in the Journal Entry Worksheet below. (If no entry is required for a particular transaction/event,

select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be

entered as 5,000,000).)

View transaction list View journal entry worksheet

Ⓡ

2

No

Date

1

January 31

Salaries Expense

FICA Tax Payable

General Journal

Employee Income Tax Payable

Salaries Payable

January 31

Salaries Expense

3

January 31

Payroll Tax Expense

FICA Tax Payable.

Unemployment Tax Payable

Debit

Credit

1,100,000

84,150

233,750

782,100

33,000

33,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College