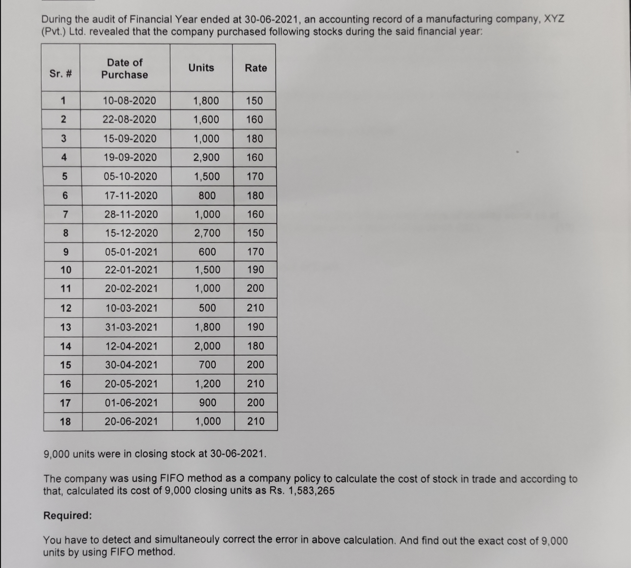

During the audit of Financial Year ended at 30-06-2021, an accounting record of a manufacturing company, XYZ (Pvt.) Ltd. revealed that the company purchased following stocks during the said financial year: Date of Units Rate Sr. # Purchase 1 10-08-2020 1,800 150 2 22-08-2020 1,600 160 15-09-2020 1,000 180 4 19-09-2020 2,900 160 5 05-10-2020 1,500 170 6. 17-11-2020 800 180 7 28-11-2020 1,000 160 15-12-2020 2,700 150 9. 05-01-2021 600 170 10 22-01-2021 1,500 190 11 20-02-2021 1,000 200 12 10-03-2021 500 210 13 31-03-2021 1,800 190 14 12-04-2021 2,000 180 15 30-04-2021 700 200 16 20-05-2021 1,200 210 17 01-06-2021 900 200 18 20-06-2021 1,000 210 9,000 units were in closing stock at 30-06-2021. The company was using FIFO method as a company policy to calculate the cost of stock in trade and according to that, calculated its cost of 9,000 closing units as Rs. 1,583,265 Required: You have to detect and simultaneouly correct the error in above calculation. And find out the exact cost of 9,000 units by using FIFO method.

During the audit of Financial Year ended at 30-06-2021, an accounting record of a manufacturing company, XYZ (Pvt.) Ltd. revealed that the company purchased following stocks during the said financial year: Date of Units Rate Sr. # Purchase 1 10-08-2020 1,800 150 2 22-08-2020 1,600 160 15-09-2020 1,000 180 4 19-09-2020 2,900 160 5 05-10-2020 1,500 170 6. 17-11-2020 800 180 7 28-11-2020 1,000 160 15-12-2020 2,700 150 9. 05-01-2021 600 170 10 22-01-2021 1,500 190 11 20-02-2021 1,000 200 12 10-03-2021 500 210 13 31-03-2021 1,800 190 14 12-04-2021 2,000 180 15 30-04-2021 700 200 16 20-05-2021 1,200 210 17 01-06-2021 900 200 18 20-06-2021 1,000 210 9,000 units were in closing stock at 30-06-2021. The company was using FIFO method as a company policy to calculate the cost of stock in trade and according to that, calculated its cost of 9,000 closing units as Rs. 1,583,265 Required: You have to detect and simultaneouly correct the error in above calculation. And find out the exact cost of 9,000 units by using FIFO method.

Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter4: Professional Legal Liability

Section: Chapter Questions

Problem 21RQSC

Related questions

Question

Transcribed Image Text:During the audit of Financial Year ended at 30-06-2021, an accounting record of a manufacturing company, XYZ

(Pvt.) Ltd. revealed that the company purchased following stocks during the said financial year:

Date of

Units

Rate

Sr. #

Purchase

1

10-08-2020

1,800

150

2

22-08-2020

1,600

160

15-09-2020

1,000

180

4

19-09-2020

2,900

160

5

05-10-2020

1,500

170

6.

17-11-2020

800

180

7

28-11-2020

1,000

160

8

15-12-2020

2,700

150

9.

05-01-2021

600

170

10

22-01-2021

1,500

190

11

20-02-2021

1,000

200

12

10-03-2021

500

210

13

31-03-2021

1,800

190

14

12-04-2021

2,000

180

15

30-04-2021

700

200

16

20-05-2021

1,200

210

17

01-06-2021

900

200

18

20-06-2021

1,000

210

9,000 units were in closing stock at 30-06-2021.

The company was using FIFO method as a company policy to calculate the cost of stock in trade and according to

that, calculated its cost of 9,000 closing units as Rs. 1,583,.265

Required:

You have to detect and simultaneouly correct the error in above calculation. And find out the exact cost of 9,000

units by using FIFO method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning