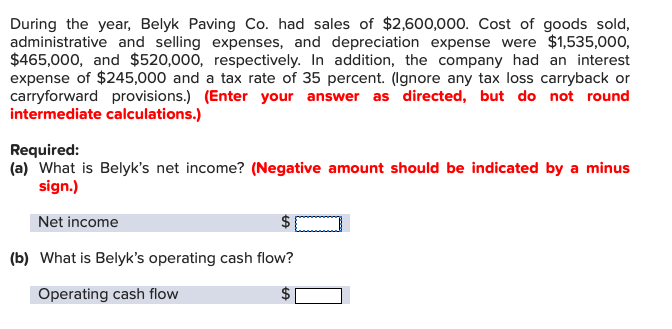

During the year, Belyk Paving Co. had sales of $2,600,000. Cost of goods sold, administrative and selling expenses, and depreciation expense were $1,535,000, $465,000, and $520,000, respectively. In addition, the company had an interest expense of $245,000 and a tax rate of 35 percent. (Ignore any tax loss carryback or carryforward provisions.) (Enter your answer as directed, but do not round intermediate calculations.) Required: (a) What is Belyk's net income? (Negative amount should be indicated by a minus sign.) Net income (b) What is Belyk's operating cash flow? Operating cash flow A

During the year, Belyk Paving Co. had sales of $2,600,000. Cost of goods sold, administrative and selling expenses, and depreciation expense were $1,535,000, $465,000, and $520,000, respectively. In addition, the company had an interest expense of $245,000 and a tax rate of 35 percent. (Ignore any tax loss carryback or carryforward provisions.) (Enter your answer as directed, but do not round intermediate calculations.) Required: (a) What is Belyk's net income? (Negative amount should be indicated by a minus sign.) Net income (b) What is Belyk's operating cash flow? Operating cash flow A

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:During the year, Belyk Paving Co. had sales of $2,600,000. Cost of goods sold,

administrative and selling expenses, and depreciation expense were $1,535,000,

$465,000, and $520,000, respectively. In addition, the company had an interest

expense of $245,000 and a tax rate of 35 percent. (Ignore any tax loss carryback or

carryforward provisions.) (Enter your answer as directed, but do not round

intermediate calculations.)

Required:

(a) What is Belyk's net income? (Negative amount should be indicated by a minus

sign.)

Net income

(b) What is Belyk's operating cash flow?

Operating cash flow

A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning