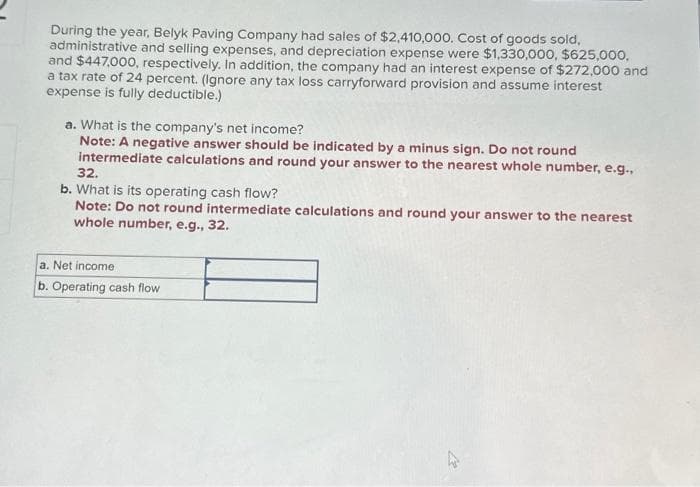

During the year, Belyk Paving Company had sales of $2,410,000. Cost of goods sold, administrative and selling expenses, and depreciation expense were $1,330,000, $625,000, and $447,000, respectively. In addition, the company had an interest expense of $272,000 and a tax rate of 24 percent. (Ignore any tax loss carryforward provision and assume interest expense is fully deductible.) a. What is the company's net income? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. b. What is its operating cash flow? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. a. Net income b. Operating cash flow

During the year, Belyk Paving Company had sales of $2,410,000. Cost of goods sold, administrative and selling expenses, and depreciation expense were $1,330,000, $625,000, and $447,000, respectively. In addition, the company had an interest expense of $272,000 and a tax rate of 24 percent. (Ignore any tax loss carryforward provision and assume interest expense is fully deductible.) a. What is the company's net income? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. b. What is its operating cash flow? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. a. Net income b. Operating cash flow

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:During the year, Belyk Paving Company had sales of $2,410,000. Cost of goods sold,

administrative and selling expenses, and depreciation expense were $1,330,000, $625,000,

and $447,000, respectively. In addition, the company had an interest expense of $272,000 and

a tax rate of 24 percent. (Ignore any tax loss carryforward provision and assume interest

expense is fully deductible.)

a. What is the company's net income?

Note: A negative answer should be indicated by a minus sign. Do not round

intermediate calculations and round your answer to the nearest whole number, e.g..

32.

b. What is its operating cash flow?

Note: Do not round intermediate calculations and round your answer to the nearest

whole number, e.g., 32.

a. Net income

b. Operating cash flow

27

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning