Dynamic Systems has an outstanding bond that has a $1,000 par value and an 11 percent coupon rate. Interest is paid semiannually. The bond has 13 years remaining until it matures. Today the going interest rate is 12 percent, and it is expected to remain at this level for many years in the future. Compute the current yield. Do not round intermediate calculations. Round your answer to two decimal places. _______% Compute the capital gains yield that the bond will generate this year. Do not round intermediate calculations. Round your answer to two decimal places. _______%

Dynamic Systems has an outstanding bond that has a $1,000 par value and an 11 percent coupon rate. Interest is paid semiannually. The bond has 13 years remaining until it matures. Today the going interest rate is 12 percent, and it is expected to remain at this level for many years in the future. Compute the current yield. Do not round intermediate calculations. Round your answer to two decimal places. _______% Compute the capital gains yield that the bond will generate this year. Do not round intermediate calculations. Round your answer to two decimal places. _______%

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 4P

Related questions

Question

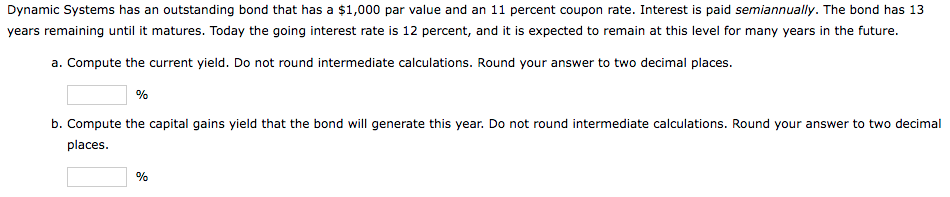

Dynamic Systems has an outstanding bond that has a $1,000 par value and an 11 percent coupon rate. Interest is paid semiannually. The bond has 13 years remaining until it matures. Today the going interest rate is 12 percent, and it is expected to remain at this level for many years in the future.

-

Compute the current yield. Do not round intermediate calculations. Round your answer to two decimal places.

_______%

-

Compute the

capital gains yield that the bond will generate this year. Do not round intermediate calculations. Round your answer to two decimal places._______%

Transcribed Image Text:Dynamic Systems has an outstanding bond that has a $1,000 par value and an 11 percent coupon rate. Interest is paid semiannually. The bond has 13

years remaining until it matures. Today the going interest rate is 12 percent, and it is expected to remain at this level for many years in the future.

a. Compute the current yield. Do not round intermediate calculations. Round your answer to two decimal places.

%

b. Compute the capital gains yield that the bond will generate this year. Do not round intermediate calculations. Round your answer to two decimal

places.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning