Dynamo Manufacturing paid cash to acquire the assets of an existing company. Among the assets acquired were the following items: Patent with 4 remaining years of legal life. Goodwill $33,800 37,400 Dynamo's financial condition just prior to the acquisition of these assets is shown in Required B. Required . Compute the annual amortization expense for these items. Record the acquisition of the intangible assets and the related amortization expense for year 1 in a horizontal statements model.

Dynamo Manufacturing paid cash to acquire the assets of an existing company. Among the assets acquired were the following items: Patent with 4 remaining years of legal life. Goodwill $33,800 37,400 Dynamo's financial condition just prior to the acquisition of these assets is shown in Required B. Required . Compute the annual amortization expense for these items. Record the acquisition of the intangible assets and the related amortization expense for year 1 in a horizontal statements model.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter7: Property Transactions: Basis, Gain And Loss, And Nontaxable Exchanges

Section: Chapter Questions

Problem 1BD

Related questions

Question

5

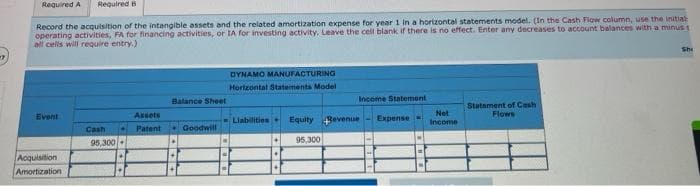

Transcribed Image Text:Required A Required B

Record the acquisition of the intangible assets and the related amortization expense for year 1 in a horizontal statements model. (In the Cash Flow column, use the initial

operating activities, FA for financing activities, or IA for investing activity. Leave the cell blank if there is no effect. Enter any decreases to account balances with a minus 1

all cells will require entry.)

Event

Acquisition

Amortization

Cash

95,300

Balance Sheet

Assets

Patent Goodwill

DYNAMO MANUFACTURING

Horizontal Statements Model

Income Statement

Liabilities Equity Revenue

95,300

Expense

Net

Income

Statement of Cash

Flows

Sha

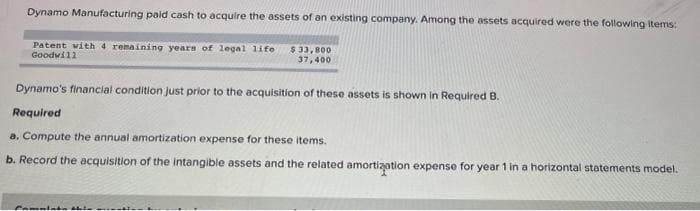

Transcribed Image Text:Dynamo Manufacturing paid cash to acquire the assets of an existing company. Among the assets acquired were the following items:

$33,800

37,400

Patent with 4 remaining years of legal life.

Goodwill

Dynamo's financial condition just prior to the acquisition of these assets is shown in Required B.

Required

a. Compute the annual amortization expense for these items.

b. Record the acquisition of the intangible assets and the related amortization expense for year 1 in a horizontal statements model.

Camale

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning