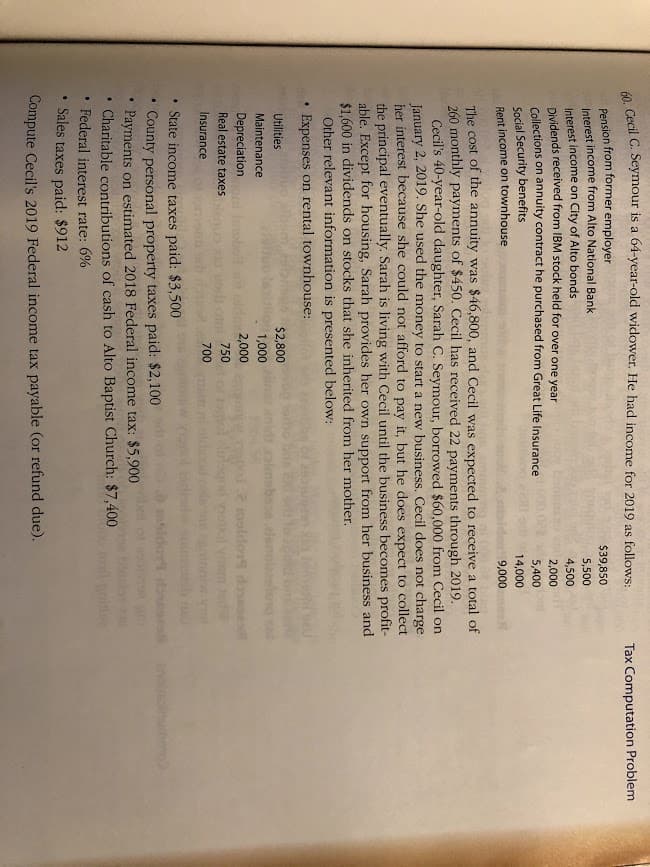

e Cecil C. Seymour is a 64-year-old widower. He had income for 2019 as follows: Pension from former employer $39,850 Interest income from Alto National Bank 5,500 Interest income on City of Alto bonds Dividends received from IBM stock held for over one year 4,500 2,000 Collections on annuity contract he purchased from Great Life Insurance 5,400 Social Security benefits Rent income on townhouse 14,000 9,000 The cost of the annuity was $46,800, and Cecil was expected to receive a total of 260 monthly payments of $450. Cecil has received 22 payments through 2019. Cecil's 40-year-old daughter, Sarah C. Seymour, borrowed $60,000 from Cecil on January 2, 2019. She used the money to start a new business. Cecil does not charge her interest because she could not afford to pay it, but he does expect to collect the principal eventually. Sarah is living with Cecil until the business becomes profit- able. Except for housing, Sarah provides her own support from her business and $1.600 in dividends on stocks that she inherited from her mother. Other relevant information is presented below: Expenses on rental townhouse: Utilities $2,800 Maintenance 1,000 Depreciation boll 2,000 oldons dse Real estate taxes 750 lagod pa vn Insurance 700 State income taxes paid: $3,500 County personal property taxes paid: $2,100 Payments on estimated 2018 Federal income tax: $5,900 Charitable contributions of cash to Alto Baptist Church: $7,400 Federal interest rate: 6% Sales taxes paid: $912 Compute Cecil's 2019 Federal income tax payable (or refund due).

e Cecil C. Seymour is a 64-year-old widower. He had income for 2019 as follows: Pension from former employer $39,850 Interest income from Alto National Bank 5,500 Interest income on City of Alto bonds Dividends received from IBM stock held for over one year 4,500 2,000 Collections on annuity contract he purchased from Great Life Insurance 5,400 Social Security benefits Rent income on townhouse 14,000 9,000 The cost of the annuity was $46,800, and Cecil was expected to receive a total of 260 monthly payments of $450. Cecil has received 22 payments through 2019. Cecil's 40-year-old daughter, Sarah C. Seymour, borrowed $60,000 from Cecil on January 2, 2019. She used the money to start a new business. Cecil does not charge her interest because she could not afford to pay it, but he does expect to collect the principal eventually. Sarah is living with Cecil until the business becomes profit- able. Except for housing, Sarah provides her own support from her business and $1.600 in dividends on stocks that she inherited from her mother. Other relevant information is presented below: Expenses on rental townhouse: Utilities $2,800 Maintenance 1,000 Depreciation boll 2,000 oldons dse Real estate taxes 750 lagod pa vn Insurance 700 State income taxes paid: $3,500 County personal property taxes paid: $2,100 Payments on estimated 2018 Federal income tax: $5,900 Charitable contributions of cash to Alto Baptist Church: $7,400 Federal interest rate: 6% Sales taxes paid: $912 Compute Cecil's 2019 Federal income tax payable (or refund due).

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 60CP

Related questions

Question

image attached

Transcribed Image Text:o Cecil C. Seymour is a 64-year-old widower. He had income for 2019 as follows:

Tax Computation Problem

Pension from former employer

$39,850

Interest income from Alto National Bank

5,500

Interest income on City of Alto bonds

Dividends received from IBM stock held for over one year

Collections on annuity contract he purchased from Great Life Insurance

4,500

2,000

5,400

Social Security benefits

Rent income on townhouse

14,000

9,000

The cost of the annuity was $46,800, and Cecil was expected to receive a total of

260 monthly payments of $450. Cecil has received 22 payments through 2019.

Cecil's 40-year-old daughter, Sarah C. Seymour, borrowed $60,000 from Cecil on

January 2, 2019. She used the money to start a new business. Cecil does not charge

her interest because she could not afford to pay it, but he does expect to collect

the principal eventually. Sarah is living with Cecil until the business becomes profit-

able. Except for housing, Sarah provides her own support from her business and

$1,600 in dividends on stocks that she inherited from her mother.

Other relevant information is presented below:

Expenses on rental townhouse:

Utilities

$2,800

Maintenance

1,000

oldor dae

plkl van

Depreciation

2,000

Real estate taxes

750

Insurance

700

• Sate income taxes paid: $3,500

County personal property taxes paid: $2,100

Payments on estimated 2018 Federal income tax: $5,900

Charitable contributions of cash to Alto Baptist Church: $7,400

• Federal interest rate: 6%

Sales taxes paid: $912

Compute Cecil's 2019 Federal income tax payable (or refund due).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT