e Index estment in one of two machines. The sewing machine will increase productivity from sewing 120 baseballs per hour to sewing 216 per hour. The contribution margin per unit is $0.46 per baseball. Assur can be sold. The second machine is an automatic packing machine for the golf ball line. The packing machine will reduce packing labor cost. The labor cost saved is equivalent to $27 per hour. The sewir - life, and will operate for 1,400 hours per year. The packing machine will cost $159,300, have a 10-year life, and will operate for 1,200 hours per year. Diamond and Turf seeks a minimum rate of return Compound Interest 15% 20% 0.870 0.833 1.626 1.528 2.283 2.106 2.855 2.589 3.353 2.991 3.785 3.326 4.160 3.605 4.487 3.837 4.772 4.031 5.019 4.192 two machines. Use the table of present values of an annuity of $1 above. Round to the nearest dollar. Sewing Machine Packing Machine he two machines. If required, round your answers to two decimal places. ewing Machine Packing Machine for only one of the machines and qualitative factors are equal between the two machines, in which machine should it invest? (If both present value indexes are the same, either machine will grade as

e Index estment in one of two machines. The sewing machine will increase productivity from sewing 120 baseballs per hour to sewing 216 per hour. The contribution margin per unit is $0.46 per baseball. Assur can be sold. The second machine is an automatic packing machine for the golf ball line. The packing machine will reduce packing labor cost. The labor cost saved is equivalent to $27 per hour. The sewir - life, and will operate for 1,400 hours per year. The packing machine will cost $159,300, have a 10-year life, and will operate for 1,200 hours per year. Diamond and Turf seeks a minimum rate of return Compound Interest 15% 20% 0.870 0.833 1.626 1.528 2.283 2.106 2.855 2.589 3.353 2.991 3.785 3.326 4.160 3.605 4.487 3.837 4.772 4.031 5.019 4.192 two machines. Use the table of present values of an annuity of $1 above. Round to the nearest dollar. Sewing Machine Packing Machine he two machines. If required, round your answers to two decimal places. ewing Machine Packing Machine for only one of the machines and qualitative factors are equal between the two machines, in which machine should it invest? (If both present value indexes are the same, either machine will grade as

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 13E

Related questions

Question

How would I do this problem?

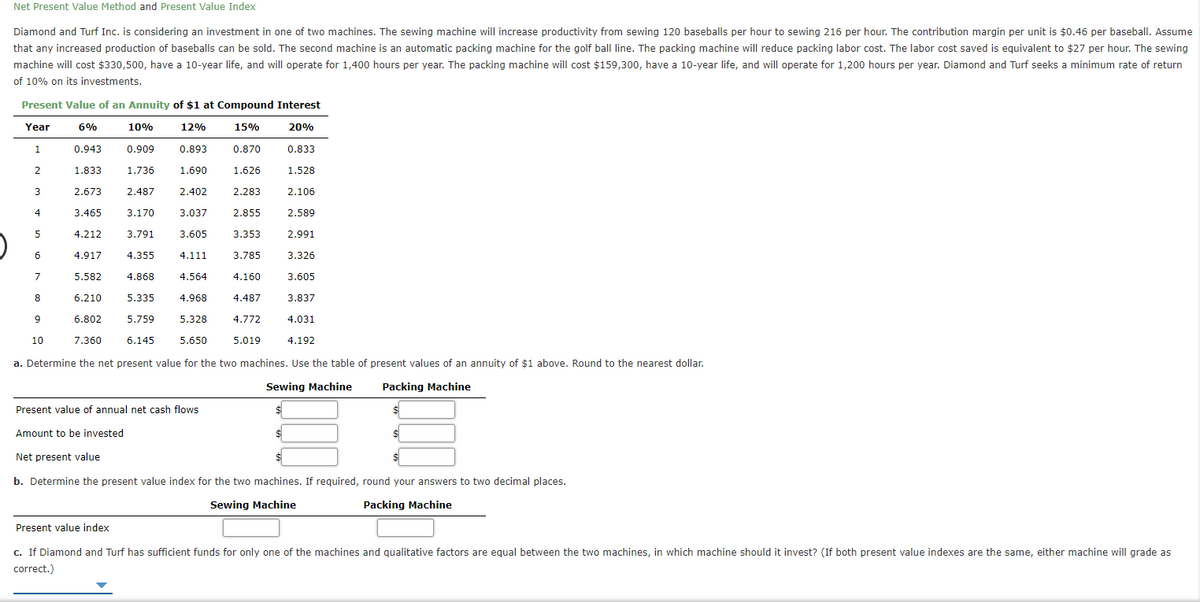

Transcribed Image Text:Net Present Value Method and Present Value Index

Diamond and Turf Inc. is considering an investment in one of two machines. The sewing machine will increase productivity from sewing 120 baseballs per hour to sewing 216 per hour. The contribution margin per unit is $0.46 per baseball. Assume

that any increased production of baseballs can be sold. The second machine is an automatic packing machine for the golf ball line. The packing machine will reduce packing labor cost. The labor cost saved is equivalent to $27 per hour. The sewing

machine will cost $330,500, have a 10-year life, and will operate for 1,400 hours per year. The packing machine will cost $159,300, have a 10-year life, and will operate for 1,200 hours per year. Diamond and Turf seeks a minimum rate of return

of 10% on its investments.

Present Value of an Annuity of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.943

0.909

0.893

0.870

0.833

1.833

1.736

1.690

1.626

1.528

3

2.673

2.487

2.402

2.283

2.106

4

3.465

3.170

3.037

2.855

2.589

5

4.212

3.791

3.605

3.353

2.991

6

4.917

4.355

4.111

3.785

3.326

5.582

4.868

4.564

4.160

3.605

8

6.210

5.335

4.968

4.487

3.837

9

6.802

5.759

5.328

4.772

4.031

10

7.360

6.145

5.650

5.019

4.192

a. Determine the net present value for the two machines. Use the table of present values of an annuity of $1 above. Round to the nearest dollar.

Sewing Machine

Packing Machine

Present value of annual net cash flows

Amount to be invested

Net present value

b. Determine the present value index for the two machines. If required, round your answers to two decimal places.

Sewing Machine

Packing Machine

Present value index

c. If Diamond and Turf has sufficient funds for only one of the machines and qualitative factors are equal between the two machines, in which machine should it invest? (If both present value indexes are the same, either machine will grade as

correct.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College