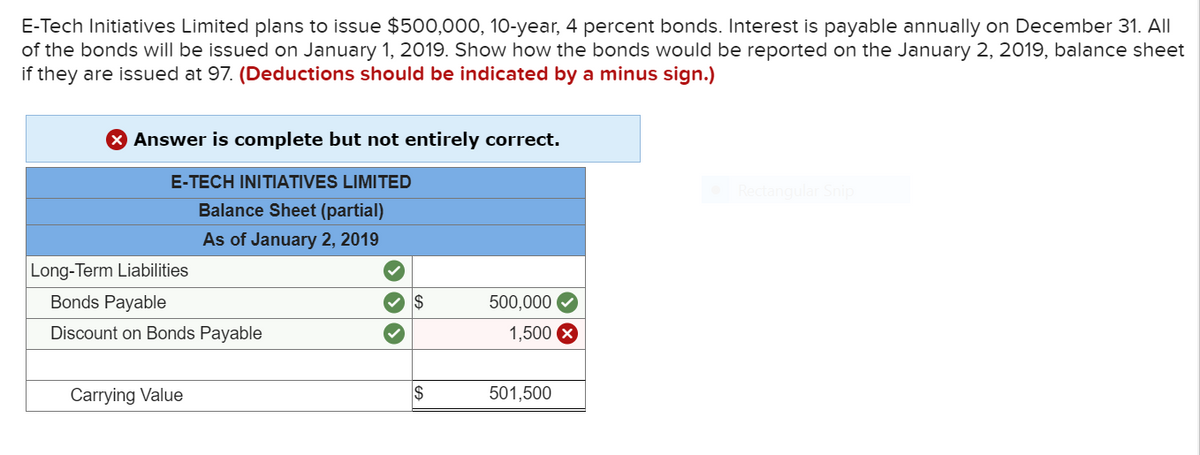

E-Tech Initiatives Limited plans to issue $500,000, 10-year, 4 percent bonds. Interest is payable annually on December 31. All of the bonds will be issued on January 1, 2019. Show how the bonds would be reported on the January 2, 2019, balance sheet if they are issued at 97. (Deductions should be indicated by a minus sign.) 8 Answer is complete but not entirely correct. E-TECH INITIATIVES LIMITED Balance Sheet (partial) As of January 2, 2019 Long-Term Liabilities Bonds Payable 500,000 O Discount on Bonds Payable 1,500 X Carrying Value 501,500

E-Tech Initiatives Limited plans to issue $500,000, 10-year, 4 percent bonds. Interest is payable annually on December 31. All of the bonds will be issued on January 1, 2019. Show how the bonds would be reported on the January 2, 2019, balance sheet if they are issued at 97. (Deductions should be indicated by a minus sign.) 8 Answer is complete but not entirely correct. E-TECH INITIATIVES LIMITED Balance Sheet (partial) As of January 2, 2019 Long-Term Liabilities Bonds Payable 500,000 O Discount on Bonds Payable 1,500 X Carrying Value 501,500

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 5P

Related questions

Question

Transcribed Image Text:E-Tech Initiatives Limited plans to issue $500,000, 10-year, 4 percent bonds. Interest is payable annually on December 31. All

of the bonds will be issued on January 1, 2019. Show how the bonds would be reported on the January 2, 2019, balance sheet

if they are issued at 97. (Deductions should be indicated by a minus sign.)

X Answer is complete but not entirely correct.

E-TECH INITIATIVES LIMITED

Rectangular Snip

Balance Sheet (partial)

As of January 2, 2019

Long-Term Liabilities

Bonds Payable

2$

500,000

Discount on Bonds Payable

1,500

Carrying Value

2$

501,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College