(e) What was the holding period return for an investor who held the bond from i. 31 May 1927 to 31 July 1931? ii. 31 July 1931 to 30 June 1937?

(e) What was the holding period return for an investor who held the bond from i. 31 May 1927 to 31 July 1931? ii. 31 July 1931 to 30 June 1937?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter11: Notes, Bonds, And Leases

Section: Chapter Questions

Problem 22E

Related questions

Question

just the subpart e please thank you so much, i appreciate it!

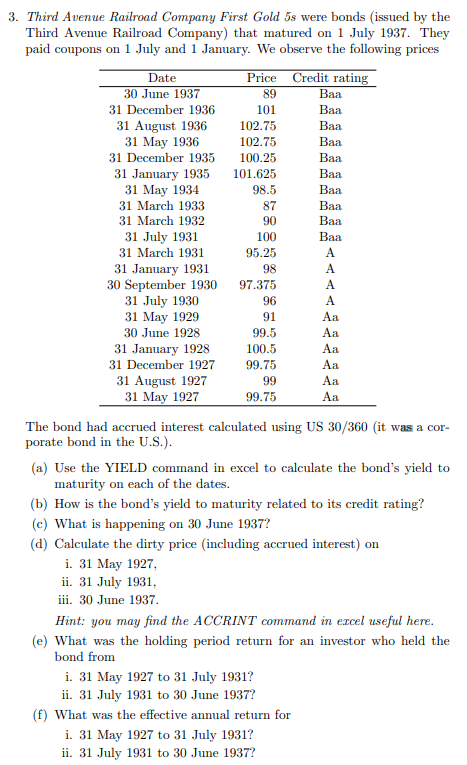

Transcribed Image Text:3. Third Avenue Railroad Company First Gold 5s were bonds (issued by the

Third Avenue Railroad Company) that matured on 1 July 1937. They

paid coupons on 1 July and 1 January. We observe the following prices

Date

30 June 1937

31 December 1936

31 August 1936

31 May 1936

31 December 1935

31 January 1935

31 May 1934

31 March 1933

31 March 1932

31 July 1931

31 March 1931

31 January 1931

30 September 1930

31 July 1930

31 May 1929

30 June 1928

31 January 1928

31 December 1927

31 August 1927

31 May 1927

Price Credit rating

89

101

102.75

102.75

100.25

101.625

98.5

87

90

100

95.25

98

97.375

96

91

99.5

100.5

99.75

99

99.75

Baa

Baa

Baa

Baa

Baa

Baa

Baa

Baa

Baa

Baa

A

A

A

A

Aa

Aa

Aa

Aa

Aa

Aa

The bond had accrued interest calculated using US 30/360 (it was a cor-

porate bond in the U.S.).

(a) Use the YIELD command in excel to calculate the bond's yield to

maturity on each of the dates.

i. 31 May 1927 to 31 July 1931?

ii. 31 July 1931 to 30 June 1937?

(f) What was the effective annual return for

i. 31 May 1927 to 31 July 1931?

ii. 31 July 1931 to 30 June 1937?

(b) How is the bond's yield to maturity related to its credit rating?

(c) What is happening on 30 June 1937?

(d) Calculate the dirty price (including accrued interest) on

i. 31 May 1927,

ii. 31 July 1931,

iii. 30 June 1937.

Hint: you may find the ACCRINT command in excel useful here.

(e) What was the holding period return for an investor who held the

bond from

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning