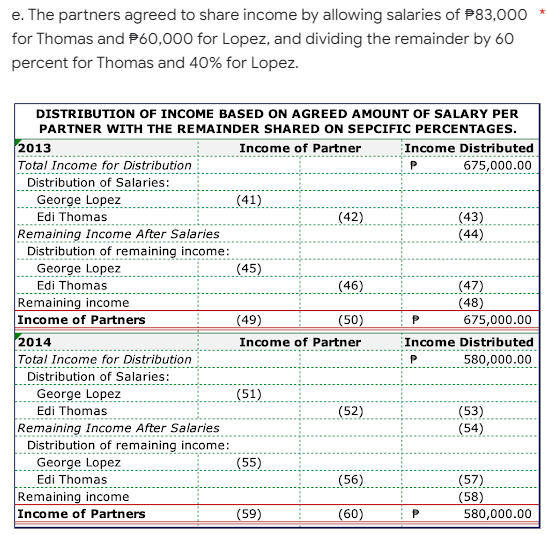

e. The partners agreed to share income by allowing salaries of $83,000 for Thomas and $60,000 for Lopez, and dividing the remainder by 60 percent for Thomas and 40% for Lopez.

Q: On December 31, 2021, BLACK MAMBA Company appropriately changed its inventory valuation method to…

A: First In, First Out Method: The accounting system known as "First In, First Out" (FIFO) requires…

Q: What is the difference between the cost of a fixed asset and its accumulated depreciation called?…

A: Accumulated depreciation is the total of all the depreciation that has been charged to the asset…

Q: hich of the following accounts ordinarily would not appear in the post-closing trial balance? Hint:…

A: Temporary accounts are the accounts which has been closed and their balance has been moved to…

Q: Teri West operates her own catering service. Summary financial data for July are presented in…

A: Net decrease in cash during the month=Beginning cash balance-Ending cash balance

Q: ABC Corp purchased goods on account from XYZ Corp for P10,000. Terms: 10%, 2/10, n/30 FOB Shipping…

A: Under net method, inventory is recorded in the books after taking the effect of any discount if…

Q: 6. What should be the basic earnings per share in 2021? a. ₱ 9.00 b. ₱ 10.50 c. ₱ 12.50 d. ₱…

A: Introduction:- Basic earning per share :- Basic earnings per share is the amount of a company's…

Q: That was VERY HARD to follow. Please display the numbers in a way that they can be easily seen.

A: Net present value is calculated as Present value of cash inflows less initial investment.…

Q: The complete accounting process that begins with analyzing and journalizing transactions and ends…

A: The eight steps of the accounting cycle are as follows: identifying transactions, recording…

Q: Question 4 Make a Taccounts for the following transaction Ahmed is a business owner and offers gym…

A: Sno Account Titles and Explanation Debit Credit 1 Cash $ 30,000 Common Stock $…

Q: Group of answer choices When nonmonetary items are translated from foreign currency to functional…

A:

Q: Co. acquired 15% of the 5,000,000 shares of common stock of Tops Co. at a cost of $8.50 per share…

A: Investment in shares is the investment which is done by the investor to get gain by the increase…

Q: CERISE Company uses accrual basis of accounting. Wages expense account had a balance of $255,000 at…

A: cash was paid for wages during the year = Beginning wages payable balance + wages expense - Endings…

Q: At the beginning of current year, BLACKPINK Company had 480,000 $60 par value ordinary shares and…

A: Diluted earnings per share (Diluted EPS) : Diluted EPS is the company's earnings per share if all…

Q: BLACK WIDOW Corporation failed to recognize accruals and prepayments since the inception of its…

A: The income statement shows the net income or net loss that is calculated by deducting the expenses…

Q: The following information pertains to Tonton Company for the year ended December 31, 2015: Net…

A: When a borrowing company holds monetary assets or liabilities in an inflationary situation and the…

Q: kes. to the separation of Church anc ishment of a cathedral. at 1 is true. at 2 is true.

A: The answer has been mentioned below.

Q: black jack company purchased an automotive equipment of june 30, 2018 for 3,000,000. at the date of…

A: Depreciation expense is the charge against income each year for the wear and tear of the equipment…

Q: The fair value of the option on 1 January 2016 was RM5 each and was estimated to rise to RM6.50…

A: It is an employees compensation scheme of employees stock option plan by passing a resolution as per…

Q: 18. Which of the following statements is most correct? a. The proper goal of the financial manager…

A: The managers hold fiduciary responsibility towards the shareholders. They act as the agents of…

Q: On March 31, 2021: Job #678 was the only job in process with accumulated costs of…

A: Finished Goods Inventory refers to Cost of Goods completed during the year from Production but not…

Q: At the beginning of current year, BLACKPINK Company had 480,000 $60 par value ordinary shares and…

A: Diluted earnings per share (Diluted EPS) : Diluted EPS is the company's earnings per share if all…

Q: What is the depreciation expense of the equipment for 2023? what is the recoverable amount of the…

A: An asset is said to be impaired if carrying amount of an asset is higher than the recoverable…

Q: How is the account Accounts Payable classified and what kind of balance should it have? Group of…

A: Accounts payable is the term for current liabilities in regard to purchases made on credit. Such…

Q: what are the pros and cons for activity based budgeting ?

A: Activity based budgeting is a method in which activity are thoroughly analyzed to predict costs.it…

Q: CERISE Company uses accrual basis of accounting. Wages expense account had a balance of $255,000 at…

A: Cash paid for the wages will be calculated by the following formula: Cash paid for wages during the…

Q: x Bb Microso X (26) JA X Blackbo X Content X WP NWP As X NWP As X Content X WP NWP As X…

A:

Q: 8. Ignoring income tax, the accounting change should preferably be reported by the company in its…

A: As the question specified ignoring income taxes, the cumulative effect on retained earnings will be…

Q: Which of the following statements regarding activity-based costing (ABC) is false? A. ABC is…

A: Overheads are the indirect cost involved in the production process of the company. It is charged to…

Q: Instructions. 1. Prepare the general journal entries DATE TRANSACTIONS 1/2/16 Invested PHP500,000 to…

A: A journal entry is used to record a business transaction in the accounting records of a business. A…

Q: What is the name of the accounting concept in which revenue earned during the accounting period…

A: An accrual is a journal entry that is used to recognize revenues and expenses that have been earned…

Q: Prepare journal entries for manufacturing costs. D3.13 (LO 2) During the current month, Dalmar…

A: Journal entries means the book of prime entry from where the ledger and trial balance are prepared.…

Q: A company produces and sells two types of products. It classifies its costs as belonging to four…

A: ABC System is a realistic approach to apportion the indirect costs to products. Under this system,…

Q: FINANCIAL STATEMENT ANALYSIS AND RATIO ANALYSIS The following are the balance sheet and income…

A: Ratio Analysis - The ratio is the technique used by the prospective investor or an individual or…

Q: please explain in steps, thanks

A: Cost of goods manufactured means the cost incurred on the manufacturing of finished goods. Formula…

Q: Which of the following constitutional rights is mainly violated by a tax law enacted for whereby its…

A: Constitutional rights are rights entrusted by the constitution of a country to its citizens. These…

Q: CARMINE Company is preparing the interim financial statements for the first quarter ended March 31,…

A: Variable expense = Expenses in first quarter ×25% = P10,000,000 ×25% = P2500000 Fixed expense =…

Q: 10.) How much is Accumulated Depreciation per year? 11.) How long is the estimated useful life of…

A: Straight line depreciation is a common method of depreciation where the value of a fixed asset is…

Q: Two methods of allocating joint costs to main products are physical measure allocation and…

A: Option (d) is correct bother are true 1) Two methods of allocating joint costs to main products…

Q: Assume 360 days in a year. Do not round your intermediate calculations and round your final answer…

A: Note receivable: Note receivable refers to a written promise received by the creditor from the…

Q: E3.17 (LO 2, 3) Total factory labour costs related to factory workers for Vargas Company during the…

A: Journal Entry: Journal entry is the act of keeping records of transactions in an accounting journal.…

Q: Bond carries a part that is popular in the manufacture of automatic sprayers. Demand for this part…

A: Introduction: The cost of inventory includes expenses of acquired products less any discounts…

Q: On January 1, 2020, Blossom Corporation had 106,000 shares of no-par common stock issued. 5,000…

A: Cash dividend = Number of shares outstanding × Dividend per share = (106000-5000+10000) ×$1 = 111000…

Q: Use the information from the Adjusted Trial Balance and Financial Statement templates provided in…

A: The Balance sheet shows the financial position of the company including the assets, liabilities, and…

Q: 2. Determine the share of income for each partner in 2013 and 2014 under each of the following…

A: Partners agreed to share income equally, so ratio would be = 1:1

Q: (d) Based on (c), what will be the ending balance in AFDA? What is net realizable value of A/R?

A: Accounts Receivables - Accounts Receivables are the amount unpaid by the customer for the service…

Q: SCARLET Corporation has an authorized capital of 10,000 shares of 100 par, 8% cumulative preference…

A: Formula: Book value per ordinary share = Total Equity available to Ordinary shareholders / No. of…

Q: Which of the following is the primary element that distinguishes accounting for corporations from…

A: A partnership firm is a constitution wherein two or more individuals come together and join hands to…

Q: Dolce Co. estimates its sales at 180,000 units in the first quarter and that sales will increase by…

A: Cash sales are 30% 65% of credit sales will be received in same quarter. Quarter 2 sales units =…

Q: How is the account Unearned Fees classified and what kind of balance should it have? Group of answer…

A: A current liability is an obligation for the company that has to be paid off within a year. It would…

Step by step

Solved in 2 steps with 2 images

- The following were the balance of the partnership between Reynolds and Wynter as at December 31, 2015. DR $ CR $ Capital on January 1, 2015 Reynolds 35,000 Wynter 35,000 Current accounts on January 1, 2015 Reynolds 1,700 Wynter 400 Drawings during the year Reynolds 8000 Wynter 6400 Land and building .........................................160 000 Equipment .......................................................15000 Cash and bank .................................................20000 Bank loan .................................................................. 90,000 Electricity ..........................................................1400 Office salaries .................................................40000…A Victoria fashion business partnership has agree that half of the annual profit be distributed in proportion to each partner's investment in the partnership, and that the other half be distributed in proportion to the total number of hours that each partner worked in the business during the year. In 2015, the profit of the company was $82,000. How should the company allocate this profit to its three investors if the amounts invested by Chloe, Arab, and Mike are $60,000, $20,000, and $50,000, and their hours of work for the year were 400, 1100, and 1300, respectively?Banayo and his very close fiend Buendia formed a partnership on January 1, 2009 with Banayo contributing P160,000 cash and Buendia contributing equipment with a book value of P64,000 and a fair value of P48,000, and inventory items with a book value of P24,000 and a fair value of P32,000. During 2009, Buendia made additional investment of P16,000 on April 1, and P16,000 on June 1. On September 1, he withdrew P40,000. Banayo had no additional investment nor withdrawals during the year. The average capital balance at the end of the fiscal year 2009 for Buendia

- Kai and her very close friend Bigan formed a partnership on January 1,2015 with Kain contributing P16,000 cash while Bigan contributing equipment with a book value of P6,400 and a fair value of P4,800 and inventory items with a book value of P2,400 and a fair value of P3,200. During 2015, Bigan made additional investments of P1,600 on April 1 and P1,600 on June 1 and on September 1, he withdrew P4,000. Kai had no additional investments or withdrawals during the year. How much is Bigan's average capital balance?In the early part of 2018, the partners of Hugh, Jacobs, and Thomas sought assistance from a local accountant. They had begun a new business in 2017 but had never used an accountant’s services. Hugh and Jacobs began the partnership by contributing $150,000 and $100,000 in cash, respectively. Hugh was to work occasionally at the business, and Jacobs was to be employed full-time. They decided that year-end profits and losses should be assigned as follows: Each partner was to be allocated 10 percent interest computed on the beginning capital balances for the period. A compensation allowance of $5,000 was to go to Hugh with a $25,000 amount assigned to Jacobs. Any remaining income would be split on a 4:6 basis to Hugh and Jacobs, respectively. In 2017, revenues totaled $175,000, and expenses were $146,000 (not including the partners’ compensation allowance). Hugh withdrew cash of $9,000 during the year, and Jacobs took out $14,000. In addition, the business paid $7,500 for repairs…In January 2018, Nick Marasigan and Dems Asacta agreed to produce and sell chocolate candies. Marasigan contributed P2400000 in cash to the business. Asacta contributed the building and equipment, valued at P2200000 and P1400000, respectively. The partnership had profits of P840000 during 2018 but was less successful during 2019, when profit was only P400000.Required:1.Prepare the journal entry to record the investment of both partners in the partnership.2.Determine the share of profit for each partner in 2018 and 2019 under each of the following conditions:a.The partners agreed to share profit equally.b.The partners failed to agree on a profit-sharing arrangement.c.The partners agreed to share profit according to the ratio of their original investment.d.The partners agreed to share profits by allowing interest of 10% on their original investments and dividing the remainder equally.e.The partners agreed to share profits by allowing salaries of P400000 for Marasigan and P280000 for…

- On January 1, 2017, the dental partnership of Angela, Diaz, and Krause was formed when the partners contributed $30,000, $58,000, and $60,000, respectively. Over the next three years, the business reported net income and (loss) as follows: 2017 . . . . . . . . . . . . . .. . . . . $70,000 2018 . . . . . . . . . . . . . . . . . . 42,000 2019 . . . . . . . . . . . . . . . . . . (25,000) During this period, each partner withdrew cash of $15,000 per year. Krause invested an additional $5,000 in cash on February 9, 2018.At the time that the partnership was created, the three partners agreed to allocate all profits and losses according to a specified plan written as follows:∙ Each partner is entitled to interest computed at the rate of 10 percent per year based on the individual capital balances at the beginning of that year.∙ Because of prior work experience, Angela is entitled to an annual salary allowance of $12,000 per year and Diaz is entitled to an annual salary allowance of…Steve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O’Donnell, a local merchant, to contribute the capital to form a partnership. On January 1, 2016, O’Donnell invests a building worth $52,000 and equipment valued at $16,000 as well as $12,000 in cash. Although Reese makes no tangible contribution to the partnership, he will operate the business and be an equal partner in the beginning capital balances. To entice O’Donnell to join this partnership, Reese draws up the following profit and loss agreement: O’Donnell will be credited annually with interest equal to 20 percent of the beginning capital balance for the year. O’Donnell will also have added to his capital account 15 percent of partnership income each year (without regard for the preceding interest figure) or $4,000, whichever is larger. All remaining income is credited to Reese. The partnership reported a net loss of $10,000 during the first year of its…In January 2019. Nick Marasigan and Dems Asacta agreed to produce and sell chocolate candies. Marasigan contributed P2,400,000 in cash to the business. Asacta contributed the building and equipment, valued at P2,200,000 and P1.400,000, respectively. The partnership had profits of P840,000 during 2019 but was less successful during 2020, when profit was only P400,000. Required: d. The partners agreed to share profits by allowing interest of 10% on their original Investments and dividing the remainder equally The partners agreed to share profits by allowing salaries of P400,000 for Marasigan and P280,000 for Asacta, and dividing the remainder equally. The partners agreed to share profits by paying salaries of P400,000 to Marasigan and P280,000 to Asacta, allowing interest of 9% on their original investments. and dividing the remainder equally.

- Costello & Summers are partners in a merchandising business. During 2014, they withdrew their salary allowances of P 34,000 & P 59,000 respectively. Bonus is given to Summers based on 20% of net income after salaries but before bonus and the remaining profit & loss equally by Costello & Summers. The partners’ capital accounts show the following: COSTELLO SUMMERS Beginning Balance P 85,000 P 67,000 Additional Investments 40,000 43,000 Withdrawal other than salary allowance 35,000 20,000 What is Summer’s capital if Costello’s capital after dividing net income is P 138,800? a. P 201,750 b. P 163,200 c. P 158,320 d. P 155,067Rosa and Linda agreed to form a partnership on June 15, 2012 for the purpose of manufacturing and selling custom silver jewelry. Both are master crafters and have their own tools and equipment, which they will invest in the business. Rosa and Linda determined that their tools and equipment have fair market values of P90,000 and P120,000, respectively. They further resolved to invest sufficient cash such that each partner will have a beginning capital balance equal to P250,000. How much will be the total cash of the newly formed partnership?In the early part of 2018, the partners of Hugh, Jacobs, and Thomas sought assistance from a local accountant. They had begun a new business in 2017 but had never used an accountant’s services. Hugh and Jacobs began the partnership by contributing $90,000 and $40,000 in cash, respectively. Hugh was to work occasionally at the business, and Jacobs was to be employed full-time. They decided that year-end profits and losses should be assigned as follows: Each partner was to be allocated 10 percent interest computed on the beginning capital balances for the period. A compensation allowance of $7,000 was to go to Hugh with a $17,000 amount assigned to Jacobs. Any remaining income would be split on a 4:6 basis to Hugh and Jacobs, respectively. In 2017, revenues totaled $115,000, and expenses were $87,000 (not including the partners’ compensation allowance). Hugh withdrew cash of $6,000 during the year, and Jacobs took out $11,000. In addition, the business paid $7,500 for repairs made…