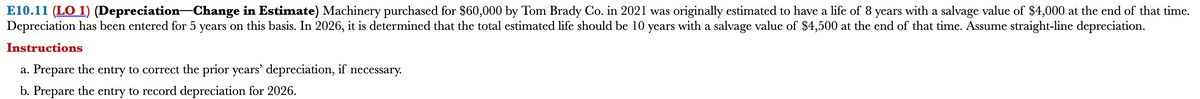

E10.11 (LO 1) (Depreciation Change in Estimate) Machinery purchased for $60,000 by Tom Brady Co. in 2021 was originally estimated to have a life of 8 years with a salvage value of $4,000 at the end of that time. Depreciation has been entered for 5 years on this basis. In 2026, it is determined that the total estimated life should be 10 years with a salvage value of $4,500 at the end of that time. Assume straight-line depreciation. Instructions a. Prepare the entry to correct the prior years' depreciation, if necessary. b. Prepare the entry to record depreciation for 2026.

E10.11 (LO 1) (Depreciation Change in Estimate) Machinery purchased for $60,000 by Tom Brady Co. in 2021 was originally estimated to have a life of 8 years with a salvage value of $4,000 at the end of that time. Depreciation has been entered for 5 years on this basis. In 2026, it is determined that the total estimated life should be 10 years with a salvage value of $4,500 at the end of that time. Assume straight-line depreciation. Instructions a. Prepare the entry to correct the prior years' depreciation, if necessary. b. Prepare the entry to record depreciation for 2026.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 8PA: Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the...

Related questions

Question

100%

Transcribed Image Text:E10.11 (LO 1) (Depreciation Change in Estimate) Machinery purchased for $60,000 by Tom Brady Co. in 2021 was originally estimated to have a life of 8 years with a salvage value of $4,000 at the end of that time.

Depreciation has been entered for 5 years on this basis. In 2026, it is determined that the total estimated life should be 10 years with a salvage value of $4,500 at the end of that time. Assume straight-line depreciation.

Instructions

a. Prepare the entry to correct the prior years' depreciation, if necessary.

b. Prepare the entry to record depreciation for 2026.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT