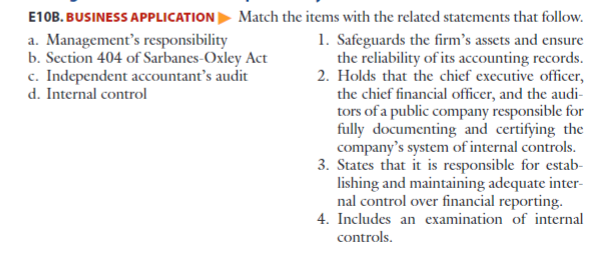

E10B. BUSINESS APPLICATION Match the items with the related statements that follow. 1. Safeguards the firm's assets and ensure the reliability of its accounting records. 2. Holds that the chief executive officer, the chief financial officer, and the audi- tors of a public company responsible for fully documenting and certifying the company's system of internal controls. 3. States that it is responsible for estab- lishing and maintaining adequate inter- nal control over financial reporting. 4. Includes an examination of internal a. Management's responsibility b. Section 404 of Sarbanes-Oxley Act c. Independent accountant's audit d. Internal control controls.

E10B. BUSINESS APPLICATION Match the items with the related statements that follow. 1. Safeguards the firm's assets and ensure the reliability of its accounting records. 2. Holds that the chief executive officer, the chief financial officer, and the audi- tors of a public company responsible for fully documenting and certifying the company's system of internal controls. 3. States that it is responsible for estab- lishing and maintaining adequate inter- nal control over financial reporting. 4. Includes an examination of internal a. Management's responsibility b. Section 404 of Sarbanes-Oxley Act c. Independent accountant's audit d. Internal control controls.

Chapter8: Fraud, Internal Controls, And Cash

Section: Chapter Questions

Problem 11MC: Which of the following is true about the Sarbanes-Oxley Act? A. It was passed to ensure that...

Related questions

Question

Transcribed Image Text:E10B. BUSINESS APPLICATION Match the items with the related statements that follow.

1. Safeguards the firm's assets and ensure

the reliability of its accounting records.

2. Holds that the chief executive officer,

the chief financial officer, and the audi-

tors of a public company responsible for

fully documenting and certifying the

company's system of internal controls.

3. States that it is responsible for estab-

lishing and maintaining adequate inter-

nal control over financial reporting.

a. Management's responsibility

b. Section 404 of Sarbanes-Oxley Act

c. Independent accountant's audit

d. Internal control

4. Includes an examination of internal

controls.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning