E3.4 (LO 1), C The following independent situations require professional judgment for determining when to recognize revenue from the transactions. a. Southwest Airlines sells you an advance-purchase airline ticket in September for your flight home in December. b. Ultimate Electronics sells you a home theater on a "no money down and full payment in three months" promotional deal. c. The Toronto Blue Jays sell season tickets online to games in the Skydome. Fans can purchase the tickets at any time, although the season doesn't officially begin until April. The major league baseball season runs from April through October. d. RBC Financial Group loans money on August 1. The loan and the interest are repayable in full in November. e. In August, a customer orders a sweater from the Target website, paying with a Target credit card. The sweater arrives in September. Target sends a bill in October and receives payment in October. Instructions Determine when revenue should be recognized in each of the above situations. Determine the type of adjusting entry needed.

E3.4 (LO 1), C The following independent situations require professional judgment for determining when to recognize revenue from the transactions. a. Southwest Airlines sells you an advance-purchase airline ticket in September for your flight home in December. b. Ultimate Electronics sells you a home theater on a "no money down and full payment in three months" promotional deal. c. The Toronto Blue Jays sell season tickets online to games in the Skydome. Fans can purchase the tickets at any time, although the season doesn't officially begin until April. The major league baseball season runs from April through October. d. RBC Financial Group loans money on August 1. The loan and the interest are repayable in full in November. e. In August, a customer orders a sweater from the Target website, paying with a Target credit card. The sweater arrives in September. Target sends a bill in October and receives payment in October. Instructions Determine when revenue should be recognized in each of the above situations. Determine the type of adjusting entry needed.

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 1PA: Consider the following situations and determine (1) which type of liability should be recognized...

Related questions

Question

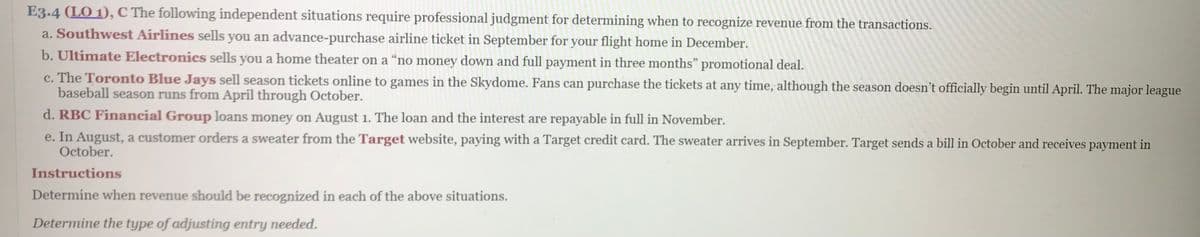

Transcribed Image Text:E3.4 (LO 1), C The following independent situations require professional judgment for determining when to recognize revenue from the transactions.

a. Southwest Airlines sells you an advance-purchase airline ticket in September for your flight home in December.

b. Ultimate Electronics sells you a home theater on a "no money down and full payment in three months" promotional deal.

c. The Toronto Blue Jays sell season tickets online to games in the Skydome. Fans can purchase the tickets at any time, although the season doesn't officially begin until April. The major league

baseball season runs from April through October.

d. RBC Financial Group loans money on August 1. The loan and the interest are repayable in full in November.

e. In August, a customer orders a sweater from the Target website, paying with a Target credit card. The sweater arrives in September. Target sends a bill in October and receives payment in

October.

Instructions

Determine when revenue should be recognized in each of the above situations.

Determine the type of adjusting entry needed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning