E9-6 (Algo) Computing and Recording Straight-Line Depreciation [LO 9-3] Yazzie Incorporated bought a machine at the beginning of the year at a cost of $42,000. The estimated useful life was five years and the residual value was $5,000. Required: Complete a depreciation schedule for the straight-line method. Prepare the journal entry to record Year 2 depreciation.

E9-6 (Algo) Computing and Recording Straight-Line Depreciation [LO 9-3] Yazzie Incorporated bought a machine at the beginning of the year at a cost of $42,000. The estimated useful life was five years and the residual value was $5,000. Required: Complete a depreciation schedule for the straight-line method. Prepare the journal entry to record Year 2 depreciation.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter7: Fixed Assets, Natural Resources, And Intangible Assets

Section: Chapter Questions

Problem 7.2.1MBA

Related questions

Question

E9-6 (Algo) Computing and Recording Straight-Line Depreciation [LO 9-3]

Yazzie Incorporated bought a machine at the beginning of the year at a cost of $42,000. The estimated useful life was five years and the residual value was $5,000.

Required:

- Complete a depreciation schedule for the straight-line method.

- Prepare the

journal entry to record Year 2 depreciation.

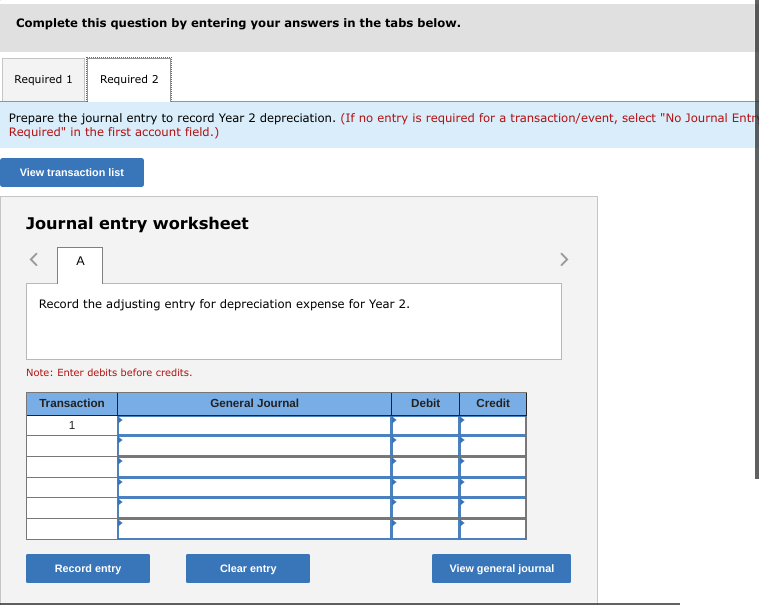

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Prepare the journal entry to record Year 2 depreciation. (If no entry is required for a transaction/event, select "No Journal Entr

Required" in the first account field.)

View transaction list

Journal entry worksheet

A

Record the adjusting entry for depreciation expense for Year 2.

Note: Enter debits before credits.

Transaction

General Journal

Debit

Credit

1

Record entry

Clear entry

View general journal

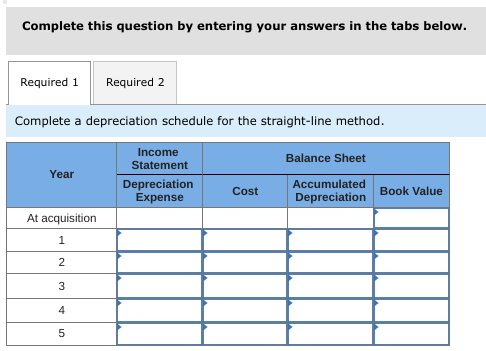

Transcribed Image Text:Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Complete a depreciation schedule for the straight-line method.

Income

Balance Sheet

Statement

Year

Depreciation

Expense

Accumulated

Cost

Book Value

Depreciation

At acquisition

1

3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College