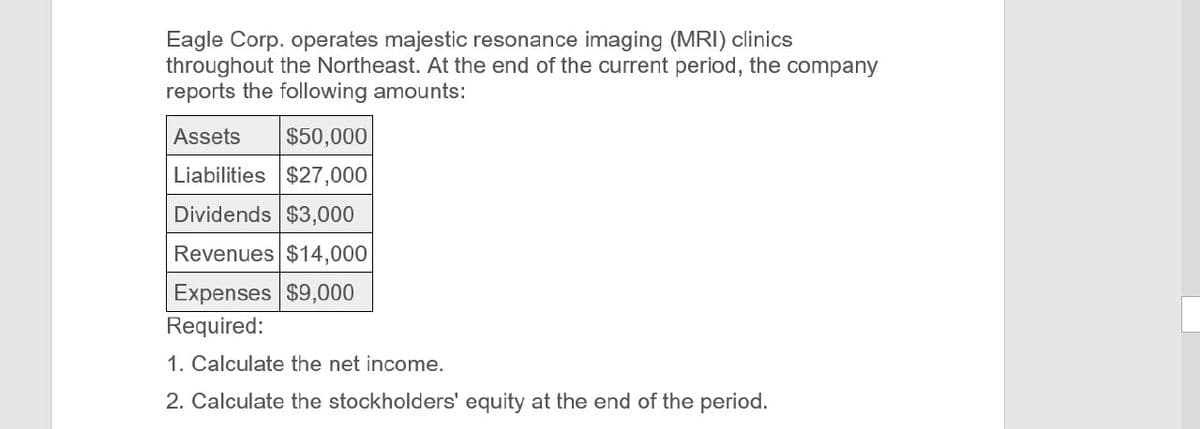

Eagle Corp. operates majestic resonance imaging (MRI) clinics throughout the Northeast. At the end of the current period, the company reports the following amounts: Assets $50,000 Liabilities $27,000 Dividends $3,000 Revenues $14,000 Expenses $9,000 Required: 1. Calculate the net income. 2. Calculate the stockholders' equity at the end of the period.

Eagle Corp. operates majestic resonance imaging (MRI) clinics throughout the Northeast. At the end of the current period, the company reports the following amounts: Assets $50,000 Liabilities $27,000 Dividends $3,000 Revenues $14,000 Expenses $9,000 Required: 1. Calculate the net income. 2. Calculate the stockholders' equity at the end of the period.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter1: Introduction To Accounting And Business

Section: Chapter Questions

Problem 27E

Related questions

Question

Transcribed Image Text:Eagle Corp. operates majestic resonance imaging (MRI) clinics

throughout the Northeast. At the end of the current period, the company

reports the following amounts:

Assets

$50,000

Liabilities $27,000

Dividends $3,000

Revenues $14,000

Expenses $9,000

Required:

1. Calculate the net income.

2. Calculate the stockholders' equity at the end of the period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning